32 Questions, Five Years in the Making

More than five years ago, I started reading an anonymous money blog called 1500 Days. The writer had a similar idea to mine, to escape the rat race early and stop working on his terms instead of what’s traditionally considered normal retirement age.

More than five years ago, I started reading an anonymous money blog called 1500 Days. The writer had a similar idea to mine, to escape the rat race early and stop working on his terms instead of what’s traditionally considered normal retirement age.

Since the beginning, the 1500 Days blog has hosted an almost weekly series called 10 Questions featuring personal finance guest bloggers. Each new blogger introduces themselves to his readers and writes about their money, life, and favorite pizza joints.

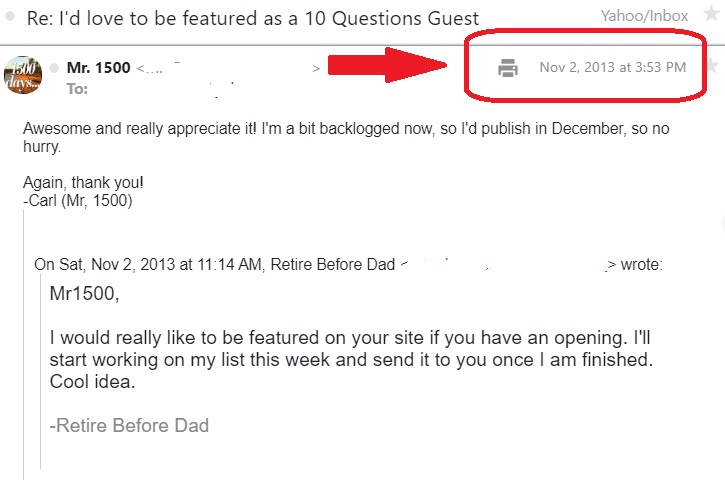

In 2013, just three months after I started RBD, I reached out to Mr. 1500 to participate as a 10 Questions guest blogger.

Here’s the email I wrote:

Carl graciously accepted my mediocre pitch, despite the very unimpressive website theme and logo (it was the words ‘Retire Before Dad’ in bold Arial font).

Sadly, I was too lazy to spend the time writing the guest post. I asked him in person two years later when we met at a bloggers conference, and again, he accepted.

I kicked the can down the road a second time.

Until finally, last year, I asked Carl again to be a guest post contributor. He said sure, but the waiting list was now six months!

Putting it on my calendar motivated me to get it done this time, more than five years after my initial ask.

He still calls it 10 Questions, but I answered 32 from his giant list of questions.

What You’ll Learn About Me (That You Didn’t Know Already)

Even if you’ve read every one of my blog posts (nobody has, I’m sure), there is still a lot you don’t know about me.

Some things you’ll learn:

- The best thing I ever bought

- The worst thing I ever bought

- My worst money mistake (might be familiar)

- My big splurge coming up this year

- The new savings plan that my son is working on

- What we pay our kids for allowance (and how they earn it)

- My ideal vacation and why

- Nine of the most beautiful places I’ve ever been

- My favorite beer (guaranteed to disappoint any connoisseurs out there)

- Four of my favorite pizza places

- And 14 of my favorite albums

Please head over to 1500Days to check out the article. The button below will take you there.

Photo credit: Emily Morter via Unsplash

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

It was this interview that brought me to your site so I’m glad you stuck with it! I’ve enjoyed reading your stuff!

Thank FFM. I like what you’re writing about on your site. I’m still trying to figure out how to talk to my kids about money. The Australia fund is the first real progress we’ve made. Board games seem to help too.

I think the only absolutely right answer is that we talk. How we do it – well we’ll all have good stories and not so good stories but if we are talking and listening, we’re doing that part right!