My Retirement Asset Allocations and Improved Portfolio Page

To be more transparent about my overall investment strategy, I’ve redesigned my Portfolio page and will be explaining the changes in today’s blog post. It now includes the details of our retirement asset allocations, my dividend growth stock portfolio, the forward 12-month investment income (F12MII) chart, and a new financial independence progress chart.

I did not write an investment income update for Q1. After more than five years of writing them, I finally decided to stop because they were repetitive, and they didn’t give readers enough of the big picture.

Since the beginning of this blog, I’ve primarily written about my taxable dividend stock portfolio and other taxable income streams. But this was always a narrow focus. In the background, I was continually investing in employer-sponsored accounts and IRAs.

Those investments were sort of scattered and disorganized for years because I neglected to consolidate accounts or annually rebalance. But with the recent transfer from Vanguard to Fidelity and subsequent rebalancing of funds, it’s now easier for me to measure and share the asset allocations in our retirement accounts.

Going forward, I will regularly update and improve the Portfolio page, but I will not be continuing the quarterly updates. The new Portfolio page is designed to provide a visual depiction of our investment allocations and make monthly updates easier.

The Portfolio page is in the top menu for easy access.

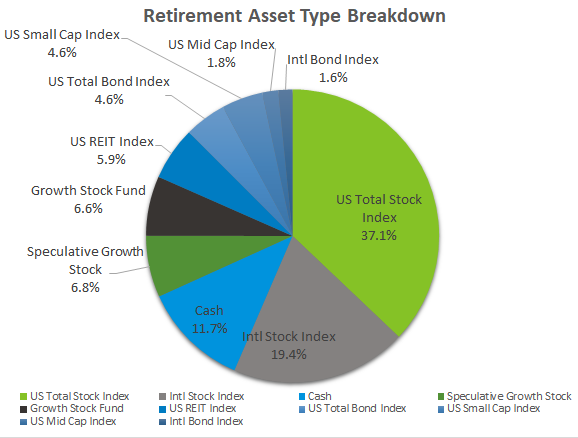

Retirement Asset Allocations in Our Tax-Advantaged Accounts

Mrs. RBD and I have six different retirement accounts. All are now with Fidelity.

They include two traditional IRAs, two Roth IRAs, and two employer-sponsored retirement accounts (a 403(b) and 401(a) with my current employer).

Since I started my first real job in 1998, I’ve mostly invested in mutual funds in my retirement accounts. For most of those years, the investments were in managed mutual funds (with high fees) because that’s all that was available in my old employer plans.

It wasn’t until I left my long-time employer in 2017 that I could transfer my 401(k) money into a traditional IRA and low-cost index funds. I also own a few individual stocks and have some cash sitting idle at the moment.

Mrs. RBD’s retirement accounts have been in index ETFs since she stopped working. But I’ve recently converted those to index funds to match the index funds in my accounts. Utilizing the same index funds makes portfolio analysis and rebalancing more straightforward.

Now that the Vanguard to Fidelity transfer is complete, I can take a more comprehensive look at our combined retirement asset allocations by exporting the data and creating pivot tables and charts in Excel. I’ve cut and pasted those charts into this post and the new Portfolio page.

Here’s an aggregated look at the retirement asset allocations of our six retirement accounts (mobile users, scroll right).

| Symbol | Description | % |

|---|---|---|

| FSKAX | FIDELITY TOTAL MARKET INDEX FUND | 24.33% |

| FSGGX | FIDELITY GLOBAL EX US INDEX FUND | 16.65% |

| FDRXX** | FIDELITY GOVERNMENT CASH RESERVES | 12.58% |

| Specs | Speculative Growth Stocks | 12.42% |

| FXNAX | FIDELITY US BOND INDEX FUND | 6.84% |

| VTSAX | VANGUARD TOTAL STOCK MARKET INDEX ADMIRAL | 6.26% |

| FCNTX | FIDELITY CONTRAFUND | 5.03% |

| FSSNX | FIDELITY SMALL CAP INDEX FUND | 4.47% |

| FSRNX | FIDELITY REAL ESTATE INDEX FUND | 3.48% |

| FSMDX | FIDELITY MID CAP INDEX FUND | 2.55% |

| FOCPX | FIDELITY OTC PORT | 1.98% |

| FPADX | FIDELITY EMERGING MARKETS INDEX FUND | 1.50% |

| VTABX | VANGUARD TOTAL INTERNTL BD INDX ADM | 1.37% |

| SPAXX** | FIDELITY GOVERNMENT MONEY MARKET | 0.53% |

| GRAND TOTAL | 100.00% |

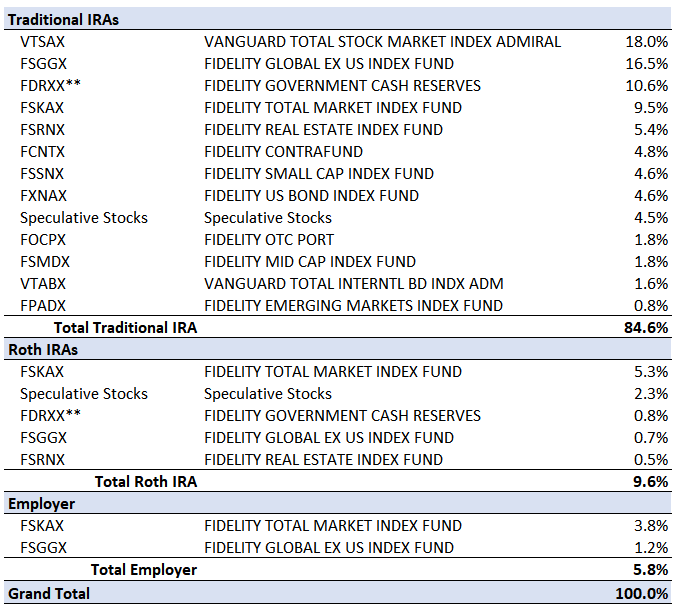

Here’s the same list of assets broken out by retirement account type.

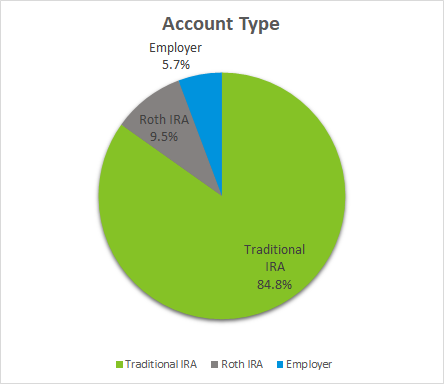

Here’s the breakdown of ind Here’s the breakdown of index funds vs. managed funds, cash, and speculative growth stocks in our six retirement accounts:

Here’s the breakdown of index funds vs. managed funds, cash, and speculative growth stocks in our six retirement accounts:

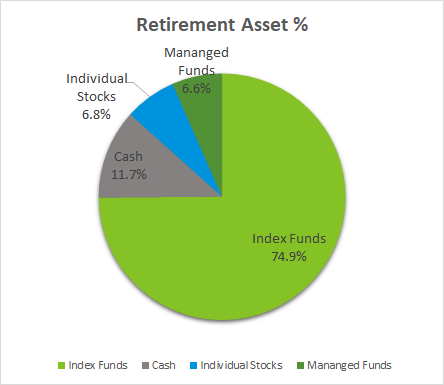

And another chart further breaking down the fund types:

I prefer to make these charts in Excel. But I do also keep track of my asset allocations in Empower. The software categorizes certain assets differently, which is why the numbers don’t line up exactly. It considers the REIT index funds as alternatives.

A few notes on the above charts and tables:

At 15%, the cash allocation is much higher than I want it to be. This is due, in part, to the consolidation of accounts. However, the market has gone straight up during the first half of 2019. I’d rather wait for a pullback before putting the money to work.

I’m now investing aggressively in my employer-sponsored accounts and receiving a 10% match, so I expect to see that slice of the pie become a more substantial proportion in the next few years.

VTSAX (Vanguard Total Stock Market Fund) remains a considerable portion of my traditional IRA because that’s where the money was before I transferred it. I’ll likely convert it all to FSKAX (Fidelity Total Stock Market Fund), but I’m hesitating in case I find a reason not to. Once I transfer out of VTSAX, I can’t get back in without paying a $75 fee to Fidelity.

I make small speculative stocks purchases in my retirement accounts to attempt to create gains that outpace the overall market. These holdings are not dividend growth stocks.

The plan is to keep my speculative stock picks to less than 10% of my overall retirement accounts.

Taxable Dividend Stock Portfolio

My dividend stock portfolio is the primary account that I’ve blogged about since the inception of RBD. Though I’m no longer reporting all of the specific transactions every quarter, I’m continuing to share my holdings and the income generated from the dividends.

The stocks in my dividend stock portfolio are not included in the tables and pie charts above.

The portfolio was held in an individual taxable account at TD Ameritrade for about 15 years. But I’ve recently transferred the entire account to a new taxable individual account with Fidelity. I’ll convert that to a joint account for estate planning purposes in the next few weeks.

I also own ten dividend growth stocks in a taxable account at M1 Finance. I’m investing $500 per month and reinvesting all the dividends back into the “pies”.

M1 Finance stocks are now marked with an asterisk (*) in the updated tables. Read my M1 Finance review to learn about dollar cost averaging with “pie” investing.

Here’s my taxable dividend growth stock portfolio as of May 1st. It currently pays me about $7,000 per year in forward 12-month income (mobile users, scroll right):

| Ticker | # of Shares | Annual Dividend | Annual Income | Yield | YOC% | Sector |

|---|---|---|---|---|---|---|

| AAPL | 112.00 | 3.28 | $ 367.36 | 0.90% | 4.88% | Technology |

| ABBV | 100.00 | 4.72 | $ 472.00 | 4.81% | 16.23% | Healthcare |

| ABT | 100.00 | 1.44 | $ 144.00 | 1.57% | 5.51% | Healthcare |

| ACN | 29.02 | 3.20 | $ 92.85 | 1.49% | 3.36% | Technology |

| ADM | 80.00 | 1.44 | $ 115.20 | 3.61% | 4.17% | Industrial |

| AFL * | 32.03 | 1.12 | $ 35.87 | 3.11% | 2.60% | Financial |

| APD * | 5.33 | 5.36 | $ 28.55 | 2.22% | 2.41% | Industrial |

| BAC | 419.00 | 0.72 | $ 301.68 | 3.03% | 4.61% | Financial |

| BEN | 130.00 | 1.08 | $ 140.40 | 5.15% | 3.82% | Financial |

| BRK-B | 15.00 | 0.00% | 0.00% | Financial | ||

| CAH * | 63.32 | 1.94 | $ 123.06 | 3.72% | 3.17% | Healthcare |

| CL | 24.00 | 1.76 | $ 42.24 | 2.40% | 2.80% | Consumer |

| CLX | 30.00 | 4.44 | $ 133.20 | 2.02% | 5.00% | Consumer |

| CMI * | 7.39 | 5.24 | $ 38.74 | 3.03% | 3.33% | Industrial |

| COST | 12.75 | 2.80 | $ 35.70 | 0.92% | 1.47% | Consumer |

| CSX | 100.00 | 1.04 | $ 104.00 | 1.49% | 3.66% | Services |

| CVX | 98.00 | 5.16 | $ 505.68 | 5.78% | 6.75% | Energy |

| DCI | 75.00 | 0.84 | $ 63.00 | 1.83% | 2.28% | Industrial |

| DIS | 60.00 | 0.00 | $ - | 0.00% | 0.00% | Consumer |

| DOV | 55.00 | 1.96 | $ 107.80 | 2.03% | 3.73% | Industrial |

| EMR | 108.00 | 2.00 | $ 216.00 | 3.22% | 4.09% | Industrial |

| FLO | 70.00 | 0.80 | $ 56.00 | 3.60% | 5.35% | Consumer |

| GD * | 26.19 | 4.40 | $ 115.26 | 2.94% | 3.57% | Industrial |

| GIS | 100.00 | 1.96 | $ 196.00 | 3.18% | 4.04% | Consumer |

| GS | 20.00 | 5.00 | $ 100.00 | 2.53% | 2.96% | Financial |

| HAS | 45.00 | 2.72 | $ 122.40 | 3.63% | 4.46% | Consumer |

| IBM | 30.00 | 6.52 | $ 195.60 | 5.40% | 4.91% | Technology |

| ITW * | 21.85 | 4.28 | $ 93.53 | 2.45% | 3.13% | Industrial |

| JNJ | 40.83 | 4.04 | $ 164.96 | 2.91% | 3.90% | Healthcare |

| KO | 254.00 | 1.64 | $ 416.56 | 3.67% | 5.62% | Consumer |

| LEG * | 41.24 | 1.60 | $ 65.98 | 4.55% | 4.50% | Industrial |

| LOW | 45.00 | 2.20 | $ 99.00 | 1.63% | 2.85% | Consumer |

| LUV * | 42.84 | 0.00 | $ - | 0.00% | 0.00% | Consumer |

| MA * | 4.16 | 1.60 | $ 6.66 | 0.54% | 0.57% | Financial |

| MKC * | 7.33 | 2.48 | $ 18.17 | 1.38% | 1.57% | Consumer |

| MMM | 35.00 | 5.88 | $ 205.80 | 3.77% | 4.23% | Industrial |

| MO * | 155.91 | 3.36 | $ 523.87 | 8.56% | 7.76% | Consumer |

| MSFT | 26.11 | 2.04 | $ 53.26 | 1.00% | 3.13% | Technology |

| NKE | 43.82 | 0.98 | $ 42.94 | 1.00% | 1.52% | Consumer |

| O | 90.00 | 2.80 | $ 252.00 | 4.71% | 6.29% | Real Estate |

| OZK | 300.00 | 1.08 | $ 324.00 | 4.79% | 4.35% | Financial |

| PEAK | 80.00 | 1.48 | $ 118.40 | 5.37% | 4.68% | Real Estate |

| PG | 39.00 | 3.16 | $ 123.24 | 2.65% | 3.90% | Consumer |

| PH | 45.00 | 3.52 | $ 158.40 | 1.92% | 3.24% | Industrial |

| PM | 60.00 | 4.68 | $ 280.80 | 6.68% | 5.85% | Consumer |

| PPG * | 12.38 | 2.04 | $ 25.25 | 1.92% | 1.94% | Industrial |

| ROST * | 13.87 | - | $ - | 0.00% | 0.00% | Consumer |

| RTX | 35.00 | 1.90 | $ 66.50 | 3.08% | 3.75% | Industrial |

| SBUX * | 16.61 | 1.64 | $ 27.23 | 2.23% | 2.40% | Telecom |

| T | 190.00 | 2.08 | $ 395.20 | 6.88% | 6.49% | Consumer |

| TGT | 80.00 | 2.72 | $ 217.60 | 2.27% | 4.62% | Consumer |

| THO | 40.00 | 1.60 | $ 64.00 | 1.50% | 2.84% | Financial |

| TROW | 60.00 | 3.60 | $ 216.00 | 2.91% | 4.54% | Services |

| UNP | 15.00 | 3.88 | $ 58.20 | 2.29% | 5.15% | Industrial |

| V * | 6.48 | 1.20 | $ 7.78 | 0.62% | 0.78% | Financial |

| VFC | 28.00 | 1.92 | $ 53.76 | 3.15% | 3.09% | Consumer |

| VTEB | 50.00 | 1.19 | $ 59.50 | 2.24% | 2.24% | EFT |

| VZ | 194.00 | 2.46 | $ 477.24 | 4.46% | 6.64% | Telecom |

| WBA | 110.00 | 1.83 | $ 201.30 | 4.32% | 3.08% | Healthcare |

| WTRG | 109.00 | 0.94 | $ 102.46 | 2.25% | 3.58% | Utilities |

| Total Dividends | $ 8,772.19 | 2.86% | * M1 Finance holding |

Forward 12-Month Investment Income (F12MII)

Here’s a newly formatted table for calculating the forward income I expect to earn in the coming 12 months. These numbers were previously reported in the quarterly reports but are now on the Portfolio page.

| Other Forward Income Streams | Yearly Income | Average Monthly Income |

|---|---|---|

| Dividends | 13032.32 | 1086.03 |

| Cash Savings + I Bonds | 3957.67 | 329.81 |

| RE Crowdfunding | 1775.22 | 147.94 |

| Total Forward Annual Income | 18765.21 | 1563.77 |

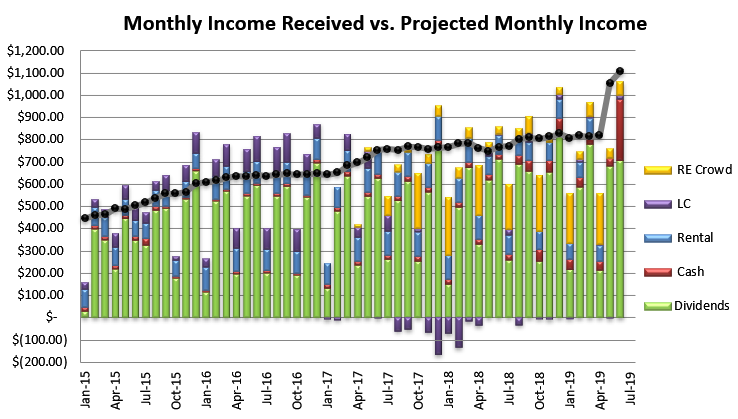

And here’s the familiar income received vs. project chart I’ve been updating since January 2015:

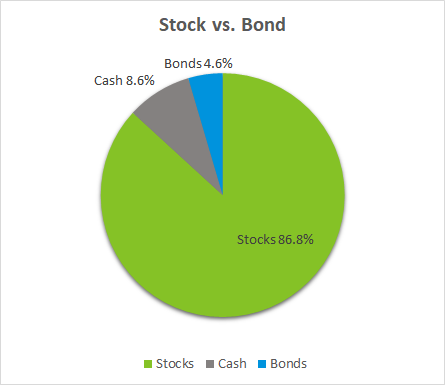

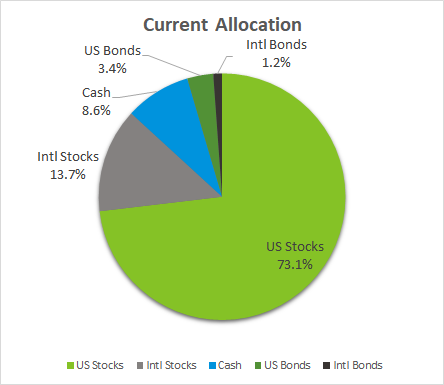

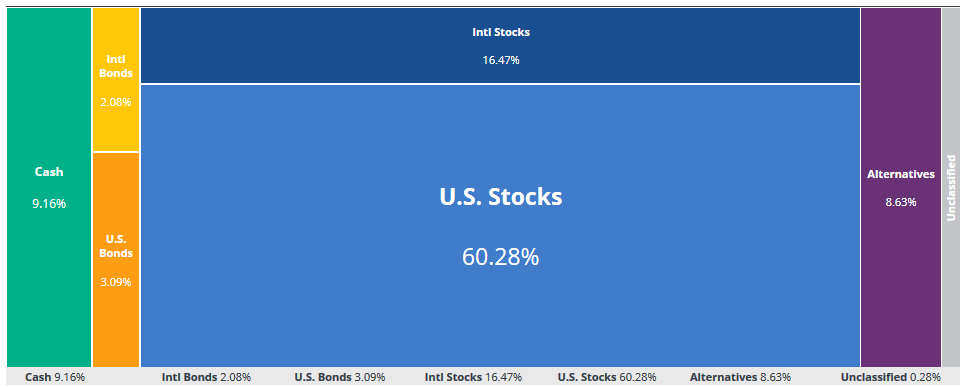

Total Combined Asset Allocation

The next section shows my combined stock and bond portfolios in both retirement and taxable accounts. I’ll use these charts to better understand my portfolio for annual rebalancing.

My target allocation is closer to 75%-80% stocks, 10%-15% bonds, 5% (or less) cash. So I have some work to do. But I don’t want to change everything all at once because I’m still deciding how to allocate some of the cash.

These charts are helping me to understand where I should balance out my holdings. I haven’t included the assets in real estate crowdfunding platforms, but the quilt below does include them.

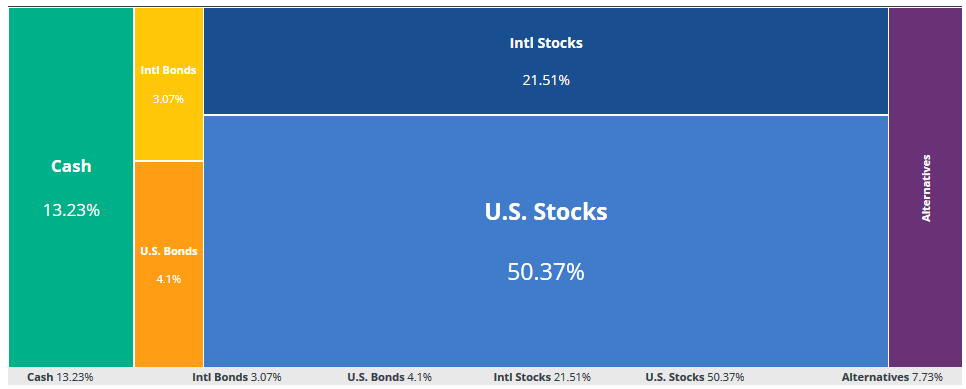

Here’s a shot of my current Empower allocation quilt for all accounts combined. This view includes alternatives and college savings, so the proportions are off from the above pies. I need to play around more to make the numbers match. It considers investments such as traded REITs as alternatives.

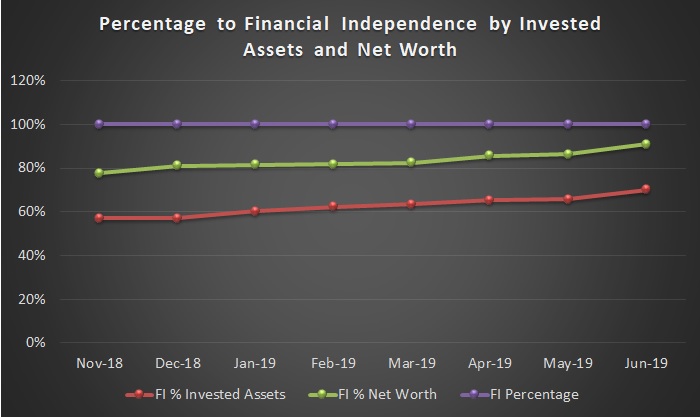

Progress Toward Financial Independence

Earlier this year, I outlined exactly how I measure progress toward financial independence. Now that I’ve been collecting data for the past few months, I can assemble and share a new chart.

I start by tracking our annual expenditures and subtracting F12MII.

I multiply that number by 25 to give me a target financial independence number. Once our invested assets (which excludes the equity in our primary residence and college 529 savings) surpass our financial independence number, we’ve reached financial independence.

I also calculate our FI number against net worth, just for fun. I use Empower to calculate net worth.

Based on the latest numbers, we are 69% (June 2019) of the way toward reaching financial independence. Once the red line overtakes the purple line, we’ve made it.

Conclusion

Putting this information together is still a work in progress. I’m still formulating exactly what I need for my purposes and determining what is best to share with you, mostly in percentages instead of actual values.

It feels good to make my retirement accounts a more prominent feature on the blog because they have grown quite a bit since I started writing. The retirement money is what will eventually carry me into retirement, more than my after-tax income streams.

Neglecting to consolidate accounts and perform the analysis on my holdings held me back from creating a sufficient target portfolio allocation and rebalancing every year. Combining accounts and consolidating investment funds was a huge step toward better understanding our asset allocation.

The next steps are to continue earning, saving, and investing aggressively. I’ll also be refining these measures to make sure I’m on track for realizing my retirement goals.

How do you keep track of your retirement asset allocations? Fidelity also provides some charts that I considered adding above, but I’d rather make my own, at least for now. I may look to improve the web-friendliness of these in future with a WordPress plugin. Come back to the Portfolio page in a few months to see what changes.

Photo via DepositPhotos used under license

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)

“How do you keep track of your retirement asset allocations?” I invest in VTSAX mostly, then focus on how to make more money, or cut costs. Your records are impressive and more than I want to do. How do you do compared to the S&P500? I keep up almost exactly with it.

I use the VTSAX and FSKAX equivalent at Fidelity. But since those are heavily weighted toward the largest companies, I add some extra exposure to small and mid cap indexes, as well as REIT. This increases exposure to the next Amazon and Apple. VTSAX also gives you exposure to the smaller companies, but not as much. Small and Mid caps should increase portfolio volatility, but slightly increase returns over time.

But with bonds and cash in my portfolio, I don’t expect to perform above the S&P 500 in bull markets with indexing alone. I’m probably older than you (43), so I’m starting to increase my exposure to non-equity assets to hedge market downturns. Under 35-40, I’m OK with 100% stocks. But I’m getting more cautious in my old age. I do, however, try to increase alpha by speculating with individual stocks. In the past few years, those investments have outperformed, but they are a small percentage of my overall portfolio.

-RBD

Timely entry. How often do you rebalance to maintain allocations? (For example in the last quarter of last year when domestic stocks took a 20% dip….your stock weighting would have been lower…..did you sell of other assets to rebalance/vice versa when the market surges? I had never paid significant attention to asset allocation. I am working on better understanding how I’m weighted and whether that’s where I want to be.

I have a buddy who works for a refinery and they don’t allow him to buy S&P500 index funds as part of his retirement account…only total market funds. I see that you do total marktet funds as well. Is there a reason for that? I didn’t expect these funds to mirror the S&P (PREIX, TRowe’s version) so well over long periods of time. [In my imagination the difference between total market and s&p500 would have been significant (I expected higher returns for the S&P w/ bigger losses in the dips…but total market is pretty much in step…that surprised me.

You’re a trusted resource in an area of life it’s easy to get antsy. Thanks for being a voice of accessible reason.

Eddie,

Thanks for the kind words. Total market funds are very similar to the S&P 500 funds. Only, after owning the first 500 largest companies, the total market funds then also own the mid and small cap stocks. The ones I own have exposure to 4000-5000 stocks. However, it’s the larger companies that drive the performance. This is, in part, why I’ve added small and mid cap index funds to help balance the largest companies.

Practically speaking, owning the S&P 500 or total market indexes, you’ll get very similar returns.

-RBD

Also….do you track sector exposure across your index funded accounts? or taxable dividend growth stock portfolio? or is the Domestic Stock/International Stock/Bond doing the majority of the allocation strategy work and anything beyond that mere fine tuning?

I also track home equity and life insurance cash value…I didn’t see that listed above. Is there a reason to omit it? Do principle mortgage payments at all count as bond allocation (being that it’s cutting down an interest bearing liability)? I treat any overpayments as an ultra conservative move to offset any overweightings in stocks. Thoughts welcome. My investing experience is limited to the past ten years of bull market…so it’s easy to feel like I know what I’m doing….even when I don’t.

Eddie,

I track sectors in my dividend portfolio. You can see that in the table. I’m not that concerned about it, so I didn’t create a chart for this post. Personal Capital does this quite well. I just did a quick look at my sector holdings among both taxable and non-taxable and accounts and here’s what it gave me:

Basic Materials 1.63%

Communication Services 4.22%

Consumer Cyclical 10.36%

Consumer Defensive 11.64%

Energy 5.19%

Financial Services 11.92%

Healthcare 10.97%

Industrials 12.63%

Technology 20.89%

Unknown 8.27%

Utilities 2.29%

Tech-heavy, as expected, because tech companies are the largest in the world (Apple, Amazon, FB, MSFT etc).

I did not include home equity, or the equity in my investment property for these purposes. Nor my term life insurance. I don’t think those are appropriate. I’m strictly looking at invested assets.

That’s a lot of info. Nice job putting it all together. Our cash/bond allocation is higher than targeted right now. I’m being more conservative this year due to life circumstances.

I’m curious, what’s the taxable to tax-advantaged ratio? Our retirement accounts total about 3x our taxable account. I think that’s about right. The retirement account will need to last much longer.

I am curious about your decision to pursue both ETF investing and dividend growth investing. Our portfolio is similar to yours with the bulk of our investments with Wealthfront (ETF based modern portfolio theory) and Fundrise (real estate crowdfunding). I’ve struggled with the decision to get dividends stock via an ETF such as VIG and SCHD or a handpicked portfolio like your M1 Finance portfolio. The Wealthfront portfolios include a specific slice for dividend growth stocks. What do you see as the upside to the extra complication of maintaining a hand picked portfolio of dividend growth stocks? Trying to balance all the arguments about simplicity, total return is most important factor, not trying to beat the market, etc. Despite those, I like the idea of a stable of income generating stocks for the long haul even if we give up a little bit of return. Your thoughts are appreciated.

All of my ETFs and index funds are in retirement accounts. That keeps them separate from my dividend growth portfolio. What I like about building my own portfolio of individual stocks, is I get to choose undervalued stocks and watch all (or most, usually) raise their dividends every year. That grows my income stream above the rate of inflation. However, owning individual stocks requires more research and paying attention to the market. I’ve done that my whole adult life, so I’m used to it. But tracking stocks is not for everyone. I use Seeking Alpha alerts to help keep track of all the stocks in my portfolio, but most of them are boring, long-term holds that don’t required a lot of ongoing research. It’s actually not that complicated because the dividend tax statement is consolidated. Only when you sell a lot you have to deal with capital gains.

As for the dividend growth ETFs, I haven’t fully researched them, but they’re OK as far as I know. Lots of bluechips in there and the Aristocrats. But the dividend growth is not as predictable as owning individual stocks. You get many of the same stocks in VTI or SPY. I prefer VTI to gain exposure to the entire market. When you own VTI, the dividend is smaller and you won’t get much dividend growth, but you’ll pay less in taxes, so there’s a trade off.

-RBD