Should You Max Out Your 401(k) in 2024?

Should you max out 401(k) in 2024? The short answer is yes. This article explains why, and the limits for maxing out your 401(k) and IRAs in 2024.

The department head at my job invited me into his office for a 30-minute chat when I first started.

We spent the time getting to know each other and talking about our past experiences and current roles at the company. Then he asked if was contributing the 403(b).

I live and breath this stuff so I saw it as an opportunity to show off my knowledge on the topic.

I said yes. But before I could go into my long-winded explanation about why I max out my 403(b), he said, “Good, because if you weren’t you might be too stupid to work here.”

Now, this comment was completely lighthearted and not meant to insult anyone who doesn’t contribute to their employer-sponsored retirement plan.

But our plan is so good, it really is a no-brainer. If you contribute just 2%, my employer will match about 10% after one year of employment.

It’s the best employer-sponsored retirement plan I’ve ever seen.

You Lost Me at Max Out 401(k)

One of the more popular posts on RBD last year was about making smart money habits a part of your daily life to build long-term wealth. When it came to the part about maxing out 401(k)s and retirement accounts, I guess I lost a few people according to the comments on Facebook.

Always take what you read in the comments section of Facebook with a grain of salt. But this one struck me as important.

Not everyone can max out their 401(k). Sometimes, there’s simply not enough money to cover monthly spending. This becomes especially difficult as your family grows and life becomes more complicated.

But’s it’s not as hard as it seems. Your take-home pay does not decrease by the amount contributed to a 401(k) per paycheck. Tax benefits kick in which ultimately make you wealthier each pay period.

The best advice I can give to any young people out there is to max out your 401(k) from day one. Always max it out and never stop.

That may not be so easy. I get it. I didn’t max out during the early stage of my career. But maxing out your 401(k) each year should be the eventual goal. The sooner you get there, the wealthier you’ll be. According to the math.

401(k) Regret

In 2004, I was deeply interested in personal finance and investing. I knew the benefits of maxing out a 401(k). But I still didn’t follow the advice I read.

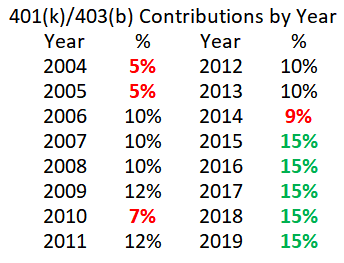

I max out my 403(b) now. But out of curiosity, I looked at all my pay stub data going back to 2004 and learned that I didn’t max out my 401(k) at my former employer until 2015. 15% per pay period was the maximum contribution allowed by my employer up to the annual IRS limit.

Here are the percentages that I contributed:

Compiling this data was hugely disappointing. Returns since 2004 have been excellent. Had I invested the maximum allowed each year, I’d be much wealthier today (even though the fund selections were bad).

Back in 2004, I guess I wanted more after-tax money to spend and invest and I figured I would eventually increase my contributions.

My lifestyle would have been the same had I contributed the max or not. But whatever I was thinking through the years, I didn’t take full advantage of the tax savings and I regret it.

For many, whatever isn’t contributed to the 401(k) is spent living paycheck to paycheck. So the 401(k) becomes a way to automatically save and not spend. That’s one reason why maxing out a 401(k) is so powerful, on top of the tax advantages and investment returns.

What are the 401(k) Contribution Limits for 2024?

For 2024, the IRS bumped the 401(k) maximum contribution limit to $23,000 from $22,500. For those aged 50 or older by 12/31/2023, the limit rises to $30,000. It’s the same for 403(b)s and 457 plans.

The maximum percentage of your paycheck you can contribute is determined by your employer. 15% is a common limit associated with maxing out a 401(k). But employers have to option to allow you to contribute quite a bit more per pay period.

If allowed, and if you were to contribute 75% of your salary to your 401(k), you’d most likely hit the maximum limit well before the end of the year. This is called front-loading.

Front-loading is fine for an IRA or 401(k) without a match. But if your 401(k) has a match, you may miss out on it for the rest of the year.

That’s why most plans with a match encourage you to contribute throughout the year by only matching a small amount each period.

Another 401(k) limit to keep in mind is the defined contribution plan limit. This number increased to $69,000 for 2024, up from $66,000. It’s your maximum contribution plus what your employer can contribute. It’s particularly helpful for self-employed individuals utilizing a solo-401(k) or SEP IRA.

The employer match does not count against the 401(k) maximum contribution limit.

Should you Max Out your 401(k) or 403(b)?

My answer is yes with a few stipulations.

For the you-only-live-once (YOLO) crowd who say you should live for today, spending all your paycheck isn’t what I’d call YOLO. Leave work for a while to do something fun.

Once you’ve got the fun out of your system, start to focus on saving.

If you have a decent job, income, and you save excess cash flow every month, I challenge you to start now. Max it out right away and adjust your spending to accommodate it. You’ll be glad you did in a few decades.

However, if you have any high-interest debt such as credit cards or payday loans (I hope not!), you should aggressively pay those off first.

Then, contribute up to where you’ll receive the match if there is one and work your way up to maximum contribution from there.

You’ll actually keep more of your earned money the more your contribute because you’ll pay less in taxes. When 15% is taken out pre-tax, your paycheck actually decreases by less than 15%.

I’ll show you what I mean.

401(k) Paycheck Calculation at 15% Max

I recommend that everyone heads over to Paycheck City to type your numbers into their salary calculator. Match the output against your pay stub so you know exactly where the deductions go.

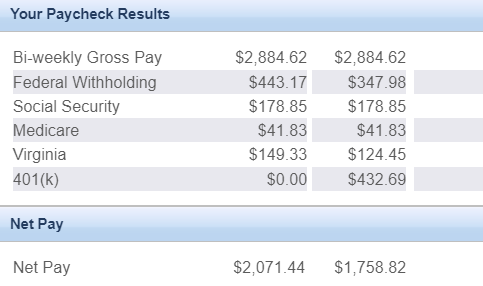

I’m going to use a $75,000 salary in the state of Virginia as an example. I’m also using bi-weekly pay, filing status = single, and 0 for federal and state allowances.

This calculation is for an employer that caps the contribution at 15%. With that limit, it would take a salary of $126,666 to reach the maximum contribution limit. Most people are below that salary and would need to bump up their contributions above 15% to hit the maximum if allowed (next section).

Here’s what the calculator returns. The left side is no 401(k) contribution. The right side is a 15% paycheck pre-tax contribution.

Bi-weekly Gross Pay is the same for both. That number is the salary divided by 26.

Notice that line 2, Federal Withholding decreases by $95.19. That’s because the government now sees you as earning $2,451.93 ($2,884.82 minus the 15% 401(k) contribution). Lower earnings = lower taxes.

=2884.82-(2884.82*.015) or =2884.82-432.69 = 2451.93

Line 6 shows the $432.69 withdrawal for 401(k) contribution. Social Security and Medicare stay the same because 401(k) contributions do not affect them. The state decreases by $24.88, giving a total of $120.07 tax savings per pay period or $3,121.82 tax savings for the year.

Making you that much wealthier at the end of the year (before investment returns).

Now, instead of the paycheck decreasing by $432.62 which is the 401(k) contribution, the paycheck actually only decreased by $312.62. That’s a 10.83% percent decrease. Not 15%.

Deferring $432.62 each paycheck for a year would leave you with $11,248.12 invested in the 401(k) account, before investment returns.

These numbers will vary based on salary, withholdings, and other pre-tax deductions. That’s why I suggest trying your own numbers at Paycheck City.

How to Max Out 401(k) on a Low Salary

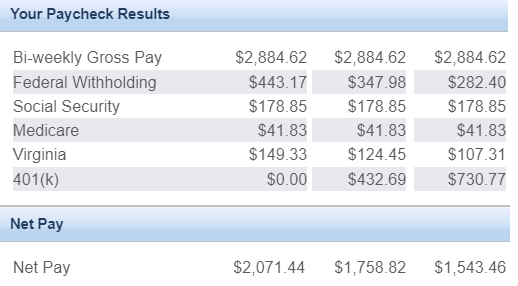

The same employee above cannot reach the maximum limit of $20,500 by contributing 15% of salary every paycheck. If an employer allows a higher percentage of 401(k) contributions, then the employee can adjust the withholding upward to hit $20,500.

This can be done either as a percentage or dollar amount. For a $75,000 salary, the contribution percentage would have to be about 27.33% (=20500/75000) or $788.46 per paycheck (=20500/26).

Here is that scenario compared to the previous:

The net take-home pay is $1,543.46. Federal and state taxes decreased by $202.79 per pay period or $5,272.54 per year.

Making you that much wealthier at the end of the year (before investment returns).

Now, instead of the paycheck decreasing by $730.77 which is the 401(k) contribution, the paycheck actually only decreased by $527.98. That’s an 18.3% percentage take-home pay decrease (=527.98/2884.62). Not 25.3%.

Maxing out a 401(k) isn’t easy for someone that’s built their financial life around their take-home paycheck amount. So it’s highly encouraged for young people just starting their careers to do this immediately.

Mid-career, it’s more palatable to gradually increase the contribution amount every time you get a salary increase.

What are the Downsides of Maxing out your 401(k) or 403(b)?

When you max out a 401(k), your take-home pay is less. Your paycheck may be several hundred dollars less. That sucks and may not be doable for some.

You have less to pay your bills, spend on things, and less money every paycheck to support yourself and your family.

Another is that your money is tied up in a retirement account and can’t be withdrawn without penalty until age 59 1/2 (with a few exceptions).

That’s seemingly bad too, but you still have the remaining paycheck amount to live off of. It’s a sacrifice you’ll need to make to reach your retirement goal and the most tax-efficient way to do it. You’ll need money when you stop working. This is the best way.

Those are the only downsides that I can think of now. But they are big ones.

I took a salary cut when I started my current job because the benefits were so much better than my old employer.

But I’m still maxing out my 403(b). Combine the lower salary, maxing out my 403(b), and contributing $900 every month to our family’s college savings accounts, plus this is our most expensive year for preschool, monthly cash flow has suffered.

This was evident in my latest quarterly income report. I have not had as much money to invest after tax.

Mrs. RBD has suggested we cut back on both 529 savings and 403(b) contributions to free up some money. But I refuse. I don’t want that regret again 15 years from now.

What are the Benefits of Investing in a 401(k) or 403(b)?

First of all, maxing out your 401(k) increases your income because you pay lower taxes. In our first example above, the worker would be $3,121.82 wealthier each year because of tax savings alone. And that’s not even the max!

That worker would have $11,248.12 in an account invested in a diversified stock portfolio at the end of the year. Over 30 years, that $11,248.12 (from just one year of saving) would be worth more than $80,000 assuming a 7% return on investment.

Tax-deferred compounding is where the magic happens.

The money invested grows tax-deferred, meaning you won’t pay any taxes on the gains or dividends until you withdraw the money. That’s a sweet deal from the government.

Think of a retirement nest egg as the foundation of wealth.

If you only pay attention to what’s in your bank account, you won’t see your wealth grow. Tracking net worth is the best way to see the compounding effect of 401(k) and other retirement savings.

Another advantage of contributing to a 401(k) is there’s no temptation to spend the money. It’s gone away to a place where it can grow and prosper. Your money remains yours instead of becoming clutter.

Even if you can’t max out your 401(k), get started. Make pre-tax savings a habit. Increase the amount every year.

What if Your Employer Doesn’t have a 401(k) Plan?

No matter how small, your employer should be able to have some kind of retirement plan. My previous employer started a 401(k) with just two employees. Encourage your employer to start one.

If they don’t, it may be worth finding another job.

You can always get similar benefits from investing in a traditional IRA. IRA limits are $7,000 for 2024. That’s still a good chunk of money to invest pre-tax and tax-deferred.

Self-employed individuals can open a solo 401(k) which allows you to contribute up to the defined contribution plan limit of $69,000 for 2023.

It’s a solid deal if your self-employment income is well above that.

Otherwise, if you’re employed and don’t have a plan, tell your employer your want one and invest in an IRA until then.

Image via DepositPhotos used under licence.

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

Great article! One potential downside you didn’t address, however, is that maxing out your 401(k) potentially leaves less (or nothing) for contributing to a Roth IRA. What are your thoughts on having lower 401(k) contributions in favor of maxing out a Roth and Spousal Roth IRA? Even though you are taxed now, the new tax rates are currently more palatable than in the past. The money can then be withdrawn tax free at retirement. Do you have an opinion on whether it is still more financially advantageous to max out a 401(k) first?

Well, yeah, when you divert funds to the 401(k) you leave less for everything else including after tax investing, saving for a home down payment, vacations, and potential Roth contributions. While I do like the Roth IRA, I prefer the trad IRA for the tax savings today. We do have Roth’s but I cannot contribute to it myself since I have an employer plan. But we can do the Spousal contribution. The last two years I’ve done Trad IRA contributions for Mrs. RBD to lower our tax burden. However, I am considering a Roth contribution for her instead this year.

Hey RBD,

I have found the following not to be an absolute statement. “That’s why most plans with a match encourage you to contribute throughout the year by only matching a small amount each period.” If you front load what happens is that the match catches up during the year so you won’t be contributing but your employer does. FYI, I run the plan at my company.

Brad… thanks for your insight on this. I had this situation happen to me a few years back with my plan. I stopped receiving the match after I hit the contribution limit. I also did some research on and found other instances of this. But perhaps this is dependent on the plan? My company was small and may not have gotten it right.

My wife’s plan is similar to RBD’s plan. If you don’t contribute that paycheck, you don’t get a match. It’s best to check with your plan. I think most plans operate that way. We missed out on a couple of matching in her first year there.

Could be. Small companies can do what they want. The best plan is if your company has a safer harbor plan.

“Front-loading is fine for an IRA or 401(k) without a match. But if your 401(k) has a match, you’ll miss on it throughout the rest of the year”

The statement above may not be entirely correct as it may be employer dependent. For example, my employer has a match and as long you contribute up to 6% of your income, you will get the full match, regardless of if you front-loaded or not. They don’t match with every paycheck but once a year…in February of the following year. For example, 2 years ago, I maxed out my 401k by October and I still got my full match the following February. Last year I maxed out by July and will get my match next month. This year, I’m going very radical and instituting artificial scarcity so I can max out by end of March. And I will not lose my employer’s match.

But a very good blog post through and through. I started working in 2011, but like you, only started maxing out my 401k since 2015. Better late than never. Keep up the good work.

Thanks for the additional information on this. It does seem to be plan specific. I’m going to add a reference link above explaining this.

I’m a huge believer in maxing out your 401k. If you crunch the numbers, you’ll see that maxing out your 401k will make you a millionaire if you start early. It’s a great way to save for retirement. It took me a few years to max out my 401k and I still regret not doing it earlier. Those early years make a big difference because of compound interest. Max it out!

The regret is real! I forgot to mention that I didn’t max out at my first job in 1998 either. I worked for three years at a tech company from 1998 through mid-2001. Though that time was volatile in the stock market, I invested about 5% of my paycheck. I still own the funds from that period and they are up 500% or so! Wish I would have done a full 15%.

What are your thoughts on traditional vs. Roth 401k? Our company opened up this option for us a few years ago and I changed from traditional to Roth – figured I might as well pay taxes now, that way in retirement I don’t have to worry about it. Company doesn’t match but does do profit sharing so we typically get 3% of salary each year regardless how much we contribute. I am maxing out my personal Roth IRA and putting in 10% to the employer Roth 401k.

I don’t have a problem with the Roth 401(k). Though my personal preference is the traditional 401(k) to lower taxes today. Since you’re putting in 10% and contributing to the Roth IRA, I suspect you’ll be pleased with your results in retirement when you don’t have to pay any taxes. You could try to max out the regular 401(k) and max out the Roth IRA, that gives you the best of both.

There are ways to get the traditional into a Roth later on. Refer to this article by the Mad Fientist for more on that.