How I Quit My Career at 39 with Out-of-State Rental Properties

The following is a guest post by Eric Hughes, who writes the blog Rental Income Advisors. Eric left his corporate job by creating passive income with out-of-state rental properties.

He owns 18 properties that produce nearly $70,000 per year.

Eric explains how rental properties can be a shorter path to financial independence than a traditional stock and bond portfolio.

A Moment of Reckoning

“So, it was your incompetence that allowed this mistake to happen.”

That was the curt assessment of my company’s CEO in response to an error in a complex Excel tool that my team managed.

The error led to a mistake in our quarterly orders. The company manufactured clothes and sold them through their chain of retail stores, but the mistake had already been identified and corrected with little real harm done.

Nevertheless, the CEO was out for blood and wanted to establish blame.

I had been at the company for less than six months. There were a dozen other senior executives copied on the email. This was a public shaming — a lashing in the digital town square where everyone could see.

She preferred when people were afraid of her because managing through fear was all she knew; like so much of her bad behavior, this email was designed to reinforce that fear.

I had seen her ire directed at others before. But I had never borne the brunt of the assaults personally.

As easily as I recognized her playground bully tactics, it was deeply uncomfortable to be threatened in this way; this was the CEO, after all.

I had a fancy title — VP of Business Process & Transformation. But you wouldn’t know it by my office digs; a windowless, harshly-lit interior office in a nondescript 80’s-era office building plopped amidst a dozen similar buildings in a deeply depressing office park outside Secaucus, New Jersey.

I spent most of my waking hours in that office, unable to see the outdoors. I made a nice salary, but this was nobody’s idea of a dream office job.

As I sat there in my dreary office, re-reading this insane email exchange, I knew something had to change. I couldn’t go on doing this kind of work for another decade or more, selling my brain to the highest bidder and subjecting myself to the whims of tyrannical CEOs.

I would lose my soul completely.

I was desperate for more time, more freedom, and less stress. I needed to take back control of my life and choices and eliminate my dependence on a company paycheck.

This realization had been slowly dawning for years, but now it was crystal clear: I had to escape.

But how?

The Quest for Passive Income

How could I live the life I wanted without my steady paycheck? I knew I would need other income — ideally passive income.

I was familiar enough with the FIRE movement (financial independence/retire early) to know one of its main tenets — the 4% rule.

In short, this “rule” says that you can withdraw 4% of your stock & bond investments every year and not run out of money over the next 30 years.

Inverting the math — if you can save 25 times your annual expenses, you can retire. Some people refer to this as their “FI number.”

When I looked at my numbers, it was disheartening.

I lived in New York City, where living expenses are very high, but I loved the city and didn’t want to move.

My spouse and I don’t live an extravagant lifestyle, but we still easily spent over $100K per year (if you’re not from an expensive city, this may sound like a crazy amount of money, but trust me — it’s not).

I did the math and realized that to meet the 4% rule — we needed to save at least $2.5 million!

Despite always maxing out my 401(k) throughout my career, I wasn’t even 20% of the way to that number.

The 4% rule wasn’t going to work. I needed a different solution.

I did some online research into different ways to produce passive income. There are lots of lists and articles published on this topic. Here’s what I kept finding on those lists:

- Start a side hustle or business. I thought: “Great…but what business? How would it make enough money to be meaningful? And this doesn’t sound too passive.”

- High-yield CD’s or bonds. “Sure, but the returns aren’t good enough here to replace my income.”

- Peer-to-peer lending. “Hmmm…maybe. I wonder what the returns would actually be.” I invested a bit of money with Lending Club to test this out. Not all it’s cracked up to be.

- Buy a franchise. “This is usually a lot of work. And it takes a lot of money. And there’s a lot of risks. Also, I’m not a fan of frozen yogurt, so no thanks.”

- Write a book. “Royalties certainly sound like a nice passive income stream. But what would I write about? Who would publish it? Do I even have a typewriter?”

- Sell a patent or invention. “Huh? Seriously? Who comes up with these stupid passive income lists anyway?!?” (RBD: slowly raises hand ✋)

But one item that appeared on all these lists of passive income streams stood out as straightforward, achievable, and quite lucrative: rental real estate.

The more I learned, the more convinced I was that rental properties were my path out of the office grind. I ran the numbers, and it looked like it would work.

So, I took the plunge. I decided to sell my condo, become a renter, liquidate some stocks, and use the proceeds to buy a bunch of cash-flowing rental properties to make enough monthly income to quit my job.

The Benefits of Rental Property Investing

Why did I pick rental properties?

They offer numerous benefits, but the most important is the potential for strong cash flow.

You can’t eat home equity, stocks, or appreciation. You need cash in your pocket every month to quit your job and still pay the bills.

Let’s define the strength of cash returns using a popular metric used by real estate investors — “cash-on-cash” returns. This metric tells you how quickly your invested capital is generating cash.

Here’s how to calculate:

(Income — Expenses) / Cash Invested

For example, if you have $100K invested and make $5K each year in positive cash flow (aka income minus expenses), your cash-on-cash returns are 5%.

The higher you can get that number, the faster your invested cash is making MORE cash.

What kind of cash-on-cash returns can you expect from rental properties? With mortgage rates so low, it’s quite easy to achieve 10% to 15% CoC.

These are very strong and consistent returns compared to most other investment vehicles.

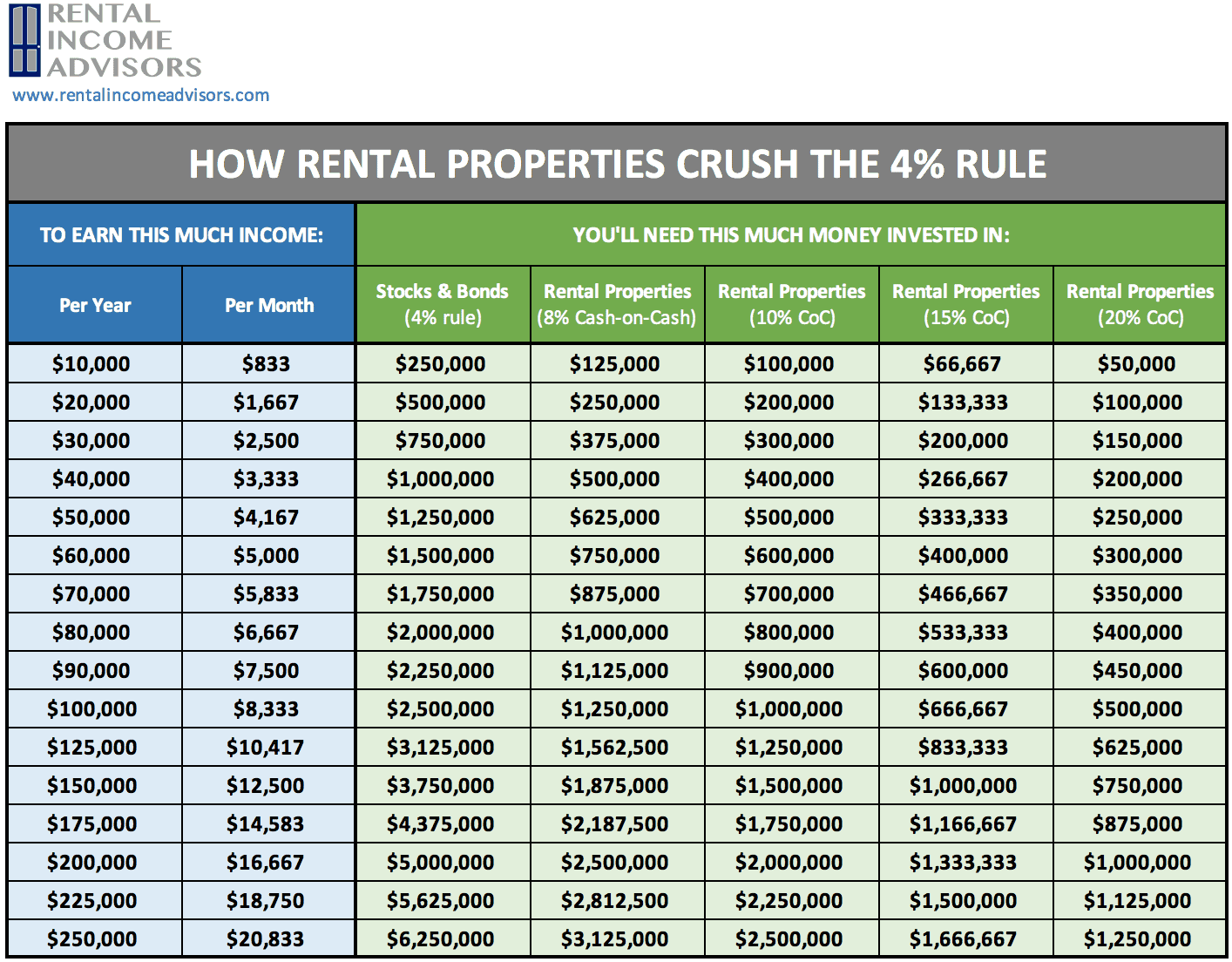

For example, let’s go back and compare that to the 4% rule for stock & bond investments. If you can make 10% cash-on-cash returns with your rental properties, that means you need MUCH less money invested to achieve the same level of annual income.

Rental properties are a much faster path to FI!

Perhaps the most controversial article I ever published was titled What the FIRE Movement Gets Wrong.

Here’s the main point — the FIRE Movement (or most of it, anyway) focuses so much on the 4% rule that most people believe they must save 25x their annual expenses before retiring.

But that’s not true with rental properties, which provide a way to get there much faster.

The numbers don’t lie:

And the financial benefits of rental properties don’t end with cash flow alone. Rental properties also offer:

- Low-cost, fixed-rate loans — Can juice your rate of return even further and multiply the power of the money you invest. You can’t get a mortgage to buy anything else — only rental properties.

- Tax Benefits — The tax system is very favorable to real estate investors. Not only can you deduct all your expenses, but you also get to deduct depreciation, which is the reduction (on paper) of the value of the home over time. This means that the effective tax rate on rental income is extremely low.

With all these benefits, the numbers for rental properties looked like a slam dunk.

But I still had to figure out how it would work in practice, particularly because I’d be buying properties halfway across the country — in Memphis, Tennessee, to be precise.

Out-of-State Rental Properties

Wait — Memphis?!? Why didn’t I just buy closer to home?

Well, for one simple reason: the numbers don’t work.

In New York City, I’d be lucky to make cash-on-cash returns in the low single digits. And that wouldn’t cut it for the kind of cash flow I needed to quit my job.

But other markets work much better.

A good cash flow market is one where home prices are low compared to rents.

Memphis, for example, has relatively cheap homes and a strong, stable rental market. This allows me to achieve much higher rates of return than I ever could in New York City.

Buying homes in remote markets might seem daunting at first, but buying out-of-state rental properties is much easier than you think.

Once I buy a house, my work is mostly done, and the property manager takes over.

Hiring a professional property manager is one of the keys to making it work. My property manager handles all day-to-day portfolio management, including rent collection, maintenance issues, and placing new tenants when there are vacancies.

Selecting Properties

Once I selected Memphis as my market, I had to find good rental properties to meet my financial targets. I used three primary sources to find properties:

- Roofstock, which is a platform for buying and selling rental homes. It’s great for new investors — I bought my first home on Roofstock (RBD’s review).

- Public MLS listings, like those you can find on Zillow.

- A turnkey provider who flips homes and sells them to investors.

I also found a local agent who works with a lot of investors. She sent me listings that matched my criteria and helped with offers and contract paperwork.

When analyzing properties, it’s important to understand the neighborhood and the house as best as you can. But you don’t have to be there in person to do this.

You can learn an amazing amount in our digital age through online research and analysis, and you can even “walk the streets” around a house using Google Street View.

It’s a myth that you have to personally know a local market (i.e., by visiting in person) to invest successfully there. I’ve been to Memphis only once and buy all my properties without ever seeing them in person.

However, the most critical aspect (by far) of evaluating properties is financial analysis. You have to “run the numbers” and calculate the cash flow and rate of return that you can reasonably expect from any particular property.

This requires estimating the home’s rental potential (unless it’s already occupied with a tenant), as well as accurately tabulating all the expenses you will incur, including mortgage, insurance, property taxes, and maintenance costs.

How do you know if a house is a good deal, and what your monthly cash flow will be? How do you know if it will meet your desired cash-on-cash returns?

You have to run the numbers.

To help with this critical task, I developed an Excel Rental Property Analyzer (free spreadsheet). It’s powerful yet intuitive and easy to use for new investors.

Without question, it’s the most critical tool in my arsenal, and I still use it nearly every day to evaluate properties.

How It All Worked Out

Did it work out as planned? The short answer is yes.

Using this strategy of out-of-state rental properties, I WAS able to create enough passive income to quit my job at 39. And no, I don’t miss it at all!

My Memphis portfolio now has 18 properties that produce nearly $70K in (mostly tax-free) income. The income didn’t replace all my W2 income, but it’s enough that I can comfortably maintain my lifestyle.

Buying the right properties takes a bit of time and energy, but once the acquisition is complete, ongoing management is passive, thanks to my property manager — usually no more than a few hours per month.

What have I been doing with all my newfound free time? Sitting on the beach? Knitting dog sweaters? Day drinking? Knitting dog sweaters while day drinking on the beach?

Not quite, I’m keeping quite busy. The difference now is that I’m busy with projects I WANT to be doing, and everything is on my own terms. Here’s some of what I’ve been working on:

- Consulting for a retail start-up (my old industry)

- Learning Spanish

- Keeping the books for my spouse’s company

- An audio recording project to capture my parents’ stories and memories

- Expanding my classical piano repertoire and challenging myself with tougher pieces

- Managing my website and writing for my blog

- Consistent at-home workouts 5x/week during the pandemic

- Doing private coaching for new rental property investors

And also plenty of sleeping in, relaxation, and Netflix binging.

Some of these projects make money, others don’t — and I have the luxury not to care too much either way.

Living life on my own terms has truly changed everything. The future is wide open.

One more quick word about the FIRE movement — I achieved the “FI” part of FIRE, but what about the “RE” part?

I left my career of 15+ years, but is it right to use the word “retired” for someone like me, who is still working and making money?

This has occasionally been a topic of hot debate within the community.

Personally, I think it’s a silly debate. I don’t think about it in terms of retired vs. not retired, and I don’t really care whether people use that word or not.

Because here’s the truth: whatever word you use for it, I have reclaimed my life, my time, and my choices. And it’s awesome.

Eric Hughes writes the blog Rental Income Advisors.

Photo by Heidi Kaden on Unsplash

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

This is a wonderful article regarding real estate investing – thank you!

Eric gave us an interesting perspective on this. Shows that it’s possible, and not as intimidating than people think.

Good read RBD! I like reading about how others have accomplished what I dream of for my life. Thanks again for the fundrise and peer street and other passive income ideas. Making good returns. Now to buy a rental property!

I firmly believe that all “Crowd Funding” Real Estate (CFRE) sites are part of a bigger plan to make private ownership of property a thing of the past. People are contributing their hard-earned dollars to HELP corporations snatch up ownership of properties while “paying” dividends to the investor.

Hint: The dividends were priced into the deal based on the number of investors.

What’s REALLY happening behind the scenes, is these companies owning every cheap property in America. Soon, real estate will be too expensive for anyone except the uber rich and us plebs will be lifetime renters.

Sure, in some instances, you can “own” one of these properties with a CFRE but the idea is for them to own the lion’s share.

Soon, that quaint $100K house on 6 acres in America’s heartland will be available to rent for the low cost of $3,400 per month or available as a cutsey AirBnB for a steal at just $259 per night.

This fact can be argued all day, and sure, it’s just a theory. My request is to leave this comment here on your blog so it can be referred to in 5-10 years to see how the cards fell.

Thanks for the comment. I’ll start by saying Eric didn’t write about crowdfunding for this article (Roofstock is not a crowdfunding site), though I have numerous other times. I still think crowdfunding can be a good investment for investors looking to add real estate to their portfolios without the hassle of buying a property. I’ve invested with success and still own real estate asset investments on crowdfunding sites.

However, I’ve never considered it from the perspective you bring up in your comment.

Real estate is getting very expensive, perhaps even those 6-acre heartland properties you mention. And true, the city slickers are buying up properties in less expensive towns. I saw this before I started blogging before 2013, a friend of mine in NYC was buying single family homes in a college town in NC.

But I think your theory probably applies to properties in excellent locations, and not so much all properties. I say this, because I live in a very expensive locality. However, about two miles away, homes get much more affordable. The location isn’t as desirable for some, but plenty of people can afford to live there. Though, that affordability does bring in investors. So even in high-demand areas, there is often options (excluding perhaps SF and NYC). But I get you point. Cheap debt is exacerbating the issue, inflating prices, and is a primary factor. As we saw in 2008-2009, real estate doesn’t have to go up forever. If imbalances start to get out of control, investors will feel the consequences again. But unfortunately, regular home owners will feel the pain too.

Man are we so similar… I’m 39, live in Long Island, work in the city, and dread going to the office. We have 4 multi-family rental properties so far. My question is, did you use Commercial Loans or are they all Personal Mortgages?

I don’t use commercial loans for my investing. There are a number of overlapping reasons for this, but the biggest one is that the terms and rates on conventional mortgages are much more attractive. Commercial loans will typically have a balloon payment after 5 or 7 years, which is a level of risk I’m not comfortable with. I have a full article on my blog about the various ways to fund rental properties, if you’re interested.

https://www.rentalincomeadvisors.com/blog/funding-your-rental-properties

I purchased three turnkey out of state single family rentals in Memphis, TN, but I have found the actual returns were much less than the predicted 10%-15%. The property management (PM) company is key and can make all the difference in whether your returns are as projected or in the 5% range, as has been my experience. I had 30 year 4% loans, so it wasn’t the financing that was impacting the returns. What it came down to was excess repair charges and poor property management that severely reduced my returns. The biggest costs for a landlord is vacancies and turnover. Every time my property turned over, there was another $3000-$4000 to paint, repair, etc., to get the house “rent ready,” and the property manager always added their 15%. When the PM leased a property, they charged their 1 month rent leasing fee. The more the property turned over, the more the PM made, and the lower my returns were. If you get a good PM that actually manages the property and doesn’t just collect rents and tenants stay for more than 12-18 months, you can make money on turnkey long distance single family rentals. I’m glad the author was able to find that combination, but that has not been my experience.