Sector Weighting – Developing a Game Plan

I have recently done some sector weighting analysis on my portfolio. By evaluating my portfolio, I can see where I am overweight and underweight large sectors of the economy. When determining my watch list priorities, I can use this analysis to help guide my purchase selection.

Stocks can be broken into nine sectors. They are:

- Basic Materials

- Consumer Goods

- Conglomerates

- Financial

- Healthcare

- Industrial Goods

- Services

- Technology

- Utilities

Sometimes sector weightings are as listed as 11 sectors and break out Real Estate, Communication Services, Consumer Cyclical, Consumer Defensive, and Energy. I’ll be combining Conglomerates and Industrial Goods for this post. Companies are further broken down into industries. For example, Coca-Cola (KO) is in the Consumer Goods sector in the Beverages industry.

A great tool for looking at market sectors and industries is the Industry Screener on Yahoo Finance. From here you can type in a symbol and all the stocks in its sector and industry will come up in a sortable table.

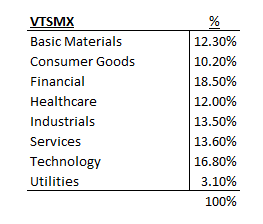

Total Market Sector Weighting

In order to get a generic baseline weighting for the total market, I looked at the Vanguard Total Stock Market Index Fund (VTSMX) as of 11/30/2013. These numbers change constantly based on the market weightings of the underlying securities. The sector weighting I used for my analysis are as follows:

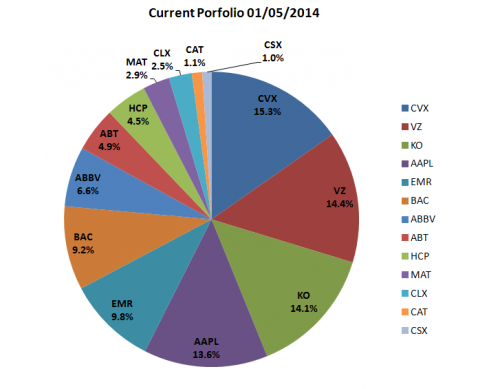

My Portfolio as of Nov 2013

The analysis I’ve recently done has brought to light some imbalances. The imbalances aren’t necessarily bad, but I plan to use them to guide my future purchases. Here is a chart of how my current portfolio is weighted:

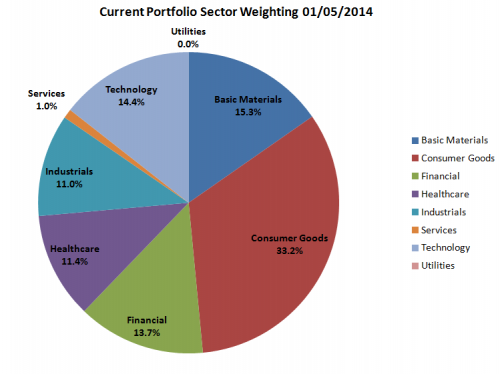

Here is another chart showing the same portfolio weighted by sector:

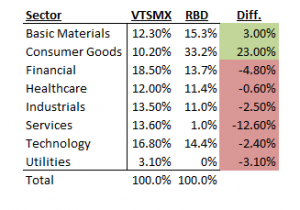

This next table compares my portfolio sector weightings to the total market sector weighting:

There are obvious variances in the above table. My portfolio is overweight Consumer Goods and Basic Materials and severely underweight Services and Utilities compared to the total market. The purpose of my taxable dividend income portfolio is not to mimic the total market sector holdings percentages. If it were, I would just buy the total market index funds or ETFs. But I can use this analysis to guide the construction of my portfolio to help me diversify. Because of the imbalances discovered above, I should aim not to buy more consumer goods companies in the immediate future, instead I should focus on the underweight sectors.

Using the total market as a baseline, I can make adjustments to my portfolio to generate more income. For example, as a whole, the Technology sector historically doesn’t pay dividends as much as the Utility sector. Consequently in the long-term, I may aim my portfolio to weigh Utilities higher than the total market baseline for Utilities and lower for Technology.

The purpose of my dividend income portfolio is to generate sustainable income from diversified dividend paying companies to augment income generated from other sources. The income generated from this portfolio is added to my real estate investment, P2P lending account, and interest received on cash to determine my total investment income. But in order to put the weighting of my portfolio into perspective, I need to compare it to something which is why I use the VTSMX.

2014 Dividend Stock Game Plan

Based on this analysis I’ll start the year looking for companies in the Services sector. CSX is included in the Services sector, but I only hold a small number of shares compared to the rest of my portfolio. I’ll be dripping into CSX throughout the year and that will increase my weighting in this sector. Additional desirable companies shouldn’t be a problem to find because the sector is rather large and diverse. Industries in this sector include retail stores, groceries, airlines, restaurants, publishing, movies, lodging and many more. A few names that come to mind in this sector are Target (TGT), Darden Restaurants (DRI), and Regal Entertainment Group (RGC).

Additionally, I’ll be on the lookout for Utilities trading at reasonable valuations. These companies can include diversified utilities, electric, water, and gas companies. Utilities are often known for their steady income and sometimes monopolistic hold on consumers in certain regions. Predictable revenues and profits often lead to steady dividend increases. A few names of interest in these industries are WGL, Dominion Resources (D), Aqua America (WTR), and Consolidated Edison (ED).

Sector weighting won’t entirely guide my stock purchases this year or in the future. Its one of many tools in my belt to help build a diversified portfolio.

Conclusion

I am running a marathon, not a sprint or 5k. Building my dividend income portfolio to where I want it to be will take a few more years. I want my portfolio to be as broad ranging as possible, but not necessarily targeting the market indices. Index and total market targeting I’ll leave to my retirement and education savings accounts.

For my taxable dividend stock portfolio, my goal is to generate income through buying companies that pay me regularly and grow their dividends every year. I’ll use this money to support me in retirement, particularly for the period before my retirement savings accounts are accessible without penalty.

While a portfolio is never complete and no weighting technique is perfect or precise, the analysis demonstrated above will help me make better decisions this upcoming year on what companies to buy. Future posts will look more closely at these sectors and the companies on my radar.

How do you use sector weighting to build your portfolio?

Disclosure: Long AAPL, ABBV, ABT. BAC, CAT, CLX, CSX, CVX, EMR. HCP, KO, MAT, VZ, TGT, WTR

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

Seems like a good approach RBD. Especially, as consumer staples companies have gotten VERY pricey. With rising interest rates you can pick up “bond proxies” like REITs and Utilities cheaper than a year ago. I started a position the other day in Entergy (ETR), and that may be worth a look. Thanks for the thought provoking post

-Bryan

Thanks Bryan. Still looking to pick up more HCP REIT soon. I have utilities in mind but need to do more work on them.

-RBD

I track my sector weightings but, like you, it’s just a guideline. Tech has just recently started providing some DG stocks but historically they haven’t. So you won’t see a lot of tech exposure among DG investors. I’m tilted quite heavily towards consumer goods and materials, namely big oil. Of course those are sectors that have some great companies that have consistently raised their dividends for decades so it’s a natural sector to trend to. In the future I’ll worry more about sector weighting and trying to even out position sizes, but for now there’s still a lot of work to be done as far as accumulation goes so I think it’s best to focus on the best values you can find. I’m probably going to continue to stay away from utlities for the time being because the growth just isn’t there. Heck they can’t even decide what/when they can increase the rates they charge. That has to get approved by the government/agency. I’d consider adding some in the future, but they still look on the expensive side as a whole and could face some big headwinds as interest rates should start their climb higher.

Hi PIP,

There are the big tech companies that pay dividends (INTC, MSFT etc) that I could always go for. I’m thinking more ACN or BR when I go in that direction. As for the utilities, I’ll be buying one that has manageable debt and a nice stable yield. Buying income is the name of the game, so I won’t be too worried about growth in the short term. They’ve come down some so I’ll be taking a look, but I need to do more work.

-RBD

Certainly a different way to look at things. For me, early in the accumulation phase, the sectors are not as big of a concern. I’m more concerned at finding what I perceive to be fairly priced equities, while keeping an eye for grander diversification down the road. That and my DG portfolio is just a small piece of the overall pie, so it isn’t as much of concern if the weightings aren’t what some would consider ideal.

Ultimately, I do keep track of the sector weights, but more for my own informational purposes more than anything else at the moment.

WYOR,

I found myself looking at sector weighting when working on my buy list. Since it is something I look at, I thought I’d write about it. But I am more concerned with finding good value. My portfolio holdings aren’t too big now, so I the weighting are skewed to my biggest holdings. That said, I’m not going to buy a big chunk of another consumer goods company right away. I’d like to pick up some other sector first, like consumer services. Just to keep things balanced.

-RBD

I pay attention to the sectors I’m invested in, but haven’t done much else with it. I like the idea of looking at a total market index fund just to get a baseline for where you might want the weights to be. I’ll have to do this comparison to see where I end up. Right now I’m trying to increase my holdings in the stocks I already have (I’ve wanted to keep to between 20 and 30 stocks) but looking more closely at the sector weights should help with this.