Airbnb Stock: Should You Invest in the Company Today?

This page contains links to our partners. RBD may be compensated when a link is clicked. Read disclosures.

Airbnb stock is open for trading. Open an account with a commission-free broker such as M1 Finance and buy the stock today (details on how below).

The Airbnb stock symbol is “ABNB” and trades on the NASDAQ stock exchange.

The Airbnb stock price is updated below.

Did you receive IPO shares from your broker (excluding Airbnb hosts)? Which broker do you use? Contact me with details to provide better information to readers in the future.

Table of Contents

Latest Airbnb Stock IPO News

12/10/2020: Airbnb IPO is complete – All investors can now own the stock

12/09/2020: Airbnb IPO prices IPO at $68

12/08/2020: Cramer predicts a strong 2021 rebound for Airbnb after IPO

12/06/2020: WSJ: Airbnb Boosts IPO Price Range to Between $56 and $60 a Share

12/01/2020: Eligible Fidelity customers may indicate interest for Airbnb IPO (see below)

12/01/2020: ClickIPO accepting interest through app (via TS) and Webull (see below)

12/01/2020: Airbnb seeks valuation of up to $35 billion in its IPO

11/30/2020: Airbnb and DoorDash plan to target higher valuations for their December IPOs

11/16/2020: Hosts may be eligible to participate via a directed share program (see below)

11/16/2020: The Airbnb S-1 filing is now available to the public.

11/10/2020: Airbnb Said to Delay IPO Filing to Distance It From Election.

11/05/2020: Reuters: Airbnb to make IPO filing (public) next week, braving COVID-19 surge

Older news…

What is Airbnb?

Airbnb is a marketplace that empowers homeowners and landlords to rent their properties to tourists and those in need of a night’s stay. Potential visitors can find unique accommodations and avoid staying in a hotel.

Property owners become hosts and make money by letting people stay in their homes. They list the property on Airbnb with pictures, and potential visitors browse the area for a place that works for them.

The model works for a basement apartment or a mansion in the Hollywood Hills. If there’s a demand for a place to stay, and the property is right for the potential visitor, the entire transaction occurs on the Airbnb platform.

Click here to browse properties on Airbnb and book your first room. You can also consider becoming a host yourself.

Is Airbnb Publicly Traded?

Yes. The company became a publicly-traded company on December 10th, 2020 at 1:38 pm EST.

Now that the stock is open and trading, you can buy it from any online brokerage account.

When was the Airbnb IPO date?

The IPO priced the evening of December 9th, and debuted on Thursday, December 10th.

*** The Airbnb IPO first trade was $146 (1:38 pm EST) *** 12/10/2020.

*** The Airbnb IPO priced the IPO at $68 (6:35pm EST) *** 12/09/2020.

What is the AirBnB Stock Symbol, Airbnb Ticker??

The Airbnb stock symbol is “ABNB” and trades on the NASDAQ stock exchange.

What is the Airbnb Stock Price?

The Airbnb IPO priced at $68 per share, above the expected range of $56-$60 per share range.

The stock opened at $146, 115% above the IPO price.

The current Airbnb stock price is below:

Will Airbnb Stock be a Motley Fool Stock Advisor Recommendation?

Sign up with the Motley Fool Stock Advisor newsletter service to learn if Airbnb is a current recommendation, and if it is, when is a good time to buy.

Airbnb fits the mold of high-growth, disruptive business models that the Fool typically recommends.

When the Motley Fool recommends a company, there is usually an immediate spike in the price. Fool newsletter subscribers are notoriously long-term minded and rarely sell, meaning the stock price will continue to rise.

Sign up now to get regular high-growth stock tips. The newsletter is well-worth the cost.

Airbnb may also receive a recommendation by the Motley Fool Rule Breakers newsletter, its high-growth stock recommendation service.

Both services have handily beaten the broader market since the early 2000s.

Read this Motley Fool Stock Advisor review to learn about their stock selection methodologies and about how you can participate in excellent returns.

Should You Invest in Airbnb After the IPO?

This site encourages long-term buy and hold investing instead of short-term trading. Think about your investment in Airbnb in 5-10-year increments.

What does Airbnb’s business look like a decade from now?

Jim Cramer had this to say on his show December 8th:

I want you to own Airbnb because it’s set to have a terrific year starting next March. If you can get the stock for $68 or less this week, I’d back up the truck. If you can get it for less than $85, I’m granting you a small position. Any higher, though, and I’m going to have to say you’ve got to keep your bat on your shoulder and wait for a better pitch.

This rundown at The Generalist is an excellent overview and a good place to fortify your research.

Here’s another take by Scott Galloway, a Marketing professor at NYU Stern who thinks Airbnb stock can reach a $100 billion valuation by 2022.

Airbnb S-1 Filing

The Airbnb S-1 filing (amended version, Dec 7th) is available in HTML format on the SEC website here.

Previous and amended versions of the Airbnb S-1 filing are posted here.

The company seeks to raise up to $3.1 million by issuing 51.9 million shares at a price range of $56-$60 per share.

That would value the company at a range of $39 to $42 billion market capitalization.

The following is an Airbnb S-1 PDF printed version of the original filing.

Can I Buy Airbnb Stock?

Now that Airbnb stock is a publicly-traded company, only #1 below is an option for investors. #2 and #3 will remain in this list for investors who aspire to acquire IPO shares of other offerings in the future.

- Buy Airbnb Stock After it Begins Trading

Buy Airbnb Stock in the Initial Public OfferingThe Airbnb Directed Share Program for Hosts

1. Buy Airbnb Stock After the Airbnb IPO

The IPO completed on December 10th. Even though you didn’t get Airbnb at the IPO price, you can still own the company.

In some cases, investors can get in at a price near or below the IPO price (if the stock falls).

This is not always true. Uber opened below the IPO price and took more than a year to recover.

You can own the company today, buying Airbnb stock through a no-fee online brokerage account after trading begins.

So what is the best online brokerage for buying Airbnb stock?

As an individual investor, you’ll want to open an account with a commission-free broker. That way, you’ll invest most of your money instead of waste it on fees.

I’ll go over one of my favorites below. It has zero commissions and will make it easy to buy Airbnb stock once it begins trading on open stock markets.

What is the Best Online Broker to Buy Airbnb Stock after the IPO?

Active traders who want to own Airbnb immediately when it begins trading, I recommend Robinhood (current deal — new customers get a free stock worth up to $279). Robinhood does not offer IPO access.

On the contrary, long-term investors may prefer an online broker that’s better for dollar cost averaging and dividend reinvestment.

I’m a big fan of the online brokerage M1 Finance. M1 Finance is a reliable and robust, no-fee online broker for beginner to intermediate investors. It’s easy to get started.

As your investing skills and portfolio mature, M1 is one of the best platforms to scale.

Investing in stocks is 100% free on the platform. Read my complete M1 Finance review here.

M1 Finance does not offer IPO access, but it’s my favorite for long-term buy and hold investing — my preferred strategy for Airbnb stock.

The platform is more intuitive than old school brokers because it’s built on a modern technology platform. You create your ideal portfolio first, then fund it over time.

Simply fund your account add Airbnb stock to your portfolio pie.

2. Buy Stock in the Airbnb Initial Public Offering (IPO)

It is too late to participate in the Airbnb IPO if you have not indicated interest with a broker yet. See previous section.

Demand is extremely high, making it very difficult to acquire pre-IPO shares.

Position yourself now for future IPOs.

IPOs have always been available to the wealthiest customers of the leading brokerage firms. That’s great if you’re wealthy. Certain online brokers are better for IPO investing than others.

Financial technology is changing the way ordinary investors can invest in IPO. You can now invest in select IPOs.

The top broker for accessing IPOs today is TradeStation.

TradeStation has partnered with the IPO investing app ClickIPO to give its customers seamless access to IPOs and follow-on offerings.

The company empowers ordinary investors to invest in IPOs through their existing brokerage account.

The ClickIPO app is available to all US-based investors today for research and indicating interest in IPO shares. Link your existing online brokerage at TradeStation to get started.

The minimum to invest in upcoming IPOs is $500.

Another broker for accessing IPOs today is Webull, which has also partnered with ClickIPO to bring direct IPO access through its investing app.

Webull is a smartphone-first broker similar to Robinhood but has built a significant desktop trading platform as well.

Unlike Robinhood, Webull offers free access to IPOs.

You can start buying IPOs once you deposit your first $100 to Webull. Deposit $100 or more and receive at least two free stocks (often more).

Read this Webull review for IPOs to learn more.

For a more extensive list of IPO-friendly online brokers and their eligibility, check out this page. Fidelity (see below), Morgan Stanley, TD Ameritrade, and Schwab are the most likely to receive allocations for their customers.

Joining a broker that offers access to IPOs does not guarantee an allocation, especially high-demand IPOs such as Airbnb. You may be better off waiting for the company to start trading after the IPO.

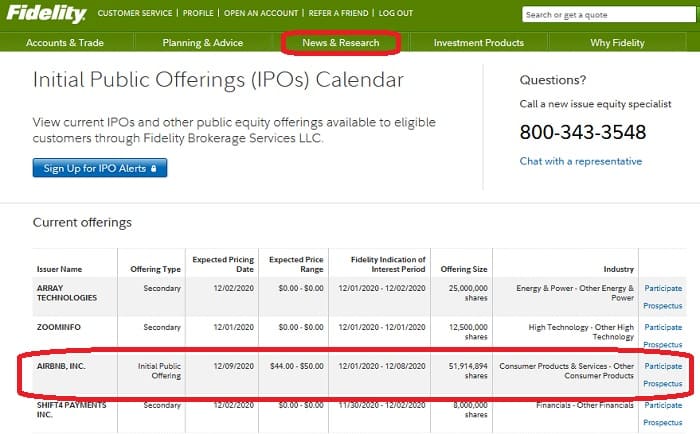

Fidelity

Fidelity update 7:33 am EST: “To be eligible for an allocation of shares in this offering, you MUST confirm your indication of interest through Fidelity.com or by calling 800-544-5631 by, 9:00 AM ET Thursday, 12/09/2020.”

Fidelity accepting indications of interest for the Airbnb IPO for eligible customers as of December 1st. Indication of interest does not guarantee an allocation.

Log into your desktop Fidelity account. Go to News & Research, then IPOs.

Demand is extremely high, making it very difficult to acquire pre-IPO shares.

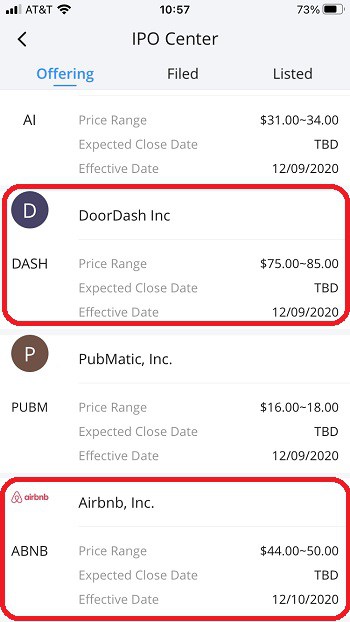

ClickIPO

ClickIPO is displaying the Airbnb IPO and letting people indicate interest. No guarantee they will receive an allocation. Demand is extremely high, making it very difficult to acquire pre-IPO shares.

Only TradeStation customers can access IPOs through the ClickIPO app at this stage. Webull customers can indicate interest in the Webull app.

Webull

Webull is displaying both Airbnb and DoorDash, but no indication if Webull (via ClickIPO) will receive a meaningful allocation.

Demand is extremely high, making it very difficult to acquire pre-IPO shares.

3. The Airbnb Directed Share Program for Hosts

This offering is now closed.

Thanks to those who already reached out. Good luck!

BIG NEWS: The S-1 filing indicates there will be a directed share program for hosts! That means, if you’re a host, you may be able to access Airbnb IPO shares.

Here’s the text from the S-1 filing, updated after the amended release on December 1st:

At our request, the underwriters have reserved up to 3,500,000 shares of Class A common stock, or 7.0% of the shares offered by us in this offering, for sale at the initial public offering price through a directed share program to eligible U.S. hosts and certain individuals identified by our officers and directors. For hosts, those who reside in the United States and had by November 1, 2020 accepted a reservation that began, or was scheduled to begin, in 2019 or 2020 are potentially eligible for the program. Airbnb employees are not eligible. If demand for the program exceeds capacity, we may invite hosts to participate based on tenure, as determined by the year they first hosted on Airbnb.

The number of shares of Class A common stock available for sale to the general public will be reduced to the extent that such persons purchase such reserved shares. Any reserved shares not so purchased will be offered by the underwriters to the general public on the same basis as the other shares offered by this prospectus. Morgan Stanley & Co. LLC will administer our directed share program.

HOSTS: Watch your emails for communication from Airbnb about the directed share program. You may be able to participate in the IPO.

Updates from Hosts

A few hosts have reached out with information about receiving emails from Morgan Stanley about the directed share program. Emails went out on December 1st.

The main takeaway was that shares were limited. One host reported only being able to indicate interest for up to 275 shares or $16,500 (actual allocation will likely be smaller). Minimum investment was set at $300.

Participation required opening a “special brokerage account” with Morgan Stanley and shares available on a first come, first served basis.

One reader wrote:

I’m wondering if you know where Airbnb hosts who qualified for the IPO can reach out if we didn’t receive the offer (we’re 2 years with Airbnb, in the U.S., superhosts, above average revenue, filled out the paperwork the day we received it).

Emails came from this email account: “[email protected]”. Check your Airbnb email account and spam.

Another reader wrote:

Hi ~ I’m a super host on Airbnb and was invited to buy IPO shares. I’ve set up my account with Morgan Stanley and the ACH is all set to go. Do you have any advise as to how many shares I should buy or any other advise for me? Thanks so much!

Based on demand, I’d say as much as you can afford! This email came on December 2nd, indicating the account setup process happened quickly.

Another email:

I am an Airbnb host who received an invitation to participate in the host Pre-IPO stock purchase. I was lucky an got my account approved the first day. They closed the application process after 24 hours due to so much interest. I will be happy to share information if your still interested.

Thanks to the readers who reached out. I did not post a copy of the email from Morgan Stanley because it is too long. The bottom line is that this opportunity was briefly open, it looks like on December 1st, and closed on December 2nd. .

Here’s a question received on 12/07 at 6pm EST:

Any update on The Airbnb Directed Share Program for Hosts? We didn’t receive any notification so I’m looking all over before the stock goes live.

Answer: From what I’ve heard, eligible hosts (as defined in the S-1) received an email from Morgan Stanley on December 1st. With tight demand, hosts needed to respond quickly, likely within 24 hours or less to participate. Those who responded successfully should have been contacted to open a special account with Morgan Stanley for the IPO. If you haven’t been contacted to set up the account, my guess is you did not respond quickly enough. If you never received an email from Morgan Stanley, you were likely not eligible.

Keep in mind, access to this IPO is a privledge, not a right, and these rollouts are difficult to execute flawlessly in short time. Some eligible may not have received the email, or not in time. Others got lucky, saw the email right away, and signed up. Airbnb and Morgan Stanley don’t owe anyone anything, even for those who responded in time.

For those that moved quickly, congratulations and good luck. For the rest, I’m sorry. These kinds of opportunities are rare! See above section 1: Buy Airbnb Stock After the Airbnb IPO.

Airbnb Stock News Archive

10/31/2020: How Airbnb is giving hosts a seat at the table

10/27/2020: Airbnb Stock to List on the Nasdaq Exchange

10/25/2020: Airbnb Tells Shareholder Group Board Approves Share Split

10/21/2020: Airbnb teaming up with former Apple design boss Jony Ive

10/16/2020: Here’s why Airbnb is the most valuable private company in America

10/03/2020: Airbnb seeks to raise roughly $3 billion in IPO – Valuation Approximately $30 Billion

09/23/2020: Airbnb CEO Brian Chesky on the company’s IPO— ‘When the market’s ready for Airbnb, it will go public’

09/17/2020: Airbnb Opponents Take Fight to SEC Ahead of IPO

09/09/2020: How Airbnb got its IPO plans back on track

09/03/2020: Airbnb spurns approach to go public through Bill Ackman’s blank-check company

08/24/2020: Airbnb IPO could be the ‘steal of the century,’ Jim Cramer says

08/24/2020: Airbnb is set for a blockbuster IPO – here’s why (opinion piece)

08/19/2020: Airbnb has filed confidential IPO paperwork

08/11/2020: Airbnb plans to confidentially file for IPO this month

07/22/2020: Airbnb approached about blank-check company merger for public listing: CEO

07/15/2020: Airbnb Says Its IPO. Plans Are Back on Track

06/30/2020: Airbnb could still IPO in 2020, CEO Brian Chesky says: ‘It has exceeded everything we expected’

06/09/2020: Airbnb revives internal IPO conversations

06/08/2020: Airbnb Joins Vacation-Rental Sites Seeing Surge in Demand

05/06/2020: Airbnb hosts are building their own direct booking websites in revolt

04/15/2020: Airbnb to lay off nearly 1,900 people, 25% of company

04/15/2020: Airbnb raising another $1 billion in debt as coronavirus ravages tourism business

04/06/2020: Airbnb Raises $1 Billion In New Funding. An IPO Seems Unlikely Anytime Soon

04/03/2020: Airbnb lowers internal valuation by 16% to $26bn

02/11/2020: Airbnb Swings to a Loss as Costs Climb Ahead of IPO

11/18/2019: Jim Cramer of CNBC interviews Airbnb CEO Brian Chesky

10/08/2019: Airbnb is gearing up to be the most anticipated IPO of 2020, here’s why – Video about the upcoming Airbnb IPO.

10/01/2019: Airbnb Leans Toward Direct Listing Over Traditional IPO

09/19/2019:$31 billion Airbnb announces plan to go public in 2020

Conclusion

Time is running out to participate in the Airbnb IPO. If you’re not positioned to participate, keep a long-term view and consider buying the stock after trading begins.

But that’s not necessarily a reason to be disappointed. Google’s shares rose 18% on the day of its IPO. Many people probably sold that day. Had they held for the next decade, their holdings would have been up 1,000%.

If Airbnb is a truly remarkable business, the real money will be made over the next decade, not on the IPO date.

Please perform due diligence on the SEC S-1 filing and don’t buy Airbnb stock with money you can’t afford to lose.

* Disclosure: The web page contains affiliate links from our partners. If a reader opens an account or buys a service from a link in this article, we may be compensated at no additional cost to the reader. Opening an account with a broker that provides access to IPOs does not guarantee the customer allocations of specific IPOs.

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)