Liquor, Ladies, and Leverage: How Smart People Go Broke

In 2002, a nineteen-year-old garbage man in the U.K. named Michael Carroll won a lottery jackpot worth $14 million dollars. Instead of making smart money moves with his winnings, he spent his fortune on jewelry and a mansion where he threw lavish parties with drugs and prostitutes.

In 2002, a nineteen-year-old garbage man in the U.K. named Michael Carroll won a lottery jackpot worth $14 million dollars. Instead of making smart money moves with his winnings, he spent his fortune on jewelry and a mansion where he threw lavish parties with drugs and prostitutes.

A decade later, he was broke and working in a cookie factory.

At the peak of his debauchery, he’d wake up and snort a line of cocaine and chase it down with a can of beer.

After his “crazy days” were over and the money was gone, he switched to bran flakes for breakfast.

If you’re gonna spend it all anyway, might as well go broke spectacularly.

Liquor, Ladies, and Leverage

In a recent interview on CNBC, Warren Buffett offered his opinion on buying stocks with borrowed money.

It is crazy in my view to borrow money on securities. It’s insane to risk what you have and need for something you don’t really need… You will not be way happier if you double your net worth.

(says the guy with the $84 billion net worth).

Buffett is talking about margin debt.

Margin lending is a service that brokerages provide to qualified customers.

Investors who believe their short-term investment strategy has a high chance of success may leverage their investment with margin, or borrowed money, to increase returns.

Brokers charge a set rate and withdraw the prorated interest amount out of the brokerage account at the end of each month. Rates vary dramatically between different brokers.

Hedge funds and other financial institutions are known for making big bets with leverage. When correct, the returns are amplified. When a bet is wrong or the broader market doesn’t cooperate, losses can be painful.

Later, Buffett paraphrases a quote from his business partner, Charlie Munger in the CNBC interview:

My partner Charlie (Munger) says there is only three ways a smart person can go broke: liquor, ladies, and leverage. Now the truth is — the first two he just added because they started with L — it’s leverage.

Here’s the video clip:

How Smart People Go Broke

There’s a very simple reason why investing with margin is a bad idea. Paying interest is the opposite of investing.

So if you borrow on margin at 5%, and long-term expected stock returns are 9%, the margin wipes out all but 4% percent of your gains. There are lower-risk investments for 4% returns.

Simple math, right?

Of course, margin investors aren’t chasing 9% returns, they’re looking for something bigger.

What Buffett is really talking about here are the hedge funds and “smart” money managers. Most sophisticated institutions are investing on margin, making big bets on certain investments and leveraging up when they believe they are very right.

Just because they are doing sophisticated things doesn’t mean they beat the market. Most don’t, but they still charge exorbitant fees. Hence, the growth in popularity of index investing.

The strategy can work well in bull markets but eventually leads to arrogance and over-leverage.

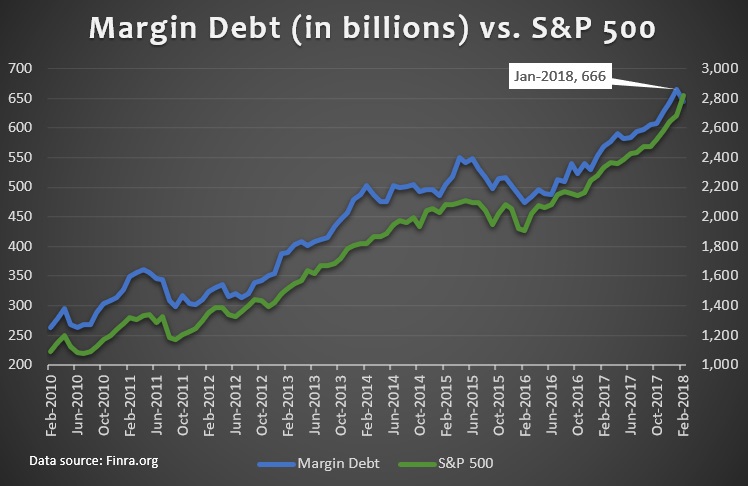

As the bull market continues, margin debt increases.

Margin debt rises and falls with the market as seen in the chart below. It can also be a leading market indicator. When margin debt spikes, it’s sometimes followed by a sharp market decline.

See a more indicative chart and explanation of margin debt on Investopedia.

Danger lurks when margin gets out of hand and the market declines quickly. Investors with margin accounts that are over-extended will receive what’s called a margin call if their holdings decline enough. This means they either need to sell stocks to increase their cash position or add cash to their account.

If declines are bad enough and funds aren’t added, brokers may begin forced selling. As things get bad, they get worse. Losses cascade as margin investors bail. We all suffer from price declines.

Severe market declines are exacerbated by margin selling. Notable examples include the 1929 Black Tuesday crash that started the depression and the Black Monday crash in 1987.

Investors who do not invest on margin don’t have to worry about margin calls and can, therefore, hold through the turmoil. As mentioned in the CNBC article, Berkshire Hathaway’s stock declined by 37%-59% four times in the last five decades.

Buffett is known for holding through the storms and buying when there’s turmoil. This is what long-term investors aspire to do, but when markets collapse, it’s not so easy to hold and buy more because it feels like there’s no bottom.

But Aren’t We All Investing on Margin?

Margin debt is borrowed against a security or portfolio of securities. The shares of stock serve as collateral.

Investing with other debts is not the same.

Using credit card debt to invest is incredibly stupid. If you have revolving credit card you shouldn’t start investing until it’s paid off, except through an employer-sponsored retirement plan.

Mortgage debt is different too. When your mortgage rate is low (sub 5%) and you invest to achieve long-term stock returns of 9%+, a mortgage is a great deal. Especially with the tax advantages.

Homeowners with lots of equity may be tempted to borrow against their home to invest using a HELOC or home equity loan to tap into the equity that’s already been paid. The temptation is always there with home ownership, especially when rates are low.

The numbers make sense, but will that make you happier if you can earn another 4%-5% on that loan while taking on additional risk? Or as Buffett says, to risk what you have and need for something you don’t really need.

You may think it’s a smart thing to do, and smart people do it every day. But it’s certainly not risk-free. In a bad year, your investments could go down 10%, 20%, 30%, or more.

Worse yet, someone might borrow against their home then buy stocks on margin with the borrowed cash. That’s a good way to put your lifestyle at risk.

I’ve refrained from taking very cheap home equity loans and using the proceeds to invest despite the temptation. Though I did seriously consider the idea of taking a HELOC loan at 0.9% to invest in Lending Club notes at one point.

Seeing how my Lending Club returns sharply declined over the past two years, I’m grateful the smarter half of my brain prevailed. It’s a lesson I didn’t have to learn the hard way.

How I’ve used Margin in the Past (and Why I Don’t Anymore)

My TD Ameritrade account is a margin account because it’s required for options investing. I rarely invest in options anymore, but the margin is still there. Short-selling requires a margin account too, though I’ve never sold short.

Margin rates at TD Ameritrade are notoriously high (~10% for accounts under $100,000). But other online brokers such as Interactive Brokers charge much less.

On occasion in the past, I’ve purchased stock on margin when I had no available cash in my account. I bought in a hurry thinking there was an exceptional value available for a short period of time. Then I’d add the cash a few days later to get back above zero. I paid a small amount of margin interest for this convenience.

This move only exposed my impatience and never made me any extra money. I’ve stopped this practice and only buy when I have cash in my account.

Another slightly better way I’ve used margin is for tax-loss selling. If one stock in my portfolio is way down, I may buy more shares of the company with the plan to sell the original lot 30+ days later, allowing me to take the capital loss on my tax returns. I’ve done this on margin to not tie up my cash for 30 days.

Last time I did this, I wrote off about $1,500 on my taxes and the margin cost me about $20. Worth it in this case. But this was a very small percentage of my account, so I was never at risk of a margin call.

Nonetheless, I’ve sworn off this practice too. I wait until I have cash available. It’s not worth the risk.

Obviously, I’m not going to contradict the Oracle in my advice to you. Don’t purchase stocks on margin. Your sure-thing investment idea is probably a loser. Like all debt products, it’s very easy to go down that road but a difficult trudge home.

The Lotto Lout

Michael Carroll has surely been called a lot of things since his lottery windfall. Smart is probably not on that list. The British tabloids labeled him “the lotto lout”. I had to look that word up since I’m not British.

Lout: An uncouth and aggressive man or boy. – The Oxford Dictionary

Being financially responsible takes discipline and focus nearly all of the time. Sometimes I’m envious of stories like Mr. Carroll’s because, for a few years there, he didn’t give a shit about money and lived totally carefree.

I guess that’s what I’m ultimately striving for, to not give a shit about money and to live completely carefree. Hopefully not to the same excess. But it’s the same goal. Only he did it in his 20’s instead of saving it for retirement.

Photo credit 955169 via Pixabay

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

Great article! I love the quote from Buffett: “It is crazy in my view to borrow money on securities. It’s insane to risk what you have and need for something you don’t really need… You will not be way happier if you double your net worth.”

Plus, this quote could be applied or a lot of different situations as well.

I used to buy on margin several years ago, and even at one point had 15% – 20% in one of my brokerage portfolios on margin. I dislike debt however, and didn’t like owing money with the possibility of facing a margin call. So the dividends gradually paid this margin off, and I do not use it anymore.

Thanks DGI. The first quote is so true and the second just made me laugh. Margin is so tempting, but it makes zero sense from an amateur investor perspective.

-RBD

Great post, even considering that Clickbait Title! (haha). I, too, have TDAmeritrade margin for options trading. I’ve only had to use it on the rare occasion that options expired in the money, and I got put a stock. I’ve always transferred $$ immediately to minimize the Loan Shark margin interest rates. Great quote from Charlie/Warren. It’s Leverage.

Hey Fritz… I’d call it a ‘catchy title’ rather than the pejorative 🙂 Nobody clicks on average titles! I think my margin account is around 10%, though I haven’t looked in a while. Loan shark-esque considering long-term returns are likely lower than that.

-RBD

Michael Carroll is probably very lucky that he only won $14 million. If the money had never run out he could have spent himself into an early grave.

Margin is extremely dangerous. I’ve never used it, and never will. With margin you cannot hold until you’re right. In other words, a short term decline in the market can permanently wipe out your gains if you face a margin call.

Sounds like a good rule of thumb for most of us.

That’s a great quote about borrowing to invest. I haven’t seen it before. Nice job digging it up.

I used margin debt before too – in 1999. Luckily, I didn’t have that much money to lose at that time. I learned my lesson and haven’t borrowed to invest since then. Experience is the only way that a lesson sticks.

I need to learn how to make clickbait titles. 🙂

This quote made me laugh, typical ‘old guys’ in finance. 1999 was a terrible time to use margin! Good thing you didn’t have much to lose.

It’s easy for Warren Buffett to make statements about only investing with cash; he sits on a mountain of it.

Investing on margin has its place. But you do need to appreciate the pitfalls and proceed with caution and eyes wide open.