The Retire Before Dad Story

At age 27, I was broke, unemployed, and living at home with my parents. Not surprisingly, I was single too.

Sounds depressing, right? Not so.

I had recently returned from an epic 14-month backpacking trip to Asia and Latin America, spending just $10,000 on the entire journey, then completed a three-month, 8,000-mile road trip throughout the U.S and Canada in a brand new car I bought with no money down.

Every last dollar in my bank account went toward making the most of my 20’s, checking off a lifetime’s worth of bucket list items in less than a year and a half.

Living at my parent’s house was an opportunity to pause and regroup before starting the next phase of my life.

At some point during the traveling, my Dad retired from a 35-year teaching career. He was 56-years-old. As a student of finance, 65-years-old was always the gold watch standard retirement age. I wondered, could I retire earlier than he did?

Fresh off living a life of freedom and wanderlust, I wanted to be able to travel again someday without the restrictions of time, money, or old age. But I also wanted to start a family of my own.

So with empty pockets, the travel bug fully satiated (for the time being), and my Dad’s life and career as my inspiration, I set a goal to retire before my Dad did, at age 55.

Fast forward to today, I’ve built the life I always wanted; married, three beautiful kids, and a home in the near-city suburbs. I’m still nostalgic for the backpacking days and the freedom it gave me, but I’m looking forward the Disney cruises, cross-country road trips, beach vacations, and international travel as a family of five.

Full retirement is likely years away, but the decisions I make today will shape the quality of retirement I’ll ultimately have.

Beginnings

When I was younger, my Dad would show me National Geographic videos about wild animals in exotic places around the world. Those videos stuck with me. As a senior in high school, I applied to college with the idea I’d go into the natural sciences to study animals.

What I learned over the next few years was it wasn’t the animals I was interested in, it was the exotic places.

The summer before freshman year, one of my older friends returned from his first year of college. I asked about his major, Finance. Everything clicked during that conversation. It wasn’t that my friend was overly convincing. Before then, I simply didn’t know Finance was a major.

My favorite class senior year in high school was a basic microeconomics course. The teacher was cool and everything made sense to me. We even had a stock picking project where we all chose a company out of the newspaper quotes. Mine was Gillette (now a part of Proctor & Gamble (PG)). That class had a lasting impact on me.

I changed my major to Finance during the first semester of college. Business and investments was my new career path. I wanted to be a stock broker.

The summer after my junior year, I was offered an unpaid internship at Merrill Lynch. With no paid internship options, I took the 12-hour per week job. To make ends meet, I also worked in a used record store. This was pre-Napster.

What I learned during my internship was that being a stock broker is not about investing, it’s about sales. The young ‘financial consultant’ assigned as my mentor knew nothing about finance. He knew someone that got him in the door and was eager enough to work hard and succeed. He explained that the brokerage intentionally hid the amount of fees they charged their clients. Most of his clients didn’t know anything about money in the first place. They put their complete trust in him because it was their best option.

Working in the used record store was a much better learning experience. I helped the manager with all aspects of the business, including managing inventory, sales, staffing, and accounting.

By the end of the summer, I no longer wanted to be a stock broker. It seemed like a stressful and unsatisfying job. The best could make great money, but many would fail. A major predictor of success was how persistently a new recruit was willing to cold call.

At the record store, I saw what it took to run a successful franchise business first hand. That was more appealing to me at the time, but it still didn’t translate into a career. So I didn’t know what was in store for me after graduation, aside from my first big trip.

Backpacking the World the First Time

After college I didn’t have a job. My plan was to move to Washington D.C. where a few friends were based, and find something there.

But before that, I joined the throngs of American college graduates that crossed the Atlantic to ‘Eurorail’ around the European continent. That trip was my first real taste of freedom and independence. In 60 days, I visited 15 countries traveling from London to as far east as Romania and back.

Packed into that two month period were some of the more impactful travel days of my life. From being immersed in the beauty of the Swiss Alps, to getting stuck in a lightening storm in the Rila Mountains of Bulgaria. Traveling over land with only a friend, a backpack and a guidebook was enlightening.

But 60 days of travel wasn’t nearly enough to satisfy my curiosities.

Entering the Workplace

In D.C. in 1998, temporary work was easy to find with a Finance degree. The US economy was in the middle of the ‘dotcom’ boom and the looming perceived Y2K crisis. After two months as a temporary entry level financial analyst, a friend submitted my resume to a large IT consulting company. Shortly after, I had a real job, comfortable salary, and new timeline to go traveling again.

I knew nothing about IT, but the computer systems I’d be working on were finance related. My resume was just barely enough to get me in the door.

My new job came with many of the negative attributes of a typical consulting job. Long hours were expected. Some bosses were stressed out and shitty. The end customer was demanding and highly irrational. The commute was debilitating.

But I learned a lot about IT, and mastered one particular software application that would eventually lead to another job years later.

With my new salary, inexpensive housing and a small car loan to pay off, I was able to estimate the amount of time it would take to go backpacking again; three years. Everything I did with my money was aimed at the ultimate goal of traveling the world again. Next was Asia.

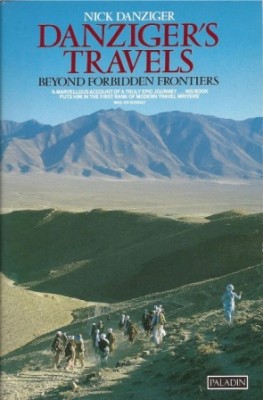

During those early years of my career, I read books about travel to keep me motivated. One outstanding book of influence was DANZINGER’S TRAVELS: Beyond Forbidden Frontiers.

During those early years of my career, I read books about travel to keep me motivated. One outstanding book of influence was DANZINGER’S TRAVELS: Beyond Forbidden Frontiers.

This book is long out of print and difficult to find. It’s about a British guy who hitchhikes from Turkey to China, taking a grueling overland route. He crosses multiple borders without a visa, joining nomads and warlords to make his way across the continent, including parts of Afghanistan during the conflict with Russia. One poignant detail I remember – he wrote about becoming accustomed to wiping his ass with sand (sort of reminded me of college dorm TP).

This book is the epitome of what adventure is all about. It inspired me to always focus on overland travel instead of air.

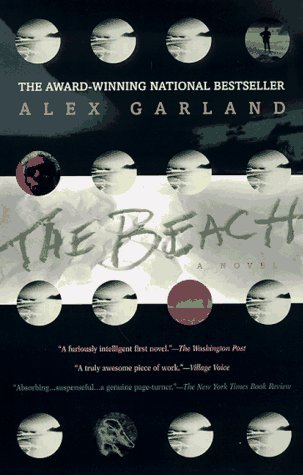

Another book that influenced my travels was The Beach, by Alex Garland. Though fictional, this book introduced me to the world of backpacking in Asia. Thailand, I learned, was one of the largest backpacking hubs in the world. Aside from the beautiful beaches, from there you can travel to see many diverse lands and cultures. And with the late-nineties collapse of the Thai Baht and strong U.S. dollar, that part of the world was incredibly cheap.

So after two and a half years of consulting and putting my finances in order, I arranged my life around the upcoming trip. First, I bought a plane ticket to Beijing five months before my departure date. That ticket was my commitment and solidified my plans. The departure date coincided with the end of my housing lease, and, I estimated, gave me enough time to save up the money to travel for four months. My return flight was from Singapore.

So after two and a half years of consulting and putting my finances in order, I arranged my life around the upcoming trip. First, I bought a plane ticket to Beijing five months before my departure date. That ticket was my commitment and solidified my plans. The departure date coincided with the end of my housing lease, and, I estimated, gave me enough time to save up the money to travel for four months. My return flight was from Singapore.

The Big Trip

I wrote an entire post about my trip called 14 Months, 18 Countries, $10,000. It remains one of the most popular posts on the blog. It explains where I went and how I did it on a tight budget. Anyone with a first world income and passport can save the money and plan a trip like mine. The biggest challenge is dedicating yourself to make it happen.

Since travel is what drives my retirement goal, I’ve included some of my favorite travel stories on the blog. Click here to read about an ugly dollar bill I acquired in Myanmar and how I spent it. Another post was about travel scams and robbery that I experienced during that trip. One of those incidents involved a machete and my neck!

Traveling on an ultra-tight budget is the most rewarding way to see the world, because you mainly eat and travel the way the locals do. Traveling cheap had another upside; the less I spent the longer I could keep going. Fortunately, with nothing tying me down at age 26, time was not a limiting factor.

The attacks of 9/11 occurred during the first month of my trip. I was in a small town in the south of China and didn’t really grasp the significance of the event for a few days. Most U.S. news websites were blocked in China at the time, so information was scarce.

A few days later I crossed into Vietnam where I finally saw some images from that day. The following Monday was the first day the stock market opened. I paid $5 for a room with satellite TV and watched CNBC all day (night) long. The familiar faces of Sue Herera and Bill Griffith were comforting. Strangely, I was safer in Hanoi than in Washington D.C. My first apartment in the D.C. area was less than a mile from the Pentagon.

9/11 negatively impacted the US economy and ultimately extended the slowdown that started with the bursting of the dotcom bubble. The lack of jobs due to that event is what spurred me to extend my trip from a planned four months, to fourteen.

A Sort of Homecoming

Returning from such a long and memorable trip can be depressing. My parents were gracious enough to accept me back after being away for so long. Having lived out of a 35 pound backpack for 14 months and sleeping in a new bed every three days, home life was a rude awakening.

Instead of exploring the magnificent ruins of Bagan, Angkor Wat, and Macchu Piccu, I was driving around my hometown interviewing for jobs I didn’t want. A year of sampling the street foods of the world was replaced with nightly dinner with Mom & Dad, reluctantly talking about the jobs I couldn’t get over the recipes of my childhood. Daily encounters with interesting travelers and locals from all over the globe became daily run-ins with high school classmates who wanted to talk about how awesome senior year was.

Living at home was both easy and unbearable.

Every night I had my own clean room, a bug-free bed, 25+ pairs of clean underwear to choose from (instead of six), and all the resources and facilities I needed without any effort or cost (thanks Mom & Dad). I wasn’t roaming the streets of Bangkok at night anymore, hoping to find a bed within budget, let alone a decent toilet or safe place to put my things, or a meal that wouldn’t give me diarrhea. My life was back to the way it was when I was 15.

I was accustomed to not knowing where I’d be sleeping every night, or what book I could swap for, or who I’d be joining for beers each evening. Sometimes I’d sleep on a bus, or train, on an overnight ferry, or not sleep at all. Backpacking was something new every day. Home was known. That was a difficult transition.

Moving Out

After numerous bad temp jobs, included the worst job I ever had, and months of searching for something permanent in my hometown, I got a call that changed my life.

A company in Washington D.C. picked up on a small, but uncommon, skill set on my resume. My resume had a big time gap missing from taking almost two years off, something employers are never happy about. But this position was hard to fill, because specialists with this skill just weren’t common.

On the phone call I was offered a full-time position and given the choice between traveling back and forth from my hometown, or moving back to D.C. where I started my career before traveling. Moving came with a salary that was 37% higher than what I was paid before traveling. Just like that, I was moving out of my parents house.

Building Wealth and More Travel

During the period of extended travel, I spent everything in my bank accounts. But I didn’t touch my 401k savings (probably under $5,000 at this point thanks to the dotcom bubble), or my Chevron and Coca-Cola stocks. Temp work while living with my parents allowed me to get back on my feet. Now, with a brand new salary and decent benefits, I was armed to start building wealth.

I moved into a house with a few guys in the D.C. area. Rent was affordable and I met quite a few people through the arrangement. My commute was 20 minutes, and my new job wasn’t too challenging. Overtime was never required or expected, so I could return home early every day and pursue my interests. These included getting involved with organizations related to travel and human rights, which was a way to stay connected to what I experienced on my trip.

With a decent salary and three weeks of paid vacation, I also made a point to travel to at least one new country every year. In the years following the big trip, I took extended vacations to Ukraine, Russia, Belize, Morocco, Ireland (read a story about it here), Dominican Republic, and Indonesia.

This stage in my life was also about finding the right woman to settle down with. Money that wasn’t saved or invested was put toward my social life or travel. I probably spent too much on beer, food and live music. But I was 28 and enjoying myself in a great city. I don’t regret a penny of it.

Starting a Family

After a few fun years, I moved out of the group house into a condo. About a year later, I met my future wife. Another year after that she moved in with me and shortly after I proposed.

The time we spent living together in that one bedroom was a great opportunity to save. Having two incomes and both of us being debt-free, we combined everything about our finances and saved aggressively for a house. A full three years before having children, even before we married, we started planning for Mrs. RBD to stay at home with the future kids.

When we moved to the suburbs, the neighbors were suspicious of us moving onto a family dominated street without any kids. In due time that changed with the birth of our son. Then around the time I started this blog, we welcomed a daughter. Summer of 2015 we welcomed a second little girl.

Today, a big part of our financial planning is our commitment to pay for a four-year college education for each of our kids. College 529 savings takes up a big chunk our our cash flow, but I believe it’s worth it. My parents paid for my education with the understanding that I’d pay it forward. Paying for college may be the greatest risk to reaching my retirement goal.

Investment Philosophy

I divide my portfolio of investments in two broad categories, investments that generate income before the age of 59 1/2 (taxable), and investments that will provide income after age 59 1/2 (non-taxable). This blog primarily focuses on my taxable investments.

If I’m to retire at age 55 or earlier, I want to primarily fund my lifestyle with taxable funds so that tax-advantaged savings can be utilized after 59 1/2.

Each year I max out my 401k, my Roth IRA, Mrs. RBD’s spousal Roth IRA, and 529 plans for all three kids with my salary income. Most of that money goes into managed mutual funds (because my 401k sucks), index ETFs, and dividend growth stocks.

I choose to put a large portion in index ETFs to keep those portfolios more passive. I realize there’s a never-ending philosophical and mathematical debate over indexing vs. active management vs. dividend growth investing vs. option trading etc. Chose one, or violate all that is holy. I believe it’s OK to mix and match. When someone is trying to persuade you that their strategy is the best, go with what strategy works for you.

Money leftover after all the pretax investing and normal monthly spending goes into dividend paying stocks, a cash fund for future use, or peer to peer lending.

In my quarterly investment income updates, I write about four different investment income sources. Dividends, real estate, peer to peer lending, and interest on cash. I believe that building multiple streams of income is the best way to diversify retirement income.

Dividend Stocks

Over the years, I followed a lot of investment advice attained through books and television. One Up On Wall Street, by Peter Lynch was the most influential early on. Lynch was a growth investor managing the Fidelity Magellan fund and quite successful at an early age. The fund was so big that he needed to invest in a lot of stocks. But his biggest winners were every day stocks, ones that normal consumers could understand.

I followed Lynch’s wisdom early on, but reading a book or two won’t make you a success. It took many more years of experience, mistakes, and successes to reach a conclusion for the best retirement strategy for me. And that still is always a work in progress.

Warren Buffet was an early influence as well. I started buying Coca-Cola in 1997 solely based on Buffet’s ownership and after reading the Warren Buffet Way, by Robert Hagstrom.

As I traded more frequently in the dotcom era and in the years after I returned from traveling, I realized I didn’t have enough time to be an active trader. You need to be at a computer screen all day. I could not access stocks from my day job. High beta stocks and momentum trading aren’t good for infrequent investors.

Riding the success of my Coca-Cola and Chevron investments, I started investing in other DRIP stocks including Verizon (VZ), Bank of America (BAC) and Emerson Electric (EMR). I noticed that every year, these stocks would increase their dividends and they’d pay me more.

I loved that.

In addition to the DRIPs, I now hold a total of almost 50 stocks in accounts with TD Ameritrade and Fidelity and M1 Finance. See my entire stock portfolio here, updated monthly.

Real Estate and Cash Savings

The housing bubble had popped (in my view) in late 2006. I thought it was a great time to buy real estate.

I was wrong. It only started to pop.

Late 2006 was too early to get bargains on real estate. With a big new mortgage, my monthly cash flow took a hit. Then two years later the real housing crisis hit and condos like mine were going for 15%-20% lower than I paid. That sucked, but my job was secure and my salary income continued to grow.

The shitty economy was good for one thing, refinancing. That helped bring down my monthly costs.

When we moved to the suburbs, I put the condo up for rent and became a landlord. Real estate became an additional stream of income, then a second refinance put the cash flow solidly into the green.

The condo has been a reliable income generator, but I still wouldn’t call it a good investment. And it’s still probably not worth what I paid for it. But there’s more than $100,000 of equity in it. So from a wealth building standpoint, it has been positive. It was, however, quite a siphon on my income for a long time, and that prevented me from investing money elsewhere during the early years of ownership.

The condo isn’t a great rental to begin with, for reasons I laid out in this post. I’ve been considering selling it and may still do so if opportunity knocks.

For a long while, I was building a large cash stash slated to spend on a second rental property. When the time came to seal a deal, I had to walk away just five days before closing. A lack of decent investments in my price range, combined with the frustration over the failed transaction, made me put my real estate ambitions aside. I decided my money would be better invested elsewhere, at least for now. Since then, I’ve upped the amount of money invested into stocks.

I’m now also invest in real estate crowdfunding which I believe to be the next big passive income stream for ordinary investors. I’m currently investing on the Fundrise (review) and EquityMultiple platforms (review).

Please note: This is a testimonial in partnership with Fundrise. We earn a commission from partner links on RetireBeforeDad.com. All opinions are my own.

Views on Debt and Frugality

I’ve lived a mostly debt-free lifestyle, aside from mortgages, since 2005. However, as I’ve become more wealthy, I’ve taken on some conservative and very low interest rate debt through home equity in order to increase my total returns over the long term. I’ve mainly used the money for minor home improvements.

I think that financial experts and gurus over-emphasize debt as a problem.

But I do like companies that don’t have any debt, and highlight most of them on this page. Debt-free companies that pay a dividend are at a much lower risk of cutting their dividend.

That all said, I intend to be completely debt free by the time I retire in 2031. I don’t want a mortgage payment in retirement, regardless of what the math says.

During my travels I lived in an extremely frugal manner, often surviving on less than $5 per day. Now that I’m a family man in the suburbs, extreme frugality is not part of our retirement plan. That’s not to say we’re big spenders. Not at all. We own modest cars, a modest house, and only buy what we need when it’s on sale. I married a great partner for this. Frugality is in our blood, just not extreme frugality.

When we retire, we want to live in comfort. That is part of the reason why our early retirement date is not extreme. We want travel in comfort too, and maybe even in some luxury. When I’m 55, we will not be sleeping in $1.25 hotel rooms in Guatemala or Laos! That’s for sure.

Why I Started the Retire Before Dad Blog

My day job has never been all that exciting. It’s rewarding in that I work hard and earn decent money. I’m acknowledged and compensated for strong performance. I have mostly good managers and it’s a pleasant place to work. I don’t need the job, but it serves at the path of least resistance (nsfw) to financial independence and complete control of my life.

But something was missing. My job has never been a canvas for creativity. Everything is information technology related, meaning big computers, rules, logic, and documentation of those rules and logic. My day job entails making sure complicated software systems work for business users.

I started thinking about creative outlets. A good friend from my childhood started a health related blog. I watched him build a personal brand for himself, and become a voice of influence in his field. He built something out of nothing, riding the wave of his passion.

Around the same time, I came across some blogs via Seeking Alpha that discussed in detail the dividend growth strategy of investing. Having meticulously tracked my own dividend income since 2003, and leaving behind active trading to focus on dividend investing, I was already doing what some of these bloggers were writing about. My tracking spreadsheets, while mundane to some people, were my passion.

Saving for retirement, personal finance, investing were what I loved reading about. In fact, I almost took a career turn to get a Certified Financial Planning (CFP) accreditation at one point, but decided instead to stay with IT.

But what if I could turn my passion into a creative outlet online? What if that could turn into a business?

When I stepped back and looked at what I was passionate about, that is where the name of the blog came to fruition. Retire Before Dad. That’s my goal. It’s been my goal since the end of my traveling.

After some careful thinking and considerations of other creative outlets, I launched this blog in September of 2013 on the WordPress.com platform. I chose the .com platform (as opposed to the self-hosted .org) because I didn’t know if I’d like blogging and it was an easy place to learn. Perhaps I’d stick with it, maybe not. Why not give it a try first and see where it takes me?

It turns out I liked blogging. Readers came, and peers in the investing and finance blog communities accepted me with open arms. About five months into this endeavor, I switched over to a self-hosted site with BlueHost, and turned my creative outlet into a full-fledged side project.

Only my wife knew about my new project. She was a little skeptical. However, she had actually suggested a blog as a creative outlet at one point as she is an avid follower of many in the food and parenting spaces. Then I started meeting other bloggers, told a friend or two, and told my parents about it. But it was not intended to build a personal brand online, or to jump start a new career. It was always meant to be a moonlight project, and still is.

The main reason I blog anonymously is because of employment. The small company I work for would think I should be doing extra work for them in the evenings instead of writing. The owner can be irrational, so I just want to avoid that conversation. I also write about my job quite a bit, and not always in a good light. As it’s my singular goal to quit working, that doesn’t bode well for career advancement.

Final Thoughts

I wrote 120 blog posts in the first two years of this blog and I’ve seen a steadily growing readership since I started writing. Blogging is more rewarding than I anticipated. With readership also comes revenue. Maintaining this blog and learning about online businesses has created a small but additional stream of income too. That is extremely gratifying.

The blog has also served as a motivational tool for retirement. Writing about investing, travel and other things finance related makes me think very hard about the choices in front of me. Reading other blogs motivates me to save and invest even more than I already do. Put simply, this blog is helping me to reach my retirement goal.

Lastly, I want to thank all of my readers for subscribing to my email list and social networks, and returning to my website every week. It’s my goal here to write one quality blog post for every Wednesday morning. Thanks for reading, commenting, and sharing on your social networks. A special thanks goes out to the bloggers in the finance and investing space that have welcomed me and shared my content. Without that support, it would have been hard to gain traction.

In future, you can expect to see more similar posts and quality content. If there’s ever a topic you think I should touch on, please contact me and let me know.

Camel photo credit: RBD

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

FV,

Thanks for always stopping by and commenting. You should hope for better than my Alexa!

-RBD

Thanks for reading, especially being so long!

I love this post. It took a little while to read, but it’s so interesting to know your full arc in one go. I especially love knowing how you formulated your goals and timeline, the expenditures you prioritize (namely paying for your kids’ college), and about all of your travel in your 20s! We’ve done a little bit of backpacking overseas, but one of our big motivators to retire as early as possible is to be able to travel while we’re still willing to sleep in hostel beds full of bedbugs! 😉 (Not really — I don’t *need* bedbugs or anything!)

Congrats on the two-year anniversary, and on continuing to see well-deserved growth in your readership and revenue!

ONL,

I’ve written so many pieces of my story over the two years I figured it needed some congruency. This will also serve as a new ‘about me’ type of page. Sorry so long! I cut it back quite a bit too.

I was eaten alive by bed bugs in a rural thatch roof hostel in Guatemala. Not fun.

-RBD

I really enjoy your blog — besides your excellent content, I follow because I (sometimes weirdly) mirror your past and current situation. I traveled extensively in my 20s (studying abroad in Asia, backpacking around world for a year, etc.) and early 30s (more elaborate, young professional exotic travel). I live in Washington D.C., try to live within my means, am a pretty aggressive saver/investor AND have two kids under the age of three. Keep up the good work!

Rabbithutch,

Whoa, you’re kinda freaking me out here! Ha ha 🙂 Ya know, it’s probably not that uncommon a story, especially in DC which attracts people like us who want to stay connected to the traveling past. PCVs all move here, and international work opportunities are all over town.

So I guess you’re also exhausted every night around 7:30 too? Thanks for being a reader!

-RBD

I’m often struck by the similarities of our lives. From kids to college savings to investing styles to sticking with a career, it’s like reading about my life. Change your world travel to my Alaska travels and swap your IT to my power plant and it is a little eerie. Same age, too.

Keep up the excellent writing!

JCully,

Yeah those are some similarities! I used to live right near a coal plant too, and got a tour of the place. Very interesting. Thanks for being a reader. There’s a lot of Dad’s out there struggling with the same decisions and hurdles we are. I don’t pretend to have solutions for everyone. Hopefully sharing my situation can help people make the best decisions for their own unique situations.

-RBD

Happy 2 years anniversary.

Great read, I loved how you perfectly described your “boredom” when you came back from 14 months of backpacking. This must have been tough, and yet you were in a situation where complaining would have felt awkward… The very best definition of a first world problem (and the fact that it had a real psychological impact on you)

Stockbeard,

A lot of my problems are first world problems! I remember when I came back I was so annoyed by how wasteful people were with things like fast food napkins. That was a tough period, especially when trying to find a decent job. But I ‘survived’ and here I am. I’m sure a lot of 27 year olds are living at home and not happy with their current options. I was probably a little ungrateful at the time. But looking back, I was quite lucky to have very accommodating parents.

-RBD

RBD,

Good stuff there. Unfortunate the real estate deal fell through a while back, but that just means more money for other investments. 🙂

Wish you much luck with your goal to retire before your dad. By the look of things, you’re solidly on track. Then more travel?

I hear you on blogging helping you reach toward your goals. I’m 100% sure that blogging has contributed immensely in regards to helping me to get to where I’m now at, and I’ll forever be grateful for that.

Thanks for sharing!

Cheers.

DM,

Thanks a lot. I do feel like I’m well on my way to reaching my goal. But the more I write about it, the more I want to move my date up sooner. The numbers are tough though, particularly if college costs continue on their trajectory. But then yes, when I get there, more travel. And hopefully a lot of good travel with the kids too.

-RBD

Thanks for a nice post Retire Before Dad. I wish you the best of luck on your journey!

Hi RBD,

Gratz on the 2 years mark. I enjoyed reading this write up.

Keep on the good work.

Cheers,

Congrats on 2 years and thanks for the walk down memory lane. That backpacking trip sounds like it was pretty epic.

Keep up the good work!

Allow me to add my big congratulations on hitting the two year mark for the blog, and an even bigger congratulations on turning your financial life around and prioritizing what truly makes you happy. I think that a lot of us can relate to many portions of your story, me included.

“Each year I max out my 401k, my Roth IRA, Mrs. RBD’s spousal Roth IRA, and 529 plans for all three kids with my salary income.”

It’s funny how simple and easy that sounds (and is!), but also how many people simply don’t do it.

You have a kick ass blog, Mr. RBD. Keep it up. 🙂

Thanks a lot Steve. Very much appreciate the thoughtful comment. Two years flies by fast. My daughter is as old as this blog now! Hard to believe.

-RBD

RBD,

2 years seems like so long, but it flies so fast right? Keep it up though, investing and planning. One day you will throw up a post full of awesome pictures and stories of where you are, not just how you are getting there. The progress in getting there I find extremely interesting and rewarding too, nothing like watching the graph and marveling at where you started from your current and growing summit of passive income.

– Gremlin

Congrats man! Been refreshing having you here in our blogging family – always enjoy your posts 🙂

Thanks a lot J. Money. The family has been very welcoming! Good seeing you at Fincon15.

-RBD

I am a little late to the party, but I want to take the time to congratulate you on your 2 years.

This is a very long post, and you have obviously put a huge amount of effort into it, so just wanted to tell you how I actually enjoyed reading it until the end.

We often forget how good we have it in the US and traveling the world is the best way to put everything in perspective. I sometimes think that travel should be considered an investment on education. Roaming a foreign country for a few weeks, not knowing where to sleep at night, not able to read/write/speak the language but still getting by, meeting strangers you become best friends with for just 1 day, is certainly a life experience everyone should have once.

I have very fond memories of backpacking through Vietnam and China for a few weeks at a time, I can’t imagine how amazing a 14m trip would be.

So again, congrats on the 2y blog and congrats on being able to have had such extensive traveling and sharing with us.

Nick

Nick, First of all, thanks for reading this whole thing. Originally I had a warning on it so that people knew what they were getting into. I thought it would be good to write a new ‘about me’ type of thing going over what I’ve written so far. Sometimes it’s hard to piece a whole story together based on a bunch of posts. I hope this helped people in that regard. But most people probably skim over a lot!

Travel is a big part of my retirement plan so I touch on it a lot. Cool that you made your way through Vietnam and China. China was probably the most difficult of all the places I’ve been.

Lastly, I really enjoyed the negotiation piece. Congrats on the RSF feature.

-RBD

I share your passion about traveling and investing money.

I will follow your journey.

Thanks for sharing! Your backpacking trip sounds fantastic. We’re planning to take a trip around the world in about 5 years and I can’t wait.

Congratulations on 2 years of blogging. Keep it up! Sorry I missed you at FinCon. There were so many people there.

Hey Joe,

That’s awesome you’re planning a trip in advance like that. My trip still shapes my perspective on a lot of things. And it’s been three years of blogging now, I guess I need to update that!

-RBD

Do you have $ in Lending Club, or are you only a holder of the stock? I’m asking because I put some in to lend out, and am curious what other’s think of the returns, experience, etc.

-RZ

I do have money in both the stock and in Lending Club notes. My latest post on the subject is here. Although it’s a little outdated now. As of Dec 2016, my portfolio is about $11,000 of notes.

Awesome story! I will be checking in on your blog from time to time! 🙂

I enjoyed reading this write up .Thank you very much for your interesting story about your life.I am writing you from Kazakhstan .Now i am your subscriber:) .I was searching information about IPOs in google search and found your blog .Thank you very much and good luck !

Only recently found your site and struck by the similarities: Lots of travel in 20’s fueled a passion for travel, work in IT for just a bit longer, 3 kidlets, into personal finance, rentals owner, etc. Enjoy reading your posts and will continue to do so. Retired once but found it was too boring and until youngest leaves the nest will just keep adding to our investments. No debt makes this easier and easier, everybody’s mileage on ‘debt free’ may vary but it works for us. Plan to sell the primary residence in a year or so, proceeds in a taxable account will easily kick off enough income, and that is without touching tax advantaged accounts. Been able to save like crazy people as we learned long ago no need to keep up with the Joneses, they are leveraged to the hilt to keep up appearances. Keep it up, beat your Dad to retirement!!

Great to hear from you Nomad. I hope the virus doesn’t keep you at home for too long.