Create Multiple Income Streams for Security and Wealth

When I lost my job in 2017, my former employer didn’t have the means to pay me a severance. Our family had emergency savings, but our multiple income streams kept us afloat.

When I lost my job in 2017, my former employer didn’t have the means to pay me a severance. Our family had emergency savings, but our multiple income streams kept us afloat.

Five years earlier, a job loss would have been much worse. But since I saved and invested while times were good, I could enjoy my period of unemployment and focus on building my side business.

Having multiple income streams also gave me the flexibility to wait for the ideal job instead of jumping at the first gig I could find.

I always knew multiple income streams were key to financial security, but this was the first time I had to rely on investment and business income.

Fast-forward to today, job-free income enabled leaving my career to do work I enjoy instead of staying with a profession I only tolerated.

This article discusses different types of multiple income streams, how many you should have, the benefits of several income streams versus just one or two, and how to create them.

Table of Contents

Types of Income Streams

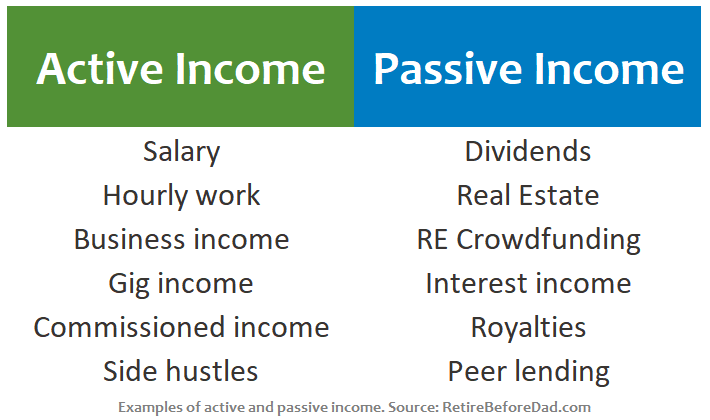

One way to examine multiple income streams is to compare active and passive income.

Active income is earned by trading your time for money. This can be a salaried full-time job, hourly work, business income, gig jobs, commissioned income (e.g., sales), or side hustle income.

On the other hand, passive income is earned by investing an upfront amount of time and/or money into investments or business ideas that pay you when you’re not actively working.

Dividend stocks are a common passive income source. I share the income produced by my dividend portfolio on my blog and offer free resources about how to invest in dividend stocks and ETFs.

Once you put in the research to choose a dividend stock, it pays you quarterly for as long as the company is thriving.

The right companies have paid increasing dividends over several decades. ETFs eliminate the stock selection process but still provide highly-reliable income.

Other examples of passive income include:

- Certain real estate properties

- Real estate crowdfunding

- Royalties

- Some online business income

- Simple interest from a high-yield savings account

The key to building wealth is to use excess cash flow from active income to build passive income streams.

Read more: 20 Passive Income Ideas

Here’s a quick look at some examples of active and passive income.

Active Multiple Income Streams Examples

Salary/Career Income

Most readers of this site probably have a full-time job that hopefully pays a healthy salary and benefits. A certain tranquility comes with a steady salary, though it can be an unhealthy addiction.

Salaried jobs take decades to make us rich, but they provide a stable baseline income to buy a home, support a family, and live a happy life.

Hourly Work

Previous jobs in my youth come to mind when I think of hourly work. Working in a record store and lifeguarding are both examples of hourly work. Retail provides readily available hourly jobs.

But not all hourly work is created equal. Consulting jobs pay on an hourly basis with no benefits. This can be an excellent way to earn and save using tax-advantaged accounts.

Business Income

Business owners earn income differently than most workers. While many business owners pay themselves a salary, they also pay themselves profits.

Moreover, business ownership has several tax advantages.

Gig Economy Income

Think Uber, Lyft, Fiverr, TaskRabbit, Rover, Upwork, etc. These are jobs in the modern economy based on supply and demand. If there is market demand, hustlers will meet it if the pay is sufficient.

Commissioned Income

Commissioned sales jobs are ideal for go-getters, people who are willing to work hard to earn more. A good friend of mine was a copier salesman for many years. It was tough work, but the harder he worked, the more he earned.

Some sales jobs have a base salary or hourly wage (e.g., wait staff). Others are completely based on performance.

Side Hustle Income

A side hustle is a business outside of your day job. The point of a side hustle is to earn smart, not hourly. Some side hustles become full-time businesses, while others (like my blogging business for many years) are fine remaining side hustles.

Passive Multiple Income Streams Examples

Before starting on types of passive income streams, it should be noted that no income stream is 100% passive. All passive income streams need to be monitored. They have different levels of passivity.

For example, a savings account that pays interest needs very little monitoring, while dividend stocks require a bit more attention.

Below is a list of examples of passive income.

Dividend Income

I’ve invested in high-quality stocks that consistently pay and increase their dividends even since my uncle gifted me one share of Chevron in 1995.

Every year since, Chevron has increased the dividend, paying me more and more. I’ve done nothing to earn those increases. All I do is read the financial news and quarterly earnings reports to ensure the company can continue to thrive and pay dividends.

Dividends are one of my favorite income streams for this reason. When stocks go up and down, dividends remain consistent. Income from dividends is far more predictable than market fluctuations.

As my kids have aged and require more attention, I find myself less eager to research stocks. I’m relying more on ETFs to continue investing with less time commitment.

I recommend buying dividend stocks and ETFs in a no-fee online brokerage such as M1 Finance. Read my M1 Finance review here.

Real Estate Properties

Rental properties are a great way to build wealth and typically offer a greater return on your money than dividends. Real estate properties can be passive, especially if you hire a management company.

I had one rental property from 2011 to 2019 before selling it. Month-to-month, it took less than one hour of my time to manage. Occasionally, it took several hours. But for the most part, I considered it a passive income stream.

Rental properties are not for everyone. So consider your willingness to deal with occasional headaches before you jump in. Or hire a manager.

Real Estate Crowdfunding

For those looking for a more passive income stream than rentals, consider real estate crowdfunding. With crowdfunding, you can invest small dollar amounts in high-quality real estate properties. You own a piece of several properties instead of one.

Investing this way spreads the risk among the crowd. It allows you to own great assets with good returns yet keeps your hands clean of all the hard work.

Crowdfunding is also good for diversifying away from stocks, which is especially important when stocks are volatile.

The most popular real estate crowdfunding is Fundrise (review) because any U.S.-based investor can start for just $10.

This is a testimonial in partnership with Fundrise. We earn a commission from partner links on RetireBeforeDad.com. All opinions are my own.

There’s a newer platform I’m looking into called Arrived Homes that allows retail investors to own $100 pieces of single-family homes around the country. The investments pay consistent dividends and require only a Form 1099 at tax time. Non-accredited investors are welcome.

Accredited investors looking to own higher-risk, higher-rewards properties can look to EquityMultiple (review). I’ve invested $30,000 on the platform.

Interest Income

Savings interest rates are excellent right now. Savers can deposit money into a high-yield savings account and receive risk-free money at 4% or better.

Raisin has competitive rates with access to several small banks and credit unions. Accounts are FDIC-insured up to $250,000 per depositor.

Royalties

Musicians, artists, acting professionals, and writers can earn recurring passive income from royalties. Royalties are payments made to creators for work they’ve done in the past.

It’s another example of doing work once and continuing to be paid for it. Talent, persistence, and luck are significant factors in determining how much money can be earned from royalties.

How Many Multiple Income Streams Should You Have?

This number depends on the individual. “As many as possible” is not the answer. It’s unwise to spread yourself too thin.

Salaried career income requires at least one skill set. Some demanding careers, such as legal, medical, and consulting, may be too time-consuming to work multiple jobs or start a side business.

But everyone should start investing, even those living paycheck to paycheck.

Choose the right income streams to match your career, skill set, risk appetite, and willingness to learn. More income streams require more tracking, monitoring, and knowledge.

Before diversifying too early, make sure you’ve built a sufficient income from one source before moving on to the next.

Setting up systems for tracking dividend income and other streams can streamline the amount of work it takes to monitor your income streams. You also must become knowledgeable in the various assets.

For example, if you’re considering becoming a real estate investor, you should read a book that tells you how it’s done before getting started. That requires a time commitment which is especially important when learning something new.

Though several multiple income streams are not required to build wealth, most wealthy people have at least five separate income streams, often many more than that.

I don’t have a specific goal for myself, but my number of income streams has hovered around seven over the years. I may add new investment income streams or additional business income sources when opportunities arise.

Benefits of Multiple Income Streams

Building multiple income streams has several advantages over relying upon one income source.

This seems like a no-brainer to me. What’s holding other people back?

I believe it’s a lack of confidence and knowledge and the fear of making a mistake. But the bigger mistake you can make is to remain idle and not make the financial and time investments required to build multiple income streams.

Focus on building income streams when times are good. You’ll thank yourself during the next recession.

Security

Security is the big one. I experienced this first-hand in 2017 when I became unemployed.

My secondary income streams did not cover all my expenses and certainly didn’t make up for my lost salary. But having that passive income hit my accounts made my family more secure by helping us pay the bills.

Also, having a business vehicle in place to help me earn while I wasn’t on a company payroll was a big help. My online business kept me busy and kept the income flowing.

Flexibility

Secondary income is empowering, giving you more leverage in your career. You work because you want to, not because you have to.

This was especially helpful during my period of unemployment. I didn’t want to search for a job out of desperation. I wanted the ideal job, which I knew was out there since the economy was strong.

Wealth creation

The key to building wealth is to use your active income to create passive income. Even if you’re starting with a few dollars a month, take your money and start building your brick wall.

There are no shortcuts. But over time, your wealth will grow and compound.

Compounding

Compound interest has been a fascination of mine since elementary school. When I first understood the concept as a kid, my mind was blown.

But for years, I relied only on compounding investments. What I’ve learned since starting my side business is that increasing income outside of a salary and investments is a turbo-charge to wealth creation.

Knowing this now, I’m disappointed in myself for not starting a business earlier when I didn’t have kids.

How to Create Multiple Income Streams

The key to creating multiple income streams is persistence. This is not a get-rich-quick scheme.

But getting started is paramount. Start your first investment immediately, even if you’re a novice. At a minimum, open an interest-bearing savings account or invest $100 in a stock ETF (I recommend the Vanguard Total Stock Market Index ETF for beginners).

After that, start retraining your brain away from a consumption mindset to a creation mindset. Develop smart money habits that are consistent with building long-term wealth.

When you think of each dollar you earn as a potential building block, you’ll want to hold onto more of them. Implement the Triforce of Wealth – earn more, spend less, invest the surplus.

Use your primary income source as the main driver while slowly building supplemental income. Exceed expectations at your day job. Relish raises, but don’t spend them.

Consider starting a side hustle to earn more.

Earned income grows faster than investment income and has greater potential in the short term. Investment income has the greater potential over the long term.

Focus on one income stream at a time. Once you’ve built up extra income through a passive or secondary active stream, consider diversifying into other income-producing investments.

Keep building. Reinvest proceeds into more income-producing assets. Rinse and repeat.

Are you building multiple income streams? How many income streams are you earning today? What’s your target?

Photo credit: uniquedesign52 via Pixabay.

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

Dividend and interest income are ideal since they are passive and relatively low risk. I think one of the barriers to people doing more like real estate crowdfunding and a business is that risk factor, losing what they put into it, which obviously those with a higher net worth can more easily buffer themselves from.

REITs are great, one of them I own is the owner of some of the most popular lifestyle centers in the country, which I feel we need more of, and they rarely have vacancies. Getting paid to park your money at a place like that isn’t so bad.

Hi Craig, I 100% agree. It’s awesome to have multiple streams of passive income. I also have several, and am currently working on 1-2 more. Portfolio-wise compared to you, it seems I prefer the “single stock” approach. Love to have total control which stocks I like to buy. It takes more time, I know, but in return I get many more dividends (almost every single week of the year). Anyways, keep up creating such good content, I am a regular reader! Cheers from Singapore, Noah

Hey Noah,

Thanks for reading. Yeah, if you have the time and passion to research individual dividend stocks, go for it. I have done it for years and still do. But I’m getting lazier and plan to scale back.

I DRIP’d into CVX for many years, but I’ve been reinvesting the dividends into other stocks for the past 8 years or so. It is a great company, but the oil price fluctuations can be a bit unpredictable. The dividend is quite large, so when oil prices drop, I fear if the rate of increases can last. There’s also the whole transition to electric cars and alignment with an ideal energy future with limited fossil fuels. The long-term trend is not in the oil companies’ favor, but gas and jet fuel will have continued demand throughout my lifetime. But how much?

Hey Craig! What are your thoughts on Treasury bills?

Hey Claudia,

T-Bills are great right now compared to the past decade and even just a year ago. T-Bills, or Treasurys with a year maturity or less, offer risk-free returns above five percent as of early May 2023. In the short-term, we’ve got to weigh 5% returns vs. trying to get 9% from stocks (and taking risk). If you have a wade of cash with short-term needs, T-bills are better than high yield savings and just as liquid. If it’s long-term money (5+ years), go with index funds/stocks. Check out my daily yield curve chart to see the latest rates. Show rates now compared to last year.

Thanks for the quick response and feedback!