Autobiography is not Financial Advice

The Atlantic writer Derek Thompson wrote an article about the best career advice he’s come across that “might be marginally useful.”

Your Career Is Just One-Eighth of Your Life was applicable to my situation back in September 2022 when I was approaching my career departure date, and it’s still relevant today as a self-employed blogger.

Mathematically, your career is a small fraction of the hours you will spend on this earth. Prioritize accordingly.

Work is too big a thing to not take seriously. But it is too small a thing to take too seriously.

The article challenges readers to look hard at their careers and be “ruthlessly honest” about their professional ambition. Some people are not ambitious, and that’s fine, he says.

He suggests pursuing professional growth not by leaving your employer for another to do the same job but by quitting “the precise set of roles for which you are salaried” and experimenting by pushing yourself into “discomfort zones”.

A passage stood out:

The most common counsel is almost always too personal to be broadly applicable. My toes curl with embarrassment when successful people say anything along the lines of “Just do these three things I did.” Autobiography is not advice.

That last line struck me as similarly relevant in personal finance and my current line of work.

Big Meal

When I was a mere blog consumer a decade ago, I enjoyed reading about what other like-minded investors were doing with their money.

Blogs were a way to connect with normal people — not pundits, Wall Street bros, or financial planners looking for new clients.

What I read made me smarter about the financial decisions I was confronting. Blogs motivated me to earn, save, and invest more than I already was.

The human side of financial decisions adds nuance where an encyclopedia, content farm, or cliché-ridden artificial intelligence text generator cannot.

I’ve implemented financial advice from strangers on the internet, and I’ve been the stranger on the internet sharing what I’ve done that works for me.

People might consider that advice, but I don’t see it that way.

My finances, career, and life situations are different than everyone else.

Where our situations intersect, I hope my writing about similar experiences adds relevant context to your decisions about money.

Learn to navigate financial crossroads yourself, and paying 1%-2% of your investments to a financial advisor each year is unnecessary.

But blindly following what other people do without scrutiny is a good way to lose money.

The internet and the infinite social media scrolling have amplified this risk, along with a baffling array of new financial products at our fingertips.

Personal finance isn’t like a food blog, where you get a list of ingredients and precise step-by-step instructions on executing a recipe.

We all have different ingredients, and we’re cooking unique seven-course meals.

Autobiography is not Financial Advice

Poke around enough personal financial websites, and you’ll find most of them have a similar disclaimer — “everything you read on this website is for entertainment purposes and should not be considered advice. Perform personalized due diligence or follow the advice of a financial advisor or accountant blah blah blah” (mine’s in the footer on every page).

Get past the legalese and CYA stuff, and it basically says here’s what I do, but don’t just do what I do. Tailor your financial decisions for your specific objectives.

But if you don’t have clearly defined objectives, it can be tempting to chase get-rich-quick ideas.

The fine print is worth stating more prominently. It applies to reading books and websites, TV, podcasts, online videos, and conversations with friends.

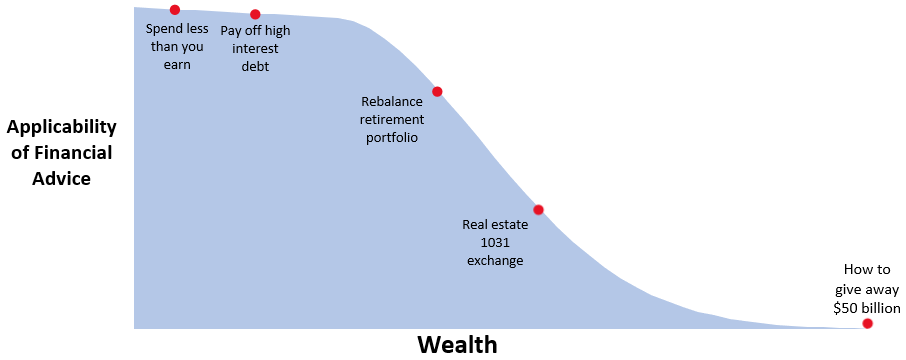

Common financial advice is broadly applicable — spend less than you earn, invest for the long-term, pay off and avoid high-interest debt, etc.

But as wealth increases and financial and life situations become more distinctive, money decisions become more complex and consequential.

Anecdotal, not to scale

Careers, financial situations, and life histories have infinite variables. When you approach a financial decision, you must apply what you’ve learned in the context of your situation today.

No matter how informed you are, behavior is still more powerful than knowledge in personal finance.

Financial advisors can help frame behavior guardrails. They spend a lot of time gathering client information to develop a custom plan.

Managing money is the easy part. Unraveling someone’s life to help them understand what’s most important and then sticking to the plan is harder.

Individuals struggle with this same exercise.

Having an outsider look at your situation holistically can be worth it for some people. Fee-only fiduciary advisors are the only people I’d talk to.

But most of you probably have no interest in hiring a financial advisor because you know that no one cares more about your money than you. And if you’re like me, too cheap.

You are capable of making the most important financial decisions you’ll ever face. You’ll make mistakes, recover, thrive, and relay the lessons learned to the next generation.

Maybe they’ll listen.

Featured photo via DepositPhotos used under license.

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)