Time, Not Trades

A young reader reached out to me about how investing and finance are underserved topics in high school.

A young reader reached out to me about how investing and finance are underserved topics in high school.

He was eager to share that he earned 20%+ returns from day trading in just a few months because he’s spent a lot of time learning how to invest and perfecting his trading strategy.

Day trading returns are repeatable, he said.

And if only young people learned more about the power of compound interest, they could reach their financial goals faster and live an easier life.

I cringed a little.

What he said about compound interest is true — it helps us reach our financial goals.

But over time, not quickly.

Day trading is a full-time job, not a worthy example of compound interest.

Then I realized, when you learn about compound interest for the first time as a teenager, you want to harness that power to earn it SO BAD.

It’s like you’ve been let in on this secret that none of your peers know about.

But you can’t experience it yet. You can only plant early seeds.

The fuel that powers compound interest is time, not trades. Decades, not days.

You can’t blame him for being impatient.

Table of Contents

I Was Him

My high school offered an introduction to economics class. It was my first significant exposure to many basic financial concepts.

We learned about supply and demand, compound interest, and reaching the point in life when you have the “pleasant dilemma” (my teacher’s words) of deciding what to do with excess monthly cash flow you don’t need to spend.

The teacher assigned us a stock-picking activity. Everyone chose one stock out of the newspaper listings (this was 1993) and tracked it for a month.

I chose Gillette, the shaving company now owned by Proctor & Gamble (PG).

I picked Gillette because I knew the brand. The stock rose 10%.

Lucky guess.

Nonetheless, it opened my eyes to what was possible — invest in stocks, and your money will grow.

Investing was easy — I, a high school kid, just earned 10% in one month!

Definitely repeatable.

And if I just kept doing that over and over again, I’d reach my financial goals faster and live an easier life.

What transpired over the next few years was humbling.

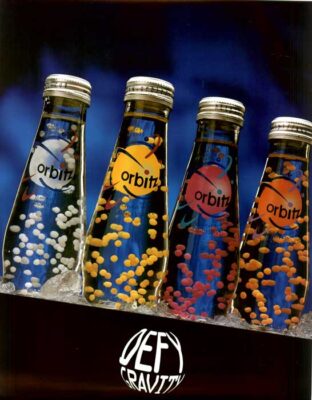

Gooey Balls that Defy Gravity!

My Uncle gave me my first stock share in 1995 — one share of Chevron (CVX). I’ve shared this story several times, and I still own 90 shares of the company.

Then I bought Coca-Cola (KO) via the DRIP in 1997.

But a story I haven’t told is about the third stock I owned.

Eager to start “compounding” my $6 minimum wage earnings from my college photography lab gig, I decided to get more serious about my investing.

The first stock ‘trade’ I ever made was the purchase of a company called Clearly Canadian. The stock traded on the NASDAQ for about $2 per share at the time (1997).

The stock price had fallen in recent months.

I saw a generational market-disrupting product, not unlike Liquid Death that I knew would turn the company around. I was an expert in the beverage industry since I owned Coca-Cola stock 😉

So I opened the yellow pages (a three-inch paper book with business and individual phone numbers printed inside), called the first broker on the list, and bought 100 shares of Clearly Canadian for about $200 plus a $50 trade commission (normal at the time).

The broker mailed me the paper stock certificate a few days later with a friendly note attached that said “Good Luck”.

So what was this mind-blowing product?

Orbitz! — A texturally enhanced alternative beverage — kind of like a lava lamp, but a drink.

My sister came home with a bottle of the stuff, and I thought it was cool.

It was cool, but cool doesn’t mean a stock will rise.

Sales never materialized. They canceled production and eventually sold the Orbitz web domain in 2001 to the travel company, now a subsidiary of Expedia Group.

I managed to get the stock certificate notarized, mailed it back to the broker, and sold my 100 shares when they were worth about $50 (before going to zero). A $200 loss.

Even if I was right and the stock rose 1,000%, my investment would have only been worth $2,000. Hardly life-changing.

Studying more or starting a small business would have paid off more in the long run.

But I was impatient.

I wanted my investments to “compound” quickly, not over time.

Time Gonna Save Our Souls

A few years later, online brokers became more widely available, and I made more unsophisticated trades headed into the dot-com boom and bust of 1999-2001.

Most notably, I bought shares in the grocery delivery company in vogue at the time, Webvan.

Thankfully, I never sold the mutual funds I bought through my first job’s 401(k) (from 1998-2001).

After some reflection, I let go of the get rich quick mentality and doubled down on boring investments when I reached the “pleasant dilemma” stage of life prophesied by my high school economics teacher.

My portfolio now consists mostly of low-cost index funds and dividend growth stocks.

And as my wealth has grown, I’ve diversified into real estate, municipal bonds, and various other passive income streams to round things out.

Only in the past five years have I started to see the effects of compound interest — and it’s much cooler than floating edible drink balls.

Those 401(k) funds are up more than 1000% after 20+ years of doing nothing.

Investing is easy, after all — for the patient.

The stocks and funds I bought during the market crash in 2009 keep going higher as the market marches on — the S&P 500 was up 16.55% per year from 2011 to 2021.

The long-term investments and tax-advantaged investing over the past 25 years are what’s empowering me to reach financial independence.

No single trade made me wealthy. Not even close.

It wasn’t buying Bank of America at $3.66 or Apple at $14.91.

It’s the consistent 401(k) contributions every two weeks out of my paycheck and investing whatever I don’t spend each month.

I’ve done this for twenty years now.

Ease of Failure Today

Nowadays, investors have so many options to make and lose money — zero-commission fractional stock trading, Ponzi-Esque digital currencies, glorified JPG NFTs, and online sports betting.

All from our phones.

The opportunities for success and failure are endless.

You hear about the successes on social media. And for $97, “experts” will share their secrets in an online course.

But we don’t hear about the trading failures. And the way stocks and cryptos have performed these past few years, everyone feels like a winner.

Investing isn’t 1st-grade gym class.

We won’t all be winners, always.

There will be tough times too.

But time, not trades, increase the likelihood of success if we stay invested and keep investing.

In twenty years, the reader who reached out will be in his late 30’s. He can be the tortoise or the hare with his investments. The farmer or the hunter.

My advice to the young and ambitious — invest in stocks for the long haul. Let index fund do most of the work for you so you can focus on earning.

Start a business if you want to get rich sooner.

Hourglass photo via DepositPhotos used under license

Orbitz Photo via Wikimedia Commons Public Domain

The author is long PG, KO, CVX

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — A reliable stock newsletter for DIY retirement investors. (review)

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)