Living Off Dividends: It Works, We’re Doing it Right Now

My Uncle gifted me one share of Chevron stock in 1995, seeding my lifelong dividend stock investment portfolio. But I didn’t start living off dividends until I left my IT career in 2022.

There were no online brokers or index ETFs making it easy to start investing in 1995. Trades cost $30+.

IRAs and mutual funds were out of reach for most young people because nearly all had $3,000+ minimum investment thresholds and required a financial advisor, most of whom were only interested in wealthy clients.

The only feasible option for investors with $100 or less to invest each month was dividend reinvestment plans (DRIPs), also known as direct stock purchase plans (DSPPs).

DRIPs were administered by mail and often charged zero or low investment fees.

My Uncle was the Stock Transfer Agent at Chevron — he oversaw the DRIP and signed the stock certificates. I still have the original certificate with his name.

He advised me to mail a monthly check to the plan administrator to buy shares. Then reinvest the dividends every quarter to buy even more shares.

The dividend income would eventually be enough to buy whole shares every quarter and may even enable me to live off dividends someday.

This investing style has been a part of my strategy since that conversation.

Twenty-eight years later, our family uses dividends from that original Chevron share to support ourselves.

Since leaving my IT career, we have needed supplemental income to pay the bills until I can earn enough from self-employment.

We’re a family of five in a high-cost-of-living area. Our dividends only cover a portion of our total living expenses.

But they cover decent chunks, such as groceries, utilities, and kids’ activities.

Table of Contents

How to Live Off Dividends

Living off dividends is straightforward, with the caveat that you need to own a sizable portfolio of investments to create a meaningful income.

Here’s how it works:

- Own dividend stocks or ETFs in a brokerage account (taxable or Roth IRA)

- Collect cash dividends in the brokerage cash account

- Transfer cash via ACH to a checking account

- Spend money from the checking account

Every month, I transfer the cash balance from my brokerage account into my checking account on the second to last day, so the money is available before our mortgage payment is due.

Roughly 85% of our dividend-paying stock and ETF portfolio is in a taxable Fidelity account. The other 15% is in an M1 Finance account.

Technically, you can live off dividends from a Roth IRA without penalty, but we’re not touching retirement accounts.

We’re only living off the stock dividends harvested from the Fidelity account and continuing to reinvest the M1 Finance dividends.

The dividend income is paying the bills combined with my wife’s modest preschool teaching income, business income, and cash savings.

We are not selling stocks to live off capital gains. Our principal remains invested.

If our taxable income is below $89,250 in 2023, which I expect it will be after business expenses and deductions, we’ll pay 0% taxes on our qualified (most of it) dividend income.

How Much Invested for Living Off Dividends?

Let’s start by reiterating a vital point. Unless you have a very high income, it will take years and a lot of money to build a portfolio that earns meaningful dividends.

Investing for dividends requires patience.

Understanding how much money you can earn from dividends to cover expenses comes down to two data points.

- Portfolio value – The total amount invested in dividend or interest-paying assets

- Portfolio average yield – The weighted average yield of assets in the portfolio

Multiply the portfolio value by the average portfolio yield to get the annual dividends. Divide by twelve to get the average per month.

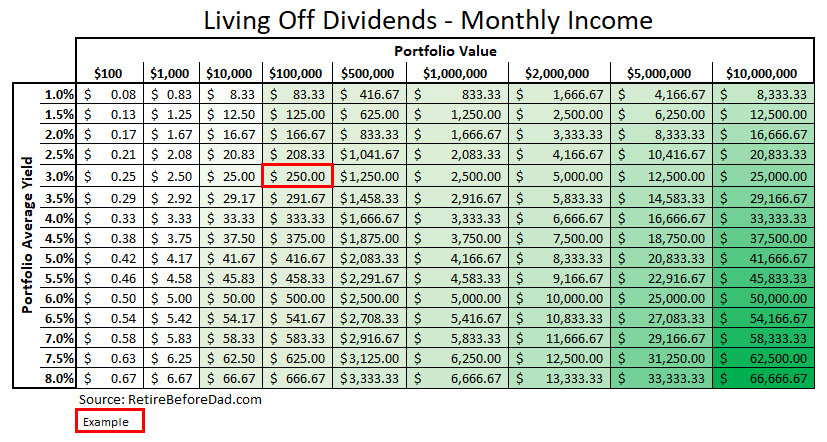

Here’s a simple example:

Amount invested in dividend-paying assets = $100,000

Average yield = 3%

Annual Dividends = $3,000

Average Monthly Dividends = $250

Here’s a chart to help visualize how much you can earn from a dividend portfolio starting with $100 up to a $10 million portfolio.

Find your monthly spending budget in the chart to estimate how much money to invest and the appropriate yield to earn enough dividends to cover your expenses.

If you’re just starting, it could take years to get to $100,000 and decades to get to $1 million. But you have to start somewhere if you want to live off dividends.

Dividend investing is not a get-rich-quick strategy.

More money or a higher-yielding portfolio can increase your earnings — the opposite is true for a smaller portfolio and lower yield.

Unless expenses are very low, it’s unlikely most of us will ever live solely off of dividends. Multiple income streams are a more likely model.

But I consider covering a portion of our expenses with dividends a huge win.

You can start small and dream big.

Aim to cover subscriptions, utilities, and food first. Aspire to earn enough dividends to pay for your mortgage and extravagant vacations.

Tracking Dividend Income

I wrote a lengthy post about tracking dividend income a few years back and still use that method to estimate monthly dividend income.

Without going into the details here, I’ll share a few charts that help me understand my dividend, interest, and other income streams. Knowing how much I’ll receive in dividends helps with monthly budget planning.

Before I share, note that this is a particularly elaborate monthly effort to make these charts. It’s probably overkill for most people.

There are free spreadsheets and paid tools available to track dividend income automatically. Some online brokers do it better than others.

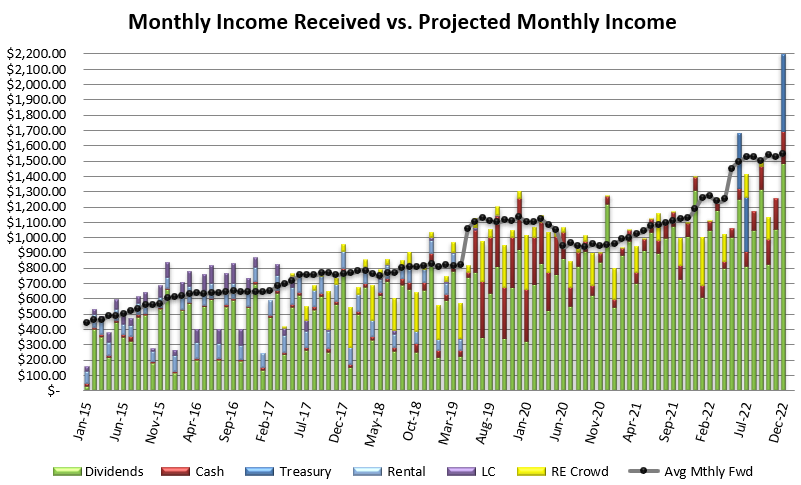

The first chart shows a history of the monthly investment income (various sources, colored) we’ve received vs. projected average monthly income (black dots).

I’ve shared versions of this chart for several years. Here is the latest:

This chart shows former income streams (rental property, LendingClub notes), current streams, and, most interesting, progress.

Currently, we’re only living off of the red (interest on cash) and about 85% of the green bar each month.

December 2022 was a big month, paying us close to $1,600.

But January 2023 will be thin because fewer companies in our portfolio pay in January. January will only be about $900.

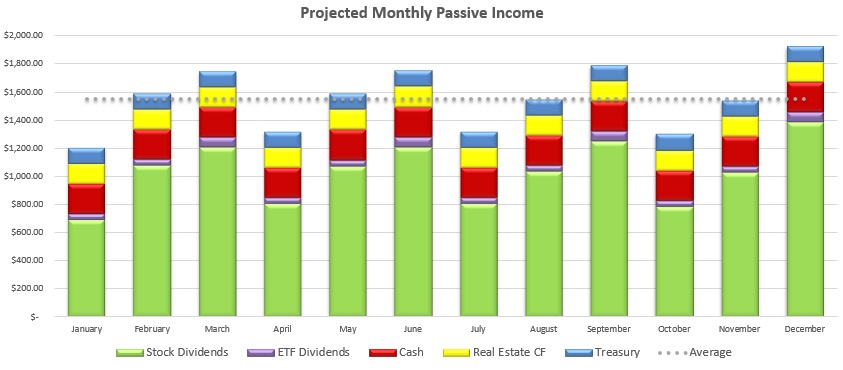

I created a new chart to see a more accurate estimate of the amount of dividend income I receive each month.

I got the idea for this chart from TD Ameritrade back when I had an account there. Fidelity will tell you when to expect dividend payments, but not in a chart.

Other brokers and online dividend tracker tools can provide a similar view. Create your own view with a spreadsheet, or download mine.

The monthly average investment income we receive from various sources is more than $1,500. We’re still reinvesting dividends from Fundrise, EquityMultiple (real estate crowdfunding), and I Bond interest (Treasurys).

Living Off Dividends Calculator

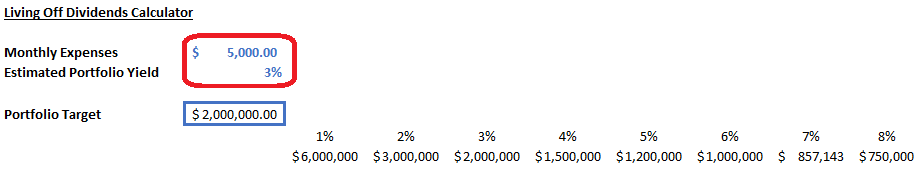

I’ve created a simple spreadsheet to calculate how much dividend income is needed to cover expenses.

Type in the monthly expenses (or a single small expense) and estimated portfolio yield. It will give you a portfolio target value.

It also shows the target portfolio value for yields ranging from 1%-8%.

In this example, if your monthly expenses averaged $5,000 per month, you’d need a $2 million portfolio yielding 3% to live off dividends.

Download the living off dividends calculator here for free.

Also included is the data table to create the Projected Monthly Passive Income chart in the section above. Type in your income streams and the anticipated amount you will earn each month, giving you the visualization.

Best Investments for Living Off Dividends (and Interest)

Stocks and ETFs are nearly always good income-producing assets if you have a long-term outlook. These are some of the easiest forms of passive income, and you get capital appreciation too.

Even when the stock market was at its worst in 2007-2009, only a handful of Dividend Aristocrats cut their dividends, mainly financials.

Investors with shorter-term investment horizons or lower risk tolerances should weigh the risks of stock investing against risk-free interest accounts.

High-yield savings accounts fetch 4% or more, are FDIC-insured, and pay monthly interest. With high interest rates, living off the interest earned from cash savings is easier.

There are also more high-yield alternative investments at our fingertips.

Consider creating a basket of income-producing assets beyond just stocks.

Stock Exchange Traded Funds (ETFs)

Investors with a five-year investment horizon or longer should be comfortable with dividend-paying ETFs for dividend income.

ETFs give you instant diversification and good yields without having to analyze stocks.

Some dividend-paying ETFs also provide monthly income instead of quarterly.

One downside is ETFs can have unpredictable yields because they pay aggregated dividends, and dividend income for more than 100 stocks can fluctuate.

Individual stocks may be a good option for more predictable income and the freedom to design a custom portfolio to match your investment objectives.

Total market ETFs, such as the Vanguard Total Stock Market Index Fund (VTI), have lower yields because they own a broad range of stocks, many of which do not pay dividends.

VTI yields 1.66% as I write this.

Dividend-focused ETFs, such as the Schwab U.S. Dividend Equity ETF (SCHD), usually own blue chip dividend stocks and no non-dividend paying stocks.

Check out the current SCHD yield.

Other popular dividend-focused ETFs include

- Vanguard Dividend Appreciation Index Fund (VIG) – 1.96%

- iShares Select Dividend ETF (DVY) – 3.43%

- Vanguard High Dividend Yield Index Fund (VYM) – 3.00%

- Vanguard Real Estate Index Fund (VNQ) – 3.91%

Individual Stocks

Individual stock investing has become less popular (and often criticized) as ETFs have proven to be efficient investment vehicles.

Owning individual stocks requires initial and continuous stock research to identify suitable investments and eliminate dogs.

I’ve invested in individual stocks for so long that it’s second nature. I like that I can buy undervalued stocks and earn a higher yield for my dollar.

Dividend growth — the percentage a company increases its dividend every year — keeps dividend income growing above the inflation rate in normal years.

Precise payment amounts and dividend growth are less predictable with ETFs.

Read more: How to Invest in Dividend Stocks

Municipal Bond ETFs

Since my taxable investment portfolios have grown above $500,000, I’ve added municipal bond ETFs to reduce my taxable income.

Municipal bonds pay tax-free dividends, even in taxable accounts.

ETFs are the easiest way to diversify and benefit from the tax advantages of this low-risk asset class.

I own three municipal bond ETFs. The first two are large and diversified, paying slightly above 2% each. The third fund pays closer to 4%.

- Vanguard Tax-Exempt Bond Index Fund ETF Shares (VTEB)

- iShares National Muni Bond ETF (MUB)

- SPDR Nuveen Bloomberg Barclays High Yield (HYMB)

Municipal bonds have become less favorable due to higher interest rates on cash, but I plan to hold these funds indefinitely.

I expect municipal bond ETF interest rates to rise in the coming years, lagging behind broader interest rates but catching up eventually.

High Yield Savings

High-yield savings accounts (savings, money markets, CDs) are risk-free (FDIC-insured up to $250.000) and now yield above 4%.

That’s a welcome change from years of lousy interest rates.

These accounts pay interest, not dividends. But it’s essentially the same.

I recommend the CIT Savings Connect account to earn great rates on savings.

Crowdfunded Real Estate

Real estate crowdfunding is a way to own small portions of high-quality real estate. Most investments, both debt or equity, pay dividends.

We own real estate through the Fundrise and EquityMultiple platforms, averaging about $150 of passive income a month. I’m still reinvesting distributions received from these platforms for now.

Please note: This is a testimonial in partnership with Fundrise. We earn a commission from partner links on RetireBeforeDad.com. All opinions are my own.

Alternative Income-Producing Assets

I reviewed an investing platform called Yieldstreet a while back. It focuses on income-producing alternative assets, most of which pay dividends, interest, or other cash distribution.

At Yieldstreet, investors can own real estate, short-term notes, private credit, marine, legal, and supply chain finance.

What About Living Off Capital Gains?

Selling assets for income works fine as well.

Some prefer living off capital gains because you can sell assets only when you need them, thereby only paying taxes upon a sale.

With dividends, you receive and pay taxes on them whether you need the money or not.

Growth stocks typically don’t pay dividends. Those investing exclusively in individual growth stocks try to beat the market and avoid dividend taxation would use capital gains for living expenses.

Nearly all stock ETFs and index funds pay a dividend. So you’ll be challenged to be an index investor and avoid dividend taxation.

Can You Live Off Dividends? — Realistic Expectations

It will take time to produce meaningful dividend income if you’re just starting with buying stocks or ETFs for dividend income.

Possibly decades.

It’s taken me 28 years to build a stock portfolio that pays more than $1,000 monthly.

Early on, I only invested $50-$100 per month. At times in the last decade, I was investing $5,000 or more.

My contributions have been consistent. But the amount I’ve had available to invest has changed as my salary, family situation, housing payment, and life expenses have fluctuated.

Now that I’m self-employed, I’ve started tapping into dividends as an income source. I’ll return to building dividend income when my primary income becomes sufficient.

We’re not covering all of our expenses today, and I don’t expect to be able to cover everything in the future.

Dividend income will always be supplemental.

Maintain realistic expectations and patience if you want to start living off dividends. Consider other income sources, such as a salary, side business income, or side gigs to supplement investment income.

Featured photo via DepositPhotos used under license.

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

Such a detailed explanation. It helps give me better perspective on what to expect at retirement. Excellent article!

Did my best to explain the current sytchuation.

Craig, have you looked into the MONTHLY dividend-paying ETFs?

RYLD – 13.50%

XYLD – 13.42%

QYLD – 13.74%

JEPI – 11.68%

NUSI – 9.06%

There are all kinds of monthly paying ETFs. These are covered call ETFs that use options to generate a high yield off the market indexes. I have not researched them, but know of their existence.

Craig, I enjoyed reading your article. I have been retired for 2 1/2 years and have totally replaced my “take home” pay with stock dividends and annual capital gains distributions from mutual funds from our joint taxable accounts. For the past two years we have made about $62,000 per year from those accounts and I have not missed not having a paycheck. Last November my wife also retired so we have lost that income stream. Going forward I will be looking at taking dividends and CG from our retirement accounts to replace her income. We worked and saved for 40 years and built a portfolio of dividend paying stocks and Mutual funds and reinvested all the income so that when we retired we could stop reinvesting and take the income to pay our expenses. I also keep an emergency fund of 3-4 years expenses in the money market which is currently paying 4.25%, which I consider a very good risk free return. That much cash has kept our overall portfolio from dropping as much as the market.

I think you are on the right track, but by starting to live off your dividends at an early age and not continuing to reinvest until you’re about 60-62, I don’t think you’ll see the compound growth you’ll need to have enough dividends to live off of in retirement. Just my thoughts and experience.