Fundrise Review After Six Years of Investing

This Fundrise review was completely updated on 01/01/2024.

Fundrise is a Washington, D.C.-based real estate and alternative assets platform enabling non-accredited investors to invest in high-quality real estate and pre-IPO startups.

The company is one of the most innovative in the real estate space, leveraging technology and systems to streamline regulatory filings and make the investing experience easy for investors from beginner to advanced.

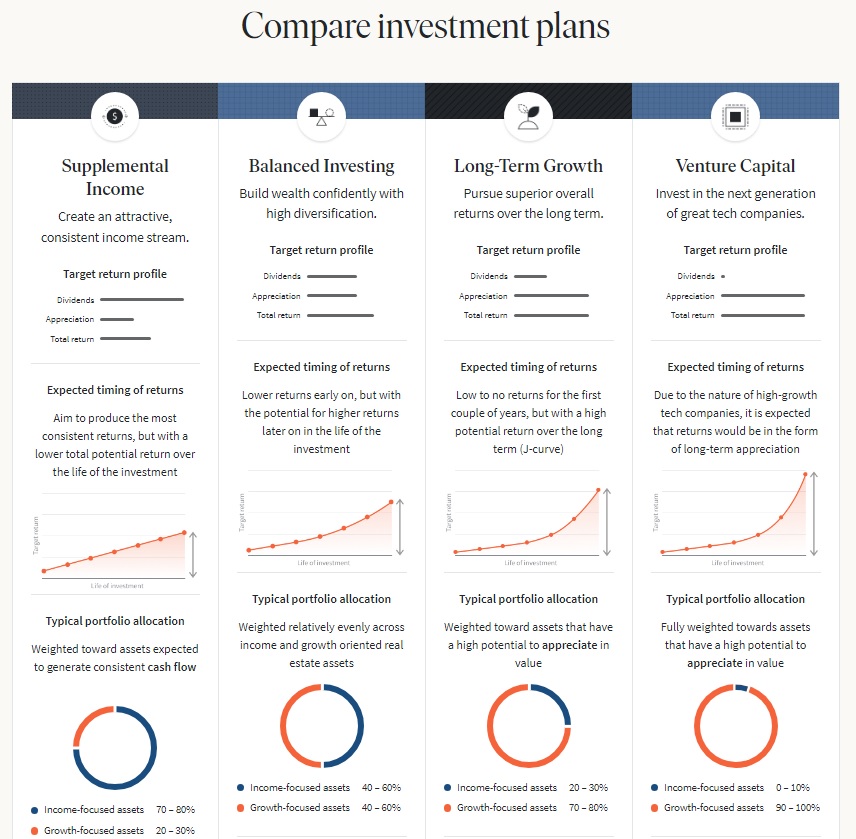

For real estate investments, investors tailor their investment strategy to focus on growth for appreciation, supplemental income for passive income, or a balanced approach.

Fundrise’s funds contain high-quality multifamily apartments, industrial properties, and single-family rentals, allowing investors to diversify among hundreds of properties with one investment.

There are also high-quality real estate debt investments branded as private credit, offering higher yields for income investors.

The venture capital offering, a unique opportunity for non-accredited investors, empowers investors to own private companies like Databricks, Anthropic, Canva, Anduril, and ServiceTitan before their IPOs.

I’ve personally invested on the Fundrise platform for over six years. I’ll share my returns below. I also share screenshots from my account so that potential investors can see a sample of what kind of long-term returns are possible.

In this Fundrise review, I’ll go over the Fundrise real estate investing platform, the Fundrise Venture Fund, and the Fundrise iPO.

Fundrise is the simplest, most hand-off way to invest in real estate. After six years of investing, I believe Fundrise is the top alternative assets platform for non-accredited retail investors with an investment horizon of five to ten years.

More than 2 million investors now invest their money with Fundrise. The minimum investment is $10.

Full disclosure: I’ve invested more than $20,000 of my money into Fundrise real estate funds and the Innovation Fund since 2017. I’m also an investor in Rise Companies Corp, the parent company of Fundrise, via a $2,000 investment in the Fundrise iPO.

This Fundrise review is a testimonial in partnership with Fundrise. I earn a commission from partner links on RetireBeforeDad.com. All opinions are my own.

Table of Contents

Fundrise Review 2024

The Fundrise mission is far-reaching, helping to explain what they’re all about.

Fundrise’s mission is to build a better financial system by empowering the individual investor.

Innovation is at the core of Fundrise. Since its first funded property, it has grown significantly in users and products, many of which were the first of its kind.

From filing the original patent for real estate crowdfunding to using Regulation A to fund itself (in the Fundrise “iPO – internet Public Offering“) to venture capital, Fundrise continues to push the limits of what is possible.

The minimum investment for Fundrise is $10, making it possible for all U.S.-based investors 18+ to invest in high-quality real estate and exciting pre-IPO startups.

The company has modified investments and refined the investment experience over time, making a Fundrise review like this one difficult to maintain because of the frequent changes. However, each change is for a better client experience.

Fundrise Overview Video

I’ve created a supplemental video to accompany this review. Watch it below or on YouTube:

How it Works

Fundrise is a separate investing platform similar to a stock brokerage account. However, investors own real estate and venture capital funds instead of stocks.

These funds are non-traded, so it’s best suited for buy-and-hold investors.

To start, investors go through a questionnaire to establish an investor profile and strategy, then connect their bank accounts and deposit funds.

Based on the investor profile and selected investment strategy, Fundrise automatically allocates new deposits into the most appropriate funds for individual investors to build a portfolio.

The funds hold multiple real estate properties ranging from $1 million in value to $50 million or more. Each property has a stated strategy and target investment horizon.

Investors can modify their strategic plans or upgrade their accounts to invest with a more manual approach.

Fundrise manages all real estate funds on the Fundrise platform. There is no access to external investments.

Fundrise Returns

Before we get into the details of an account, most investors are interested in expected Fundrise returns.

Like all investments, past performance is not indicative of future returns. Furthermore, each Fundrise portfolio will be unique, depending on when you make your first investment, how much, and into which assets.

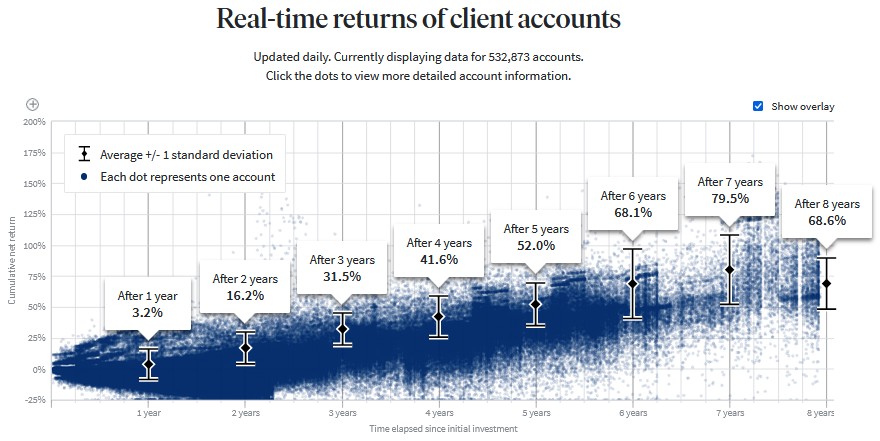

Fundrise provides an excellent visual of client returns (inspired by LendingClub), looking at cumulative returns over time. Generally, investment returns increase the longer the investor has participated.

The chart shows the returns of more than 500,000 accounts and is updated daily. The image below is a snapshot. See the latest chart here.

Fundrise Review — What are you Investing In?

Fundrise has changed the names and categorizations of its investment options over the years to improve the client experience. But the foundational investments remain the Fundrise eREITs.

eREIT stands for electronic real estate investment trust.

A REIT, or real estate investment trust, is a publicly traded equity, or a stock, that you buy through an online broker. These existed before eREITs.

eREITs are non-traded, meaning you cannot buy them on a stock exchange. You can only buy eREITs on the Fundrise platform.

However, they are securities regulated by the Securities and Exchange Commission (SEC), similar to public stocks, but the filing requirements are different.

Fundrise has created a streamlined process to submit filings to the SEC under the JOBS Act regulations to make their investments available to non-accredited investors.

The main takeaways about eREITs are:

- Regulated securities — Fundrise qualifies investments with the SEC.

- Legitimate investments — Because the investments are qualified and regulated, all Fundrise investments are legitimate but not risk-free.

- Non-traded — eREITs do not trade on exchanges, so the prices do not fluctuate with the stock market.

Fundrise appears to be using the term eREIT for vintage and specialized funds but has removed the term from its flagship offerings. We’ll discuss more about the types of investments below.

Setting Up Your Fundrise Account for Success

Fundrise makes investing easy by asking new investors questions to build an investor profile and an investment strategy. This helps to onboard novice investors and formulate an investment portfolio, even if the investor is limited in investment knowledge.

When you open an account at Fundrise, you’ll go through a questionnaire to determine the best strategy for you. The strategy can be modified later. They ask questions such as:

- What is the primary reason you want to invest in Fundrise?

- Are you an accredited investor?

- How much do you typically invest in a year?

- What best describes your investing style?

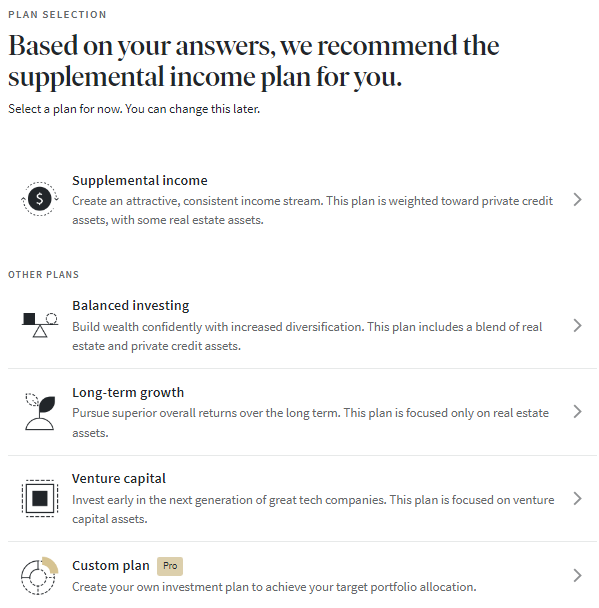

At the end, the system will recommend a plan. Mine was supplemental income:

These links discuss the strategies further:

These are the three primary real estate investment strategies. Investors most interested in venture capital can select that strategy instead.

Your selection doesn’t limit what you can invest in; it’s only used to create an initial portfolio.

There’s also a link to compare the four strategies.

Fundrise has streamlined, refined, and simplified the onboarding process for investors over the years, making it easy for anyone to invest. As your account matures, there are other options, such as Fundrise Pro, that give investors more control. But for all new investors, I recommend going with the flow to set up your portfolio.

Fundrise Investment Types

Fundrise breaks down its investment types into three high-level categories, then subcategories under each type.

These categories and names have changed several times over the past six years. So keep in mind these are subject to change. As of January 2024, here are the investment types:

- Real Estate — Typically, these are equity investments in multifamily apartments, industrial properties, or single-family rentals.

- Private Credit — Usually, real estate loans, fixed-income products, or other structured investments that aim to deliver higher yields with lower overall risk when compared to equity investments.

- Venture Capital — Investments in pre-IPO private companies. Diversified early-to-late-stage startup investing.

Real Estate

Within real estate, there are additional subcategories.

As Fundrise has grown and innovated, they’ve changed the kinds of new funds they launch and how they structure funds.

For a long time, Fundrise had a $50 million limit on new funds. Therefore, it had to launch several funds to keep up with demand. However, they later figured out a way to host larger funds (up to $1 billion) within their regulatory framework.

The Flagship Funds, Strategy Funds, and Premium Funds are larger and most likely the future. The Regional and Vintage funds trace their origins back to the earlier days of Fundrise and are still maintained.

Some smaller and more specialized funds may eventually age out or be merged into larger funds (this has happened with many older funds).

Here is the current breakdown and their descriptions taken from the Fundrise website:

- Flagship Funds — “These publicly registered funds are our largest and most diversified and are akin to mutual funds of alternative assets.”

- Strategy Funds — “These funds are more narrowly focused around specific investment strategies and typically invest alongside our Flagship Funds.”

- Premium Funds — “These are accredited-only, closed-end funds that invest according to specific investment strategy. They typically have higher minimums with no liquidity and different fee structures.”

- Regional Funds — “These are smaller, more narrowly focused funds whose investment strategy is primarily based on specific geographic regions.” Some of these are closed to new investors.

- Vintage Funds — “These are smaller, more narrowly focused funds that vary in strategy and whose portfolio is highly dependent upon the year in which they launched and acquired the majority of their assets (these funds are generally limited in availability to new investment).”

The underlying funds in these categories change a lot, so I’m not going to add each individual fund. However, you can poke around the website to see typical investments under each category. I’ll show an example portfolio further below in the Fundrise review.

Fundrise Dashboard Overview

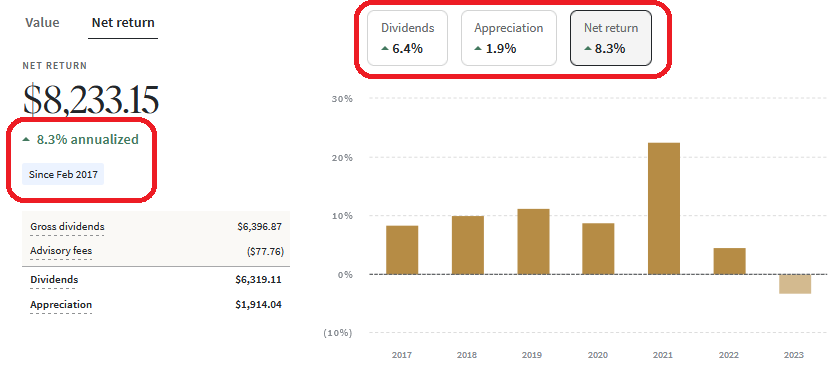

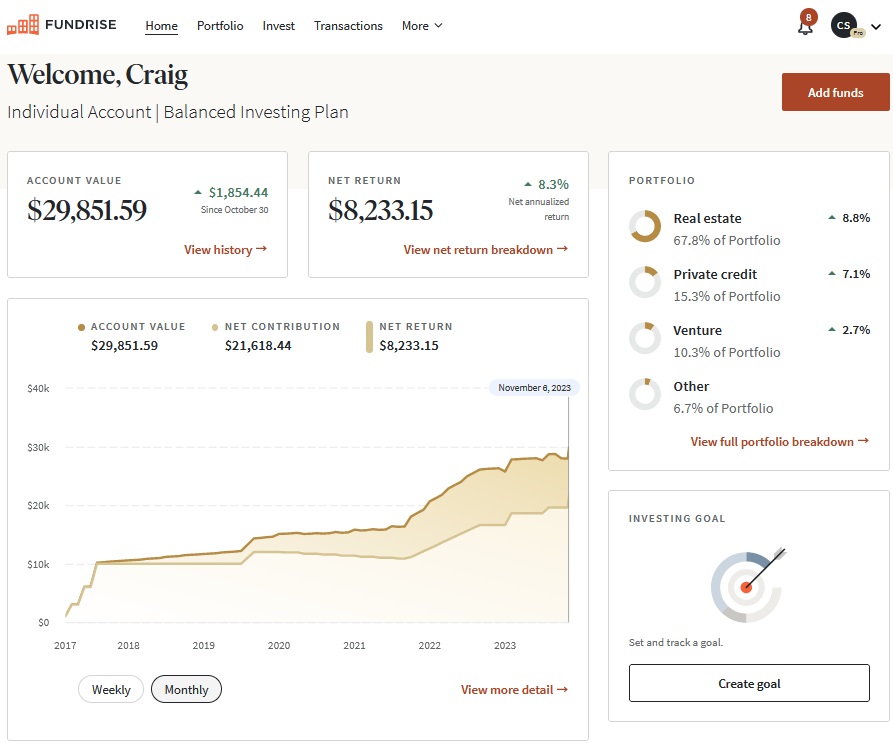

When you log into your established account, you’ll see your account value, net returns, portfolio composition, and account value over time. Here’s a look at my account as of January 2024 after six years of investing (I started in February 2017).

Mine is an individual account (taxable) using the Balanced Investing strategy.

Below that, there is a news feed and various other options to improve your account, such as setting goals or enabling automated investing. The news feed also shows property and investment updates.

Anywhere there is an orange link, you can click to get more details.

As of the screenshot date, I’ve contributed about $21,618.44 to my account, and it’s now worth $29,851.59.

My contributions are actually a bit higher as these are “net contributions”. There was a period when I could not reinvest dividends, so I took some money out.

The account value chart gives you a sense of when I contributed money, primarily at the beginning, then more regularly, from 2020 through 2022. The latest increases can be attributed to fresh investments in the venture fund and Fundrise iPO.

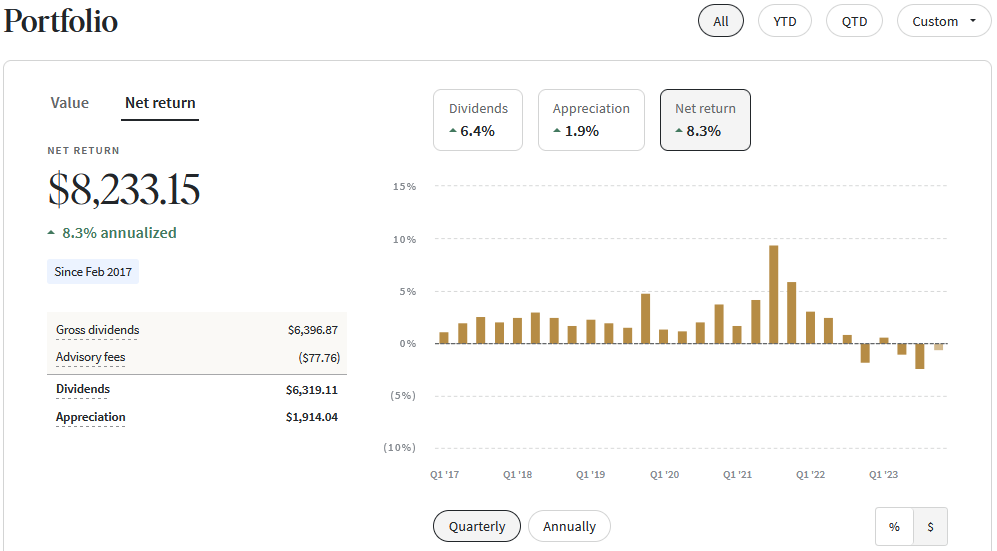

When I click into the net returns, I can break out my long-term returns by year or quarter. You can see there was a significant jump in 2021 when net returns across all Fundrise investments were about 23%. Returns have slowed in the higher interest rate environment.

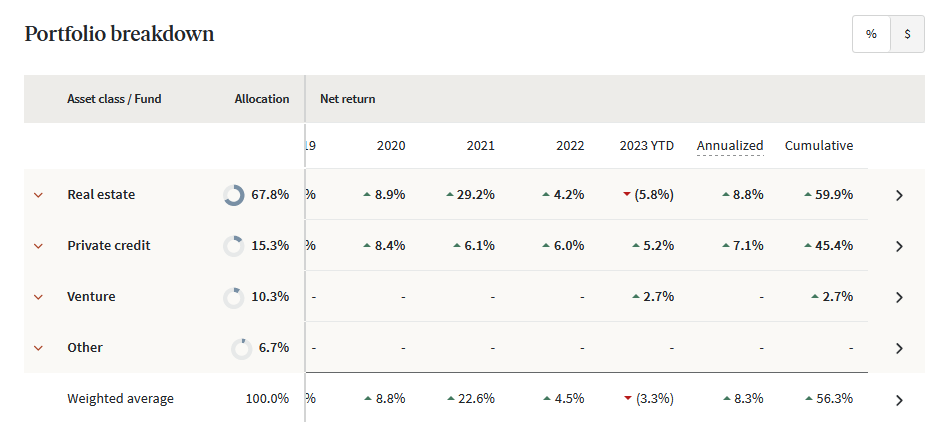

Scroll down a bit, and you come to the portfolio breakdown. I’ve simplified this view to keep it high-level. Each section has a dropdown showing the specific funds.

As of January 2024, my portfolio is about 83% real estate (private credit is debt on real estate). The remaining allocation is in the Venture Fund, and Other is the Fundrise iPO.

Anywhere there’s an arrow to the right, the investor can click in to learn more about the specific portfolio makeup, including the properties each fund invests in.

Fundrise Dividend Reinvestment

Dividends arrive every quarter in January, April, July, and October. Income-focused funds pay much higher yields than growth funds.

Similar to investing in dividend stocks, you can easily reinvest your quarterly Fundrise dividends back into your funds to compound your portfolio.

If you prefer, you can have your dividends deposited into your bank account.

When you reinvest dividends, Fundrise automatically allocates the new funds according to your investment strategy (Supplemental, Balanced, or Growth).

Fundrise Review Liquidity

Fundrise has simplified its liquidity rules substantially over the years. As always, the rules are subject to change.

The current rules (as of 2024) are as follows:

- The Flagship Fund and Income Fund will offer quarterly liquidity (in the form of quarterly repurchase offers), and there is zero penalty or cost associated with liquidating these shares.

- There may be penalties associated with liquidating your eREIT/eFund shares depending on when the request is made.

- If the age of shares is less than 5 years, the penalty on a withdrawal is 1%

- If the age of shares is more than 5 years, there is no penalty.

But remember, you’ll earn interest on your investment during that time, so you can withdraw your money and still be well ahead.

The redemption penalties help to encourage long-term investing, which is necessary to benefit from real estate investing strategies.

Liquidity may be limited during a financial crisis. CEO Ben Miller has issued a letter to Fundrise investors explaining how the company will operate during a recession.

The main point is that Fundrise investments are not correlated to stock markets, which is a good thing. However, when turmoil hits, Fundrise can limit liquidity in order to take advantage of real estate deals when there is market turmoil.

Regarding a plunge in asset prices:

In such circumstances, Fundrise will almost certainly suspend our redemption program, and investors should not expect us to provide them with liquidity.

Fundrise sees market downturns and forced selling as an opportunity. Therefore, they reserve the right to hold redemptions to have the cash to take advantage of the opportunity.

The letter also states:

If you think you may need liquidity from your investments with us during the next financial crisis, then Fundrise’s long-term illiquid real estate strategy is probably not a good fit for you.

Fees — Fundrise Real Estate Fund

I’ve included the fee information quoted from the FAQs to avoid misstatements.

Fundrise charges a 0.15% advisory fee, which means over a 12-month period, investors will pay a $1.50 advisory fee for every $1,000 they have invested with Fundrise.

Fundrise’s real estate funds have an annual 0.85% flat management fee. That’s $8.50/year for every $1,000 invested. Investors can expect to be allocated to our real estate funds if they choose to invest in our Supplemental Income, Balanced Investing. or Long-Term Growth Plan.

Fees — Fundrise Innovation Fund Fees

The fee structure is provided word for word via the Fundrise FAQs as of January 2024:

The Fundrise Innovation Fund has an annual 1.85% flat management fee, the equivalent of $18.50/year for every $1,000 invested. Investors can expect to be allocated to this fund if they choose to invest in our Venture Capital Plan.

Fundrise Taxes

Like dividend income and everything else, you do need to pay taxes on your Fundrise income. For the eREITs, private credit funds, and Innovation Fund, investors receive a 1099-DIV in February or March to report on their annual tax return.

The 1099-DIV is a simple form to file with your taxes. You’ll receive a separate form for each fund you own. So, you will have multiple forms to file with your taxes, but they come from Fundrise in a single PDF.

I am not a CPA or tax attorney, so contact yours for your own specific tax questions.

The eFunds are structured as partnerships. As such, you may receive a K-1 and be required to file it with your taxes. Fundrise told me they intend to do composite filings for the eFunds, eliminating the need for individuals to file additional state tax returns. But could not guarantee it.

Fundrise has reduced the availability of eFunds, likely due to the K-1 being a more challenging tax form for retail investors.

Fundrise Self-Directed IRA Investing

To lower your taxable income from Fundrise eREITs, you can invest with Fundrise with a self-directed IRA. Investing with a self-directed IRA requires an account with a custodian.

Fundrise has partnered with a custodian called Millennium Trust Company to provide self-directed IRA services. Read more here.

Fundrise Pro

Fundrise Pro is a premium membership that gives investors who wish more flexibility to customize their portfolios. Members choose their funds to construct their ideal portfolio instead of the hands-off approach most investors prefer.

Pro lets investors set intelligent portfolio allocation targets and access proprietary market and portfolio data for more control and intelligence. Fundrise Pro also gives members access to curated Wall Street Journal articles from the website or Fundrise app.

A Fundrise Pro membership costs $10/month or $99/year.

Existing Fundrise investors from before March 2023 with an account balance of $5,000 or a direct investment in the previous 12 months were grandfathered into the membership. This included many early investors with more significant balances or those who consistently used the direct investment option.

The Fundrise Innovation Fund

Fundrise investors now have the opportunity to invest in pre-IPO startups.

Venture capital investing is a new asset class for non-accredited investors. It’s another example of Fundrise being a prominent fintech innovator.

Fundrise is one of only two such funds available to retail, non-accredited investors. The other is the ARK Venture Fund.

Both funds have only been around since 2022, and private valuations have been declining since 2021, so it’s an exciting time to invest.

There was a waitlist for the first year of the Innovation Fund, but it is no longer in place. New investors can invest in the Fundrise Innovation Fund today.

I wrote a comprehensive Fundrise Innovation Fund review on my other blog, Access IPOs. The review maintains a current list of investments so you can see the latest companies included in the fund.

Companies such as Databricks, Vanta, ServiceTitan, and Canva are some of the more significant holdings as of this Fundrise review update (January 2024).

Owning this fund empowers investors to own future IPOs today.

There are higher risks associated with venture capital investing. However, owning a diverse fund like this one over several years will reduce overall risk.

Fundrise Review – Cons and Risks

Up to here, it’s been mostly “pros”. I’m a huge fan of Fundrise after more than six years.

But the platform could be better even though its always improving.

Fundrise manages your investments for you. This is good for most people, but not if you’re an active investor interested in performing due diligence on individual properties. EquityMultiple and CrowdStreet are better platforms for more sophisticated accredited investors.

As a result, the investments are passive but reliant upon management. If this makes you uncomfortable, the upper tiers give you more control, but similar platforms may be more suitable for professional investors.

Giving up control, however, is how many novice investors with no experience with real estate can earn good returns. Fundrise is targeting those investors, not expert real estate investors.

Liquidity remains a downside despite improvement over the years. Ideally, we’d be able to come and go as we please, even though that would not be conducive to long-term gains.

If you may need the money in a year or two, Fundrise is not the right platform for you.

Though the penalties on early withdrawals have declined (now just 1%), and the larger funds do not carry penalties, the real benefits of real estate investing come from long-term holds.

Income from Fundrise dividends is non-qualified, meaning they are taxed as ordinary income. Fundrise dividends incur taxes if held in a non-retirement account. Use a self-directed IRA to avoid dividend taxation.

Fundrise is proliferating and innovating. Sometimes, that means they will implement changes you are not expecting or want. For example, I was perfectly happy with Fundrise 1.0 way back when. Then it changed to Fundrise 2.0, and then changed again.

Startups must innovate to stay in leadership positions. I believe the platform is close to a permanent user interface now that it has been updated several times. But, the frequency of the user interface changes could become frustrating again.

Lastly, all investments carry some risks, especially those with higher returns. Fundrise was, in part, born out of the financial crisis and real estate bubble a decade ago.

Another similar crash would be detrimental to these investments. However, many of these investments provide housing to people, and those people will always need a place to live. These investments are meant for the long term and will likely recover after any storm, given a sufficient investment horizon.

You may lose money investing in Fundrise, as you would in the stock market or anywhere else.

What are my Annualized Fundrise Returns?

As of 01/01/2024, my total investment of $21,618.44 is now worth $29,851.59. The weighted average annual returns of my portfolio from February 2017 to January 2024 is 8.3%.

Between the nine real estate funds, I own a piece of 182 “active projects”.

Additional Information – Fundrise Review 2024

Onward Podcast

Fundrise and CEO Ben Miller started a podcast called Onward. The show gives insight into how Fundrise thinks about real estate and the current economic environment.

Mobile App

Fundrise has a decent mobile investing app. The information provided is a near replica of the desktop view. Here is a screenshot of my home page from the mobile app:

What is Real Estate Crowdfunding?

Fundrise is an innovator among the first to bring real estate investing to the mainstream. The founders saw inefficiencies in how real estate projects were financed. They also wanted an easy way for friends, family, and locals to invest in properties. But there wasn’t a way to do so online.

In 2012, Fundrise completed the first crowdfunded real estate purchase in the H Street Corridor of Washington, D.C., raising $325,000 from 175 investors.

Around the same time, Congress passed the Jumpstart Our Business Startups Act (JOBS) of 2012. The JOBS Act set the foundation for equity crowdfunding. Equity crowdfunding is similar to more established crowdfunding on sites like Kickstarter but allows for equity exchange.

Real estate investing was not the primary intent of the JOBS Act. However, it has seen the most growth. Since the passing of the JOBS Act, at least 100 real estate investing sites have emerged because the opportunity is so big.

But the top-tier companies do most of the volume. In addition to Fundrise, other significant platforms include:

I’m currently investing on three different platforms. Fundrise, Arrived, and EquityMultiple.

The phrase “crowdfunding” is a bit outdated. The real estate investing industry has matured in the past decade, making it as safe and reliable as traditional real estate investments (buying property alone). Fundrise has grown from around 100,000 clients to more than 2 million since I first wrote this Fundrise review in 2017.

Now, all U.S.-based investors 18+ can diversify and benefit from this tried and true asset class.

Read more: Real Estate Crowdfunding 101

Fundrise Review Verdict

Note that my review ratings have increased in the past six years. I rate my reviews on a scale of 1 to 10 for each review feature.

- 1 = Needs Improvement

- 10 = Excellent or meets full expectations

In my latest update, I’ve increased the score for liquidity and fees since each improved since my last analysis. Investment selection has also improved, having added venture capital.

I’ve also added the Mobile Access item since my previous update did not include mobile.

Fundrise Review

-

Ease of Use - 10/10

10/10

-

Transparency - 9.5/10

9.5/10

-

Diversification - 10/10

10/10

-

Fees - 9/10

9/10

-

Investment Selection - 9.5/10

9.5/10

-

Liquidity - 9/10

9/10

-

Mobile Access - 9.5/10

9.5/10

Summary

An innovative real estate crowdfunding and venture capital platform for all U.S.-based investors 18+. Instant diversification for a $10 minimum investment.

Chime In

Have you invested with Fundrise? What is your take on the platform? Please add your insight in the comments section below.

If you have any questions about Fundrise, I’m happy to answer any specific questions that I can. Add to the comments section or contact me directly, and I’ll respond.

Most everything is answered in the FAQs on the website, but being a user, I can provide insight on less obvious inquiries.

Thanks for reading my Fundrise review.

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

Been w fundrise since you brought it to my attention years ago. Great review and I agree we your ranking. I love the innovation fund and the chance to invest in a venture cap style. My returns are on pace w yours. Still have not pulled the trigger on the rise IPO.

Thanks for your articles and investing product reviews.

Kevin

Thanks for chiming in, Kevin. Glad to hear it’s been a successful investment for you as well.

I have heard from readers who signed up more recently and have not experienced good returns. All I can say is Fundrise is a long-term investment. Real estate values do not spike overnight, nor do large investment projects, or (most) startups for that matter.

Fundrise is a 5-year minimum investment.